There were 287 deals recorded involving top private banking companies in the three months to April with a number of high profile merger, sponsorship, venture financing, equity offering, asset transaction, debt offering, acquisition and private equity deals.

That’s according to GlobalData’s Financial Deals database, which tracks market activity across a variety of sectors and deal types.

The deals below only include those that have been completed – so excludes rumours or those that have been agreed but not yet executed.

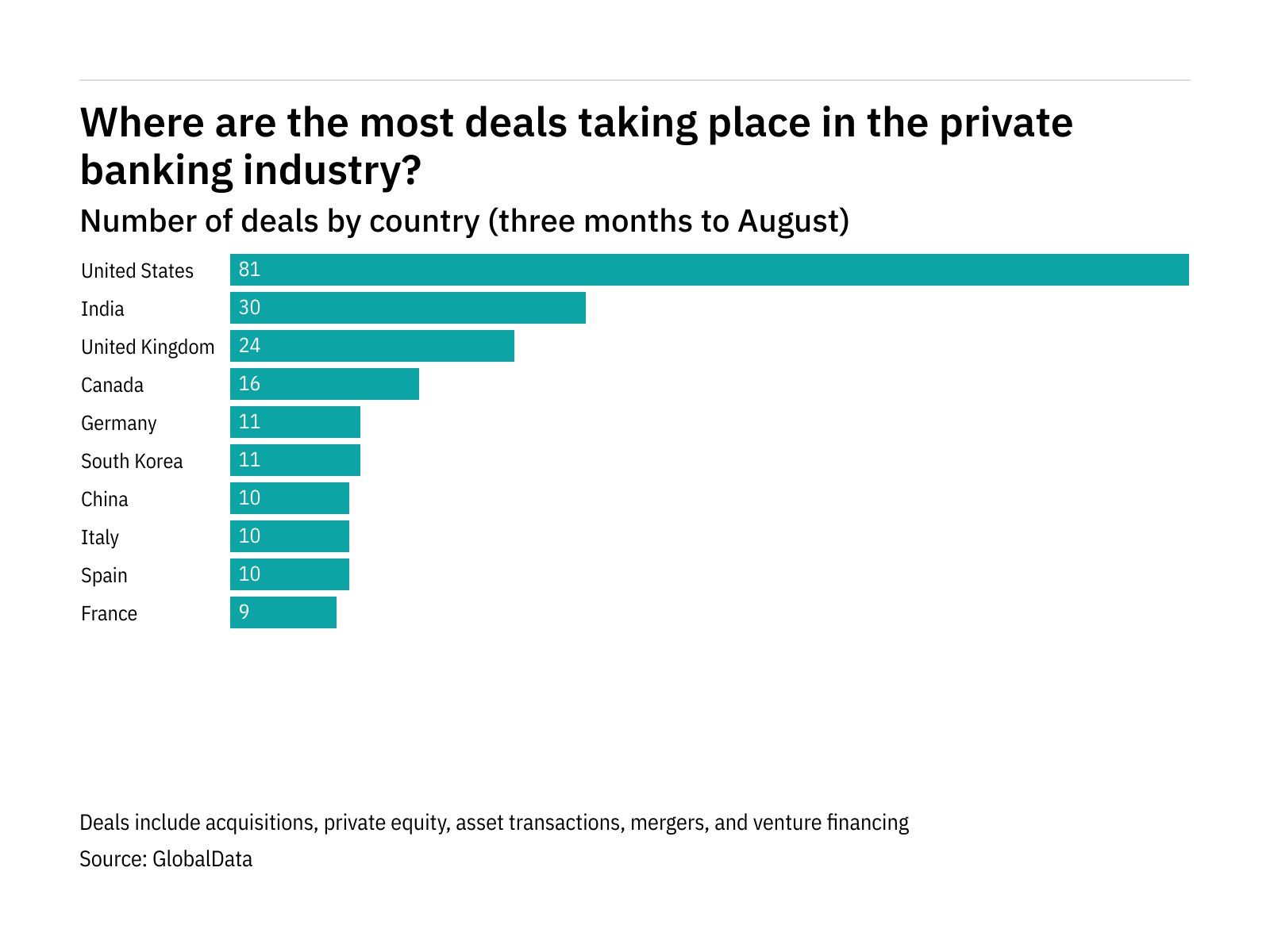

The figures, which cover the top private banking companies, show the market in the US to be the most active, with 81 deals taking place over the last three months. That was followed by India, which saw 30 deals.

