Carmignac, a Paris-based fund manager, has continued its expansion spree in Europe with the launch of a new subsidiary office in Zurich.

The new office will support relationships with retail as well as wholesale clients through a tailored regional approach, reported International Adviser.

This will offer Swiss retail clients the same opportunities to invest with Carmignac as in other European countries.

The complete fund range will be available for the Swiss-based clients including share classes in Swiss francs, dollars, sterling and euros.

Carmignac Gestion chairman Edouard Carmignac commented: "We are ready and able to help Swiss investors tackle their main challenges, namely helping them achieve financial security in retirement by preserving wealth and drawing an income from savings."

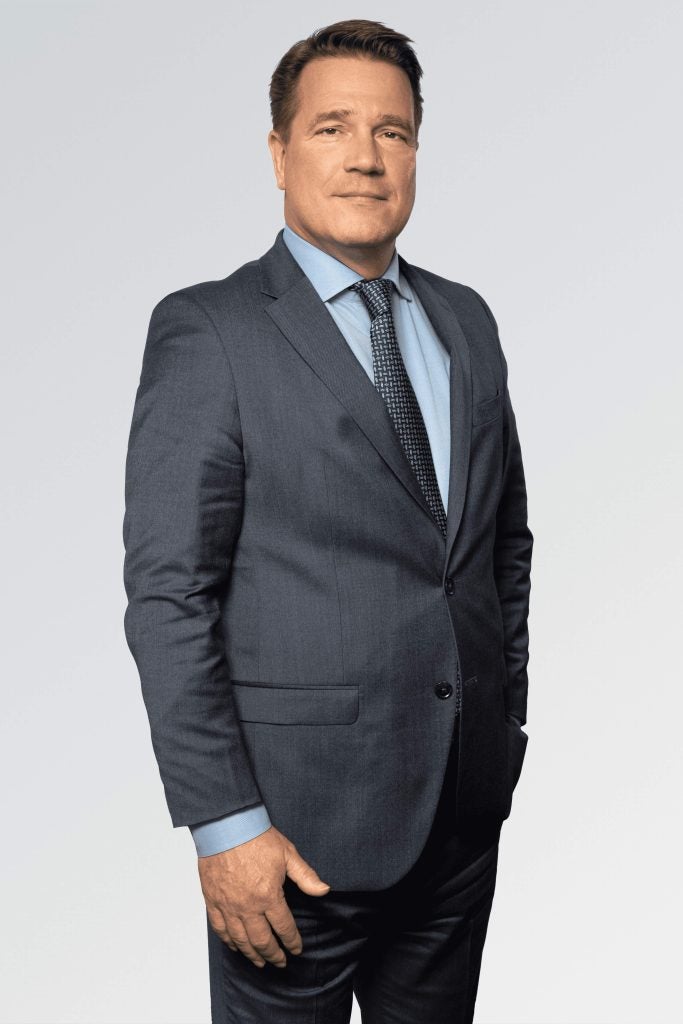

The office will comprise a six-strong Swiss team, headed by Marco Fiorini.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAdditionally, the firm has also rolled out a new distribution share class of its Carmignac Portfolio Patrimoine Fund.

This will enable investors to draw a monthly income from their investment.

Carmignac has been distributing actively managed funds in Switzerland for 12 years.