Private banks in Asia demonstrated their ‘bouncebackability’ in 2016, defying market fragmentation to return close to the record level of assets recorded in 2014, according to research by Private Banker International.

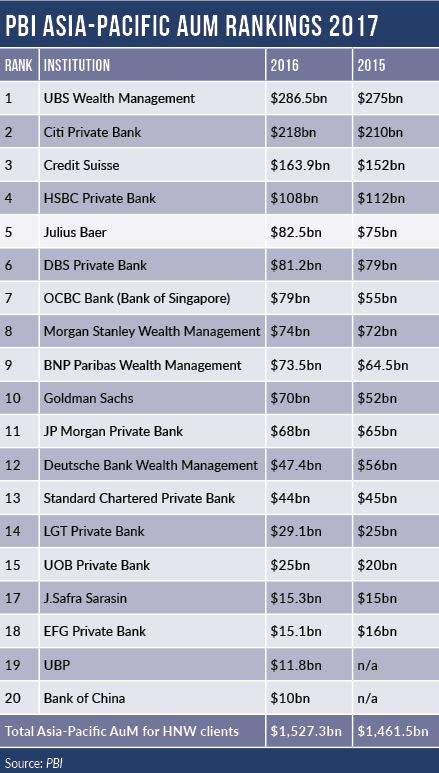

The PBI Top 20 Asia-Pacific AUM Rankings 2017 (see below) show Asian private banks were back in accumulation mode in 2016, with AuM at the top 20 institutions reaching $1,527.3bn, up from $1,461.5bn in 2015 and almost on a par with the high of 2014.

This figure is even more impressive when viewed in the context of falling brokerage revenues and clients’ response to regulatory changes. However, it also represents around half the rate of private wealth growth recorded in Asia by the Global Wealth 2017 report, which estimates that by the end of this year the level of private wealth in Asia-Pacific will surpass that in Western Europe; and by 2019, the combined level of private wealth in Asia-Pacific and Japan is projected to surpass that in North America.

Data from the World Ultra Wealth Report 2017 was more in line with the results of this year’s Asia-Pacific Top 20, though, referring to an increase of 3.5% in regional wealth creation. One of the key trends identified last year was the continuing exodus of smaller non-Swiss foreign wealth managers from Asia-Pacific, prompting some local players to expand their offshore businesses. The market has also become increasingly fragmented, with global private banks active offshore and local banks active onshore.

Acquisitions had a significant impact on this year’s rankings. Number 14 on the 2015 PBI table, Barclays Wealth & Investment Management disappeared following its acquisition by Bank of Singapore, which jumped 11th place in 2015 to 7th place in 2016. Meanwhile, the purchase of Coutts International’s activities in Singapore and Hong Kong by Union Bancaire Privée (UBP), one of this year’s two newcomers, pushed ABN Amro Private Bank off the list.

In October 2016, DBS announced that it had agreed to acquire the wealth management and retail banking business of ANZ in five markets – Singapore, Hong Kong, China, Taiwan and