Below are some of the largest completed deals to have taken place in the last quarter.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAcquisitions

The Toronto-Dominion Bank (TD Bank) To Acquire First Horizon - 28 February ($13,400m)

The Toronto-Dominion Bank (TD Bank), a Canada-based company that provides retail and corporate banking, wealth management, and related financial solutions, has announced to acquire First Horizon Corp, a US-based bank-holding company, which offers banking, wealth management, and capital market solutions through its primary subsidiary First Horizon Bank, for a cash transaction valued at USD13.4 billion.

TD to acquire First Horizon in an all-cash transaction valued at USD13.4 billion, or USD25.00 for each common share of First Horizon.

Following the closing of the transaction, Bryan Jordan, President and Chief Executive Officer of First Horizon, will join TD as Vice Chair, TD Bank Group, reporting to Bharat Masrani and will join the TD Senior Executive Team. He will also be named to the Boards of Directors of TD's U.S. Banking entities as a director and Chair. Jordan will continue to be based in Memphis.

TD Securities and J.P. Morgan served as financial advisors and Simpson Thacher & Bartlett LLP and Torys LLP served as legal advisors to TD. Morgan Stanley & Co. LLC served as financial advisor and Sullivan and Cromwell LLP served as legal advisor to First Horizon.

Berkshire Hathaway to Acquire 100% Stake of Alleghany for USD11.6 Billion - 21 March ($11,600m)

Berkshire Hathaway Inc., a conglomerate holding company engaged in insurance and reinsurance, utilities and energy, freight rail transportation, manufacturing, retailing and services, has entered into a definitive agreement to acquire all outstanding shares of Alleghany Corporation, an investment holding company that operates primarily in property and casualty reinsurance and insurance, for USD848.02 per share in cash. Both the companies are based in the US.

The transaction, which was unanimously approved by both Boards of Directors, represents a total equity value of approximately USD11.6 billion.

Goldman Sachs & Co. LLC is acting as financial advisor and Willkie Farr & Gallagher LLP as legal advisor to Alleghany. Munger, Tolles & Olson LLP is acting as legal advisor to Berkshire Hathaway.

The transaction is expected to close in the fourth quarter of 2022, subject to customary closing conditions, including approval by Alleghany stockholders and receipt of regulatory approvals.

Intesa Sanpaolo, Generali Italia and UniCredit Sell 60% Stake in Bank of Italy for USD4.77 Billion - 22 April ($4,778m)

Intesa Sanpaolo SpA, Generali Italia SpA and UniCredit SpA, providers of financial services, have sold 60% stake in Bank of Italy, SpA, a central bank of Italy, for EUR4.4 billion (USD4.77 billion). All the companies are based in Italy.

Rothschild & Co acted as financial advisor to Intesa Sanpaolo, UniCredit and Generali.

RBC Wealth Management to Acquire 100% Stake in Brewin Dolphin - 31 March ($2,083m)

RBC Wealth Management, a wholly owned subsidiary of Royal Bank of Canada (RBC), has recommended cash offer to acquire 100% stake in Brewin Dolphin Holdings PLC, a UK-based provider of wealth management services, for GBP5.15 per share, implying an equity value of approximately CAD2.6 Billion (USD2,083.07 million) on a fully diluted basis.

