The world’s 25 largest private wealth managers grew their assets under management (AUM) by 5.5% in 2016, compared to a growth rate of 2.9% in the previous year, according to research by GlobalData and Private Banker International. Meghna Mukerjee reveals who these top global players are and what they are doing right

At a time when profit margins are being squeezed and private banks are struggling with a low interest rate environment, the results from the Global Private Wealth Managers AUM Ranking reveal that there is still reason to be optimistic.

The research project undertaken by GlobalData Financial Services and Private Banker International reveals that assets under management (AUM) for the world’s 25 largest private wealth managers grew by 5.5% in 2016, in comparison to the growth rate of 2.9% in 2015.

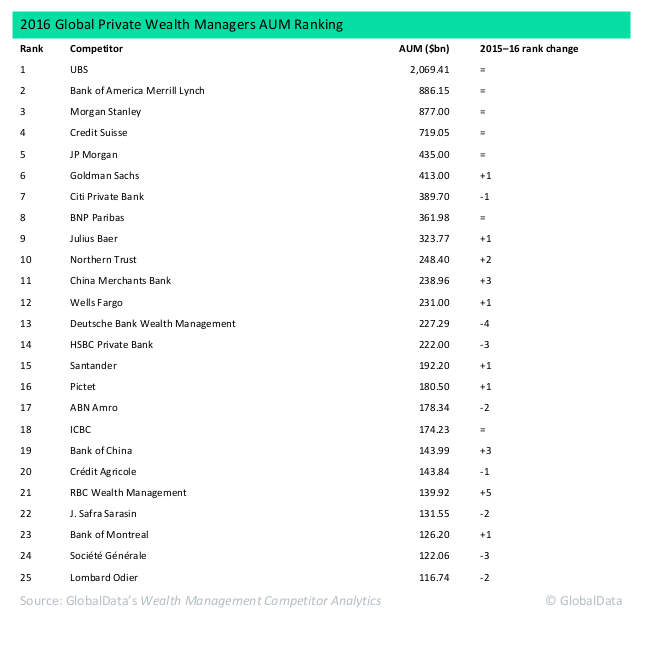

The 2016 Global Private Wealth Managers AuM Ranking revealed some usual winners alongside some unexpected movers. Swiss private banking giant UBS continued to head up the list, with AUM exceeding $2trn.

There was no movement among the first five positions on the list from last year’s ranking, with US-headquartered Bank of America Merrill Lynch ($886.15bn) and Morgan Stanley ($877bn) taking second and third position respectively. Credit Suisse ($719bn) and JP Morgan Private Bank ($435bn) also stood in their fourth and fifth positions.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataCiti Private Bank ($389bn) slipped one position, landing in seventh place while Goldman Sachs ($413bn) jumped up by one rank to sixth place.

Bartosz Golba, GlobalData’s head of content for wealth management, predicts that the two American giants might switch places next year.

“While Bank of America’s AuM decreased for the second consecutive year, Morgan Stanley recorded double-digit growth. Growth was even faster in the division catering for high net worth (HNW) individuals at Goldman Sachs, which overtook Citi Private Bank.”

Big winners and losers

Some banks made notable jumps upwards through the ranking. China Merchants Bank missed being in the top 10, with an AuM of $238.96 at the end of 2016, but landed in 11th place. This is move up three places in the ranking from the previous year’s list.

With an exemplary focused growth strategy, China Merchants Bank lead the Chinese market, even though it ranked well behind the top five in the domestic retail banking market, according to the research.

Andrew Haslip, GlobalData’s financial head of content for Asia-Pacific, said: “Despite a smaller footprint on the mainland, China Merchants Bank’s focus on helping affluent Chinese internationalise their wealth has fuelled its growth.

“The 2017 expansion of its private bank in Singapore still needs to be seen through the lens of its mainland strategy, giving its Chinese clients more options in Asia’s private wealth management capital.”

Other Chinese banks such as Bank of China (BOC) demonstrated strong performance by solidifying it’s place in the top 20 , taking 19th position ($143.99 in AuM), with a three-place jump.

RBC Wealth Management experienced a strong move up through the ranks – five-places – to reach 21st position with $139.92 in AuM at the end of 2016.

On the other hand, although the industry registered an overall growth in 2016, some players saw their asset books shrink remarkably, with HSBC Private Bank and Deutsche Bank Wealth Management not even present in the top 10 ranking.

Deutsche Bank Wealth Management slipped by four places, reaching 13th place in the most recent ranking. The firm has been through myriad changes in the last couple of years.

A fundamental restructure of its business units and management that took place in October 2015 came into effect in January 2016 leading to the bank’s wealth management division currently sitting within the Private, Wealth and Commercial Clients (PWandCC) division.

There continue to be profitability issues at group level at Deutsche Bank, weakening the wealth business. In September 2016 Deutsche Bank and Raymond James also finalised the sale of the former’s US private client services unit, which employs roughly 200 advisors managing $50bn in client assets.

HSBC Private Bank saw its global positioning slide to the 14th position with AuM of $222 at the end of 2016 as well.

All eyes on Asia

More Asian private banks, with an increasing international focus, are expected to join the top ranks of global private wealth managers in the years to come.

Even though a lot of them did not make it through to the global top 25 this year, these Asia-headquartered private banks have been consistently making international inroads by launching new offices across Europe and taking the inorganic growth routes.

Meghna Mukerjee, editor of Private Banker International, said: “The Asia-Pacific region, which saw much M&A activity in 2016 and will see more in 2017, is where we expect new top international wealth managers to emerge.

“Banks such as DBS Private Bank and OCBC’s Bank of Singapore, which have been bulking up significantly through acquisitions, are the ones to watch in the future.”

Methodology:

- The ranking captures the AUM of private banking and wealth management operations of the world’s leading competitors. The data was collected from competitors’ publicly available materials (such as annual reports and financial statements), or from contacts in relevant organizations.

- The definition of AUM differs between wealth managers. To ensure figures are comparable, the data underwent our standardisation process, with the aim of capturing assets held with a provider for investment purposes by private clients, under the beneficial ownership of the client. Presented figures exclude assets held only in custody, as well as pure asset management operations. Where no detailed breakdown of AUM was provided by a competitor, we used our model to estimate the most accurate numbers.

- The AUM data was collected in competitors’ reporting currency. Where this is not US dollars, data was converted using the 2016 end-year exchange rate.

- Rankings and data from the previous years are available from GlobalData and Private Banker International.

- GlobalData’s Wealth Management Competitor Analytics is an interactive analytics tool benchmarking the AUM and financial performance of 33 leading global wealth managers. It is available to subscribers of GlobalData’s Financial Services Intelligence Center.