The latest liberalization of Malaysia’s fixed income market will lower the cost of issuing bonds or sukuks to retail investors. However, greater uptake will not be forthcoming unless concerted investor education is undertaken says GlobalData Financial Services.

The Securities Commission Malaysia announced further liberalization to its MYR1.3tn ($306bn) bond and sukuk market, designed to facilitate greater activity among retail investors. Qualified issuers will now be able to distribute these products directly to retail investors without the need for a prospectus, while existing corporate bonds and sukuks will become available to retail investors provided they were issued by a qualified issuer and meet certain “seasoning” requirements.

Securities Commission Malaysia has been slowly opening up the domestic bond/sukuk market to retail investors in recent years, trying to encourage the holding of such securities. GlobalData sized this part of the Malaysian market at MYR13.5bn ($3.33bn) as of the end of 2017 – a tiny fraction of the overall value but considerably up from previous years.

Other regulators, notably the Monetary Authority of Singapore and the Australian Securities and Investments Commission, have tried similar reforms to spur greater retail participation in the bond market. The success of such initiatives has been limited.

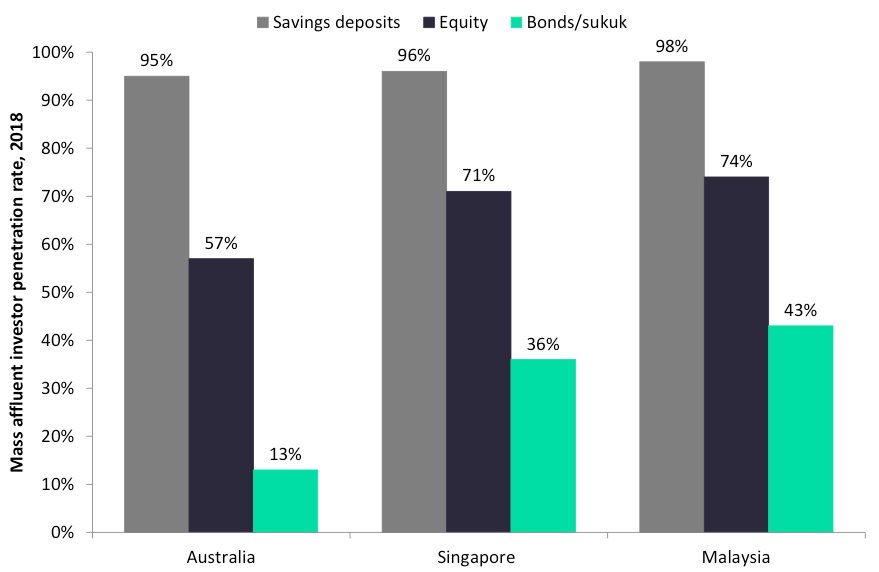

Despite bonds from blue-chip companies often being described as only one step away from term deposits, bond holding in all these countries remains limited. The gap between bond holding and shareholding among Australian mass affluent investors remains 44 percentage points (pp) in 2018, while it is 31pp in Singapore.

Low bond holding by retail investors is not simply a matter of supply but demand as well. Retail investors in these markets do not consider bonds an acceptable investment for small-scale investors. Wealth and investment managers will have to work long and hard at demystifying the asset class for retail investors, highlighting both its benefits and risks. If mass affluent investors in these markets are so accepting of volatile equity, there is clearly an unrealized appetite for less risky bonds, particularly with term deposit rates still at record lows.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataInvestor education will be crucial to realizing the opportunity.

Bonds have yet to take off among mass affluent investors in Asia Pacific