The consideration: represents a premium of 62% to the closing price of GBP3.18 per Brewin Dolphin Share on March 30, 2022, represents a premium of 54% to the volume-weighted average price of GBP3.33 per Brewin Dolphin Share for the six-month period ended March 30, 2022; and values Brewin Dolphin at 2.8% of its GBP55 billion assets under management as at February 28, 2022.

Barclays PLC, Liberum Capital Ltd and Lazard Ltd are acting as financial advisors and Travers Smith LLP is acting as legal advisor to Brewin.

RBC Capital Markets is acting as financial advisor and Norton Rose Fulbright LLP is acting as legal adviser to RBC and Bidco.

The acquisition is subject to a number of customary conditions specified in the Rule 2.7 Announcement, including regulatory approvals and Brewin Dolphin shareholder approval.

The transaction is expected to close during the third quarter of 2022.

Commonwealth Bank of Australia to Sell Bank of Hangzhou for USD1.31 Billion - 01 March ($1,310m)

Commonwealth Bank of Australia, an Australia-based provider of retail and corporate banking and other financial solutions, has agreed to sell Bank of Hangzhou Co Ltd, a provider of commercial banking products and services, for a consideration of USD1.31 billion. Both the companies involved in the transaction are based in China.

CBA said it would sell down its shareholding to entities controlled by the Hangzhou municipal government, advancing a strategy that has been adopted by most Australian retail banks to do away with non-core operations and focus on essential services at home.

The completion of the deal, currently expected in mid-2022.

Mergers

Housing Development Finance Corporation to Merge with HDFC Bank - 04 April ($58,519m)

Housing Development Finance Corporation Ltd (HDFCL), a deposit-taking non-banking financial institution that offers housing finance solutions, has agreed to merge with HDFC Bank Ltd., a provider of personal and corporate banking, private and investment banking, and other related financial solutions. Both the companies are based in India.

Following the transaction, the shareholders of HDFCL as on record date will receive 42 shares of HDFC Bank for 25 shares of HDFCL, HDFCL's shareholding in HDFC Bank will be extinguished as per the scheme of amalgamation upon the Scheme becoming effective.

As part of the transaction, HDFCL's wholly-owned subsidiaries HDFC Investments Limited and HDFC Holdings Limited, will merge into HDFCL.

Post the transaction, HDFC Bank will be 100% owned by public shareholders and existing shareholders of HDFCL will own 41% of HDFC Bank.

Currently, HDFCL, along with two of its wholly-owned subsidiaries (HDFC Investments and HDFC Holdings), holds 21% of paid-up equity share capital of HDFC Bank.

HDFCL have a total asset under management of INR5,260 billion and a market cap of INR4,440 billion, and HDFC Bank will have a market cap of INR8,350 billion.

Morgan Stanley India Company Private Ltd. Were financial advisors to HDFC Bank solely for the purpose of providing a fairness opinion on the valuation done by the valuer for the proposed transaction. Bank of America Merrill Lynch (BofA) Securities were financial advisors to HDFCL solely for the purpose of providing a fairness opinion on the valuation done by the valuer for the proposed transaction.

J.P. Morgan, Goldman Sachs, Citi, Nomura, CLSA, BNP, HSBC, ICICI Securities and Edelweiss acted as financial advisors to HDFC Bank. Credit Suisse, Kotak Securities, Jefferies, Arpwood, Motilal, Axis, JM Financial, IIFL and Ambit acted as financial advisors to HDFCL.

Wadia Ghandy & Co., Cravath, Swaine & Moore LLP acted as legal advisors to HDFC Bank and AZB & Partners, Argus Partners and Singhi & Co. Acted as the legal advisors to HDFCL.

Deloitte Touche Tohmatsu India LLP and Mr. Harsh Chandrakant Ruparelia (Registered Valuer) were appointed as valuers by HDFC Bank. Bansi S. Mehta & Co. And Ms. Drushti Desai (Registered Valuer) were appointed as valuers by HDFCL respectively.

Dhruva Advisors LLP were the tax advisors to HDFCL and HDFC Bank.

The transaction completion is subject to shareholders, creditors and regulatory approvals including from RBI, IRDAI, CCI, SEBI and Stock Exchange, and the closing is expected to be achieved by September 2023, subject to completion of regulatory approvals and other customary closing conditions.

Midea Real Estate to Merge With China Construction Bank For USD1.6 Billion - 21 March ($1,572m)

Midea Real Estate Holding Limited, a real estate developer together with its subsidiaries, has entered into an agreement to merge with China Construction Bank Corporation (CCB) Guangdong Province Branch (CCB), a financial institution, for a consideration of RMB10 billion (USD1.6 billion). Both companies are based in China.

The acquisition enable the Midea Real Estate to provide sufficient funding support for its development in related business.

Under the terms of the agreement, CCB will grant the Group a loan assistance amount of approximately RMB2 billion to finance the construction for the affordable rental housing projects and as general working capital and a housing mortgage financing amount of RMB10 billion for personal housing mortgage in respect of the Group's property development projects, respectively.

Fulton Financial to Merge with Prudential Bancorp - 02 March ($142m)

Fulton Financial Corp has signed an agreement to merge with Prudential Bancorp, Inc. Both the companies involved in the transaction are bank holding companies.

Under the terms of the Merger Agreement, Prudential shareholders will receive Fulton common stock based on a fixed exchange ratio of 0.7974 Fulton shares and USD3.65 in cash for each Prudential share they own. The implied value of the transaction, based on the 10-day volume weighted average stock price of USD18.01 for Fulton's common stock for the period ending March 1, 2022, is approximately USD142.1 million in the aggregate, or USD18.01 per Prudential common share. The transaction is expected to qualify as a tax-free exchange with respect to the stock consideration received by Prudential shareholders. In aggregate, approximately eighty percent (80%) of the transaction consideration to Prudential common shareholders will consist of Fulton common stock, with the remaining twenty percent (20%) payable in cash.

The merger is expected to close in the third quarter of 2022, after satisfaction of closing conditions described in the Agreement, including the receipt of customary regulatory approvals and the approval by Prudential's shareholders. Following the closing, Prudential's bank subsidiary, Prudential Bank, will be merged into Fulton's bank subsidiary, Fulton Bank, N.A.

Stephens Inc is acting as financial advisor, and Barley Snyder LLP is acting as legal counsel to Fulton. Keefe, Bruyette & Woods, Inc. Is acting as financial advisor and Silver, Freedman, Taff & Tiernan LLP is acting as legal advisor to Prudential, for the transaction.

Kuwait Projects Company Holding (KIPCO) to Merge with Qurain Petrochemical Industries - 14 March

Kuwait Projects Company Holding K.S.C.P. (KIPCO), a provider of financial services and involved in media, manufacturing, and real estate sectors, has reached a preliminary agreement to merge with Qurain Petrochemical Industries Co, a petrochemicals company. Both the companies involved in the transaction are based in Kuwait.

VTB to Merge with Otkritie, Russian National Commercial Ban(RNCB) and Kommersant - 29 April

VTB Bank, a provider of financial services, has agreed to merge with Otkritie, a provider of commercial banking services, Russian National Commercial Bank, a banking company and Kommersant, a publishing company. All the companies involved in the transaction are based in the Russia.

Venture financing

NTex Transportation Services (ElasticRun) Secures USD300 Million in Series E Funding - 07 February ($300m)

NTex Transportation Services Pvt Ltd (ElasticRun), an India-based B2B eCommerce platform connecting brands to rural parts of the nation, has secured more that USD300 million in series E funding led by SoftBank Vision Fund 2 with participation from Goldman Sachs, Prosus Ventures, Innoven Capital, Chimera Investment and Gablehorn Investments.

The funding round values the company at USD1.5 billion.

History:

Rumor: On January 05, 2021, techcrunch reported NTex Transportation Services Pvt Ltd (ElasticRun), may secure USD200 million in Series E funding from SoftBank Vision Fund 2 and Goldman Sachs.

Neon Payments (Neon Pagamentos) Secures USD300 Million in Series D Funding - 14 February ($300m)

Neon Payments SA (Neon Pagamentos SA), a Brazil-based digital bank that offers credit cards, personal loans, and investment products, has secured BRL1.6 billion (USD300 million) in Series D funding led by BBVA.

With this investment, BBVA acquires additional 21.7% stake in Neon Payments.

Neon Payments brings the total funding to BRL3.7 billion.

Deal History:

Announced: On February 14, 2022, Neon Payments (Neon Pagamentos), has announced to secure USD300 million in Series D funding led by BBVA.

OneFootball Secures USD300 Million in Series D Funding - 28 April ($300m)

Onefootball GmbH, a Germany-based soccer-focused media platform, has secured USD300 million in Series D funding led by Liberty City Ventures and Animoca Brands Co., Ltd with participation from Dapper Labs, DAH Beteiligungs GmbH, Quiet Capital, RIT Capital Partners, Senator Investment Group and ALSARA INVESTMENT SA.

China-Korea Life Insurance Secures USD285 Million in Venture Funding - 25 March ($286m)

China-Korea Life Insurance, a life insurance service provider that can provide general insurance, life insurance, health insurance, accident insurance and other products, has secured CNY1.82 billion (USD285 million) in venture funding from Zhejiang Dongfang, Zhejiang Changxing Financial Holdings, Wenzhou Guojin Industry And Trade, Wenzhou Electric Power Investment, Wenzhou Delivery, and Guotai Junan.

Britishvolt to Raise USD270.59 Million in Series C Venture Funding - 15 February ($271m)

Britishvolt Ltd, a UK-based electric vehicle battery startup, has to raise GBP200 million in a Series C funding round from Bank of America, Citibank, Peel Hunt, and Glencore.

Under the deal, Glencore invested GBP40 million in Britishvolt.

Lazard acting as financial advisor to Britishvolt in the transaction.

Private equity

CK Asset Holdings May Sell Stake in UK Power Networks - 03 March ($20,005m)

CK Asset Holdings Ltd (CK Asset), a Hong Kong-based company involved in the property development and property investment businesses, intends to sell stake in UK Power Networks, a distribution network operator for electricity, for an approximate purchase consideration of GBP15,000 million, according to sources citing people familiar with the matter.

A consortium led by Macquarie Group Ltd. And KKR & Co. Is in advanced talks to buy UK Power Networks. The bidder group also includes APG, China Investment Corp., Ontario Teachers' Pension Plan Board and PSP Investments, according to the people.

UK Power Networks is jointly owned by CK Infrastructure Holdings Ltd. And fellow group companies Power Assets Holdings Ltd. And CK Asset Holdings Ltd.

Consortium of Investors to Acquire Majority Stake in Vantage Towers - 18 March ($16,597m)

Consortium of investors, have submitted unsolicited proposals to acquire majority stake in Vantage Towers, a Germany-based tower infrastructure company from Vodafone Germany GmbH, a mobile telecommunications service provider, at a valuation of EUR15 billion (USD16 billion).

Consortium of investors includes Brookfield and Global Infrastructure Partners (GIP).

Apollo Global Management Terminates Acquisition of Pearson - 30 March ($9,256m)

Apollo Global Management Inc, a US-based private equity and investment management firm, has announced that it is no longer evaluating a possible cash offer for Pearson plc, a UK-based publishing and education company.

The Board of Pearson considered the Third Proposal, together with its financial and legal advisers, and concluded that it significantly undervalued Pearson and its future prospects. Accordingly, the Board of Pearson unanimously rejected the Third Proposal.

Citigroup Global Markets Limited and Morgan Stanley & Co. International Plc acted as Joint Financial Adviser and Corporate Brokers while Goldman Sachs International acted as Joint Financial Adviser to Pearson, for the transaction. Barclays Bank PLC advised Apollo.

Deal History:

Update 3: On March 28, 2022, Pearson had received a third proposal from Apollo regarding a possible cash offer for the entire issued and to be issued share capital of the Company at GBP8.7 (USD11.46) per share, representing an equity value of USD8.8 billion.

Based on the offer price of third conditional proposal, the enterprise value of Pearson was USD9.25 billion.

Update 2: On March 11, 2022, Pearson had rejected the second conditional proposal received from Apollo.

Update 1: On March 7, 2022, Pearson had received a second conditional proposal from Apollo regarding a possible cash offer for the entire issued and to be issued share capital at GBP8.54 (USD11.29) per share (including the FY 2021 dividend of GBP0.142 (USD0.18) per share which was announced but not yet paid).

Based on the offer price of second conditional proposal, the equity value of Pearson was USD8.5 billion and enterprise value was USD8.95 billion.

Rejected: On November 5, 2021, Pearson had rejected acquisition offer from Apollo Global Management.

Announcement: On November 5, 2021, Apollo Global Management had made a cash offer to acquire entire issued and to be issued share capital of the Pearson at GBP8 (USD10.86) per share.

Apollo Global Management, Cox Media Group and Standard General to Acquire Tegna - 22 February ($8,600m)

Apollo Global Management Inc, Standard General L.P. And Cox Media Group Inc, a radio broadcasting company that offers integrated broadcasting, publishing, direct marketing, and digital media services, has entered into a definitive agreement to acquire TEGNA Inc, a media company that creates and delivers television programming and digital content and information across various platforms. All the entities involved in the transaction are based in the US.

TEGNA will be acquired for USD24 per share in cash.

The transaction has an equity value of approximately USD5.4 billion and an enterprise value of approximately USD8.6 billion, including the assumption of debt.

Following the close of the transaction, Deb McDermott will become CEO and Mr. Kim will serve as Chairman of a new Board. Ms. McDermott currently serves as CEO of Standard Media and has more than 20 years of experience leading broadcast groups, including previously serving as COO of Media General and as CEO and President of Young Broadcasting.

The transaction consideration represents a premium of approximately 39% to TEGNA's unaffected closing share price on September 14, 2021, the last full trading day prior to media speculation about a potential sale of TEGNA, and a premium of approximately 11% to TEGNA's all-time high closing price since separation from the Gannett publishing business in 2015. The transaction was unanimously approved by the TEGNA Board.

Upon completion of the transaction, TEGNA will become a private company and its shares will no longer be traded on the New York Stock Exchange.

RBC Capital Markets LLC will provide debt financing.

Greenhill & Co Inc and J.P. Morgan Securities LLC are acting as financial advisors, while Wachtell, Lipton, Rosen & Katz is acting as legal advisor to TEGNA, and Moelis & Company LLC and RBC Wealth Management are acting as financial advisors, while Pillsbury Winthrop Shaw Pittman LLP and Fried, Frank, Harris, Shriver & Jacobson LLP are acting as legal advisors to Standard General.

The transaction is subject to approval by TEGNA shareholders, regulatory approvals, and other customary closing conditions, and is expected to close in the second half of 2022.

Deal History

Rumor: Sept. 21 2021, According to Nypost, Apollo Global Management, Inc., parent company of Cox Media Group, with Standard General Media has entered into a binding bid of more than USD8 billion to acquire Tegna Inc., a media company, which owns 64 TV stations in 51 markets. All companies involved in the transaction are based in the US.

Simon Property Group and Brookfield Asset Management May Acquire Kohl's - 25 April ($8,600m)

Simon Property Group, Inc and Brookfield Asset Management Inc have made an offer to acquire Kohl's Corp, a US-based specialty retailer that operates departmental stores and offers a range of clothing, footwear, bedding, furniture, jewelry, beauty products, accessories, and housewares for USD68 per share valuing the Kohl's at more than USD8.6 billion, New York Post reported citing sources familiar with the matter.

Simon Property Group is a US-based real estate investment trust and Brookfield Asset Management is a Canada-based alternative investment management company.

Reportedly Kohl's has hired Goldman Sachs as financial advisor to engage with potential buyers.

Private equity firms Sycamore Partners and Leonard Green & Partners as well as Saks Fifth Avenue's Canada-based parent company Hudson's Bay are reportedly interested in acquiring Kohl's.

Asset transactions

Axis Bank to Acquire Consumer Businesses from Citigroup and Citicorp Finance - 30 March ($1,628m)

Axis Bank Ltd, an Indian provider of commercial and personal banking and other related financial solutions, has agreed to acquire consumer businesses covering loans, credit cards, wealth management and retail banking operations in India, from Citibank NA India and Citicorp Finance (India) Limited for a purchase consideration of approximately INR123.25 billion (USD1628.13 million).

The transaction comprises the sale of the consumer businesses of Citibank India, which includes credit cards, retail banking, wealth management and consumer loans. The deal also includes the sale of the consumer business of Citi's non-banking financial company, Citicorp Finance (India) Limited, comprising the asset-backed financing business, which includes commercial vehicle and construction equipment loans, as well as the personal loans portfolio.

The acquisition is subject to customary closing conditions, including receipt of regulatory approvals and Closing is expected to be achieved in fourth quarter of 2023.

AXIS Capital and Credit Suisse acted as Financial Advisors to Axis Bank for the transaction, and Khaitan & Co acted as Legal Advisor. In addition, the Bank was supported by PricewaterhouseCoopers and Boston Consulting Group.

Deal History:

Rumor: On February 14, 2022 According to people familiar with matter, Axis Bank Ltd, an India-based provider of commercial and personal banking and other related financial solutions, may acquire retail banking business in India from Citigroup Inc., a US-based financial services company, for a consideration of USD2.5 Billion.

An agreement for the consumer unit may be announced as soon as the next few weeks and is contingent on approval from the Reserve Bank of India.

The deal would include a cash component of less than USD2 billion, accounting for the consumer business liabilities.

Banco de Sabadell May Sell its Payments Business - 11 February ($397m)

According to gulftime and pymnts sources, Banco de Sabadell SA, a Spain-based provider of banking products and related financial solutions, may sell its payments business.

The consideration may be between EUR250 million and EUR350 million (USD283 million -USD397 million).

The payments business handles the processing of transactions made with credit and debit cards.

Nexi in Talks to Acquire Payments Unit from BPER Banca - 21 February ($396m)

Nexi SpA, a payment system's bank, is in advanced talks to acquire the Italian payment unit from BPER Banca Spa, a banking group offering traditional banking services to individuals, corporate and public entities for EUR350 million (USD396.19 million). Both the entities are based in Italy.

The company began exclusive discussions with BPER Banca earlier this month to buy its merchant acquiring business, which specializes in the management of electronic payments, said the people, asking not to be named discussing confidential information.

People familiar with this matter said a deal is expected to be signed by the end of March.

Paolo Bertoluzzo is the Chief Executive Officer of Nexi SpA.

Worldline Acquires Controlling Stake in Commercial Acquiring Business from Australia and New Zealand Banking Group(ANZ) - 01 April ($363m)

Worldline SA, a France-based provider of e-payment transaction services, has acquired controlling stake in the commercial acquiring business of The Australia and New Zealand Banking Group Limited (ANZ), an Australian multinational banking and financial services company, for AUD485 million(USD363.2 million).

As part of transaction companies created 51%-49% joint-venture controlled by Worldline to operate and develop commercial acquiring services in Australia with ANZ Bank.

Banca March to Acquire Private Bank in Spain of BNP Paribas - 03 February ($113m)

Banca March SA, a Spain-based provider of private banking and business consultancy services, has agreed to acquire private bank in Spain from BNP Paribas SA, a France-based international banking group.

BNP Paribas will transfer 80% of its portfolio of clients and its bankers to the Spanish bank, the newspaper said, adding the French bank will retain 20% of the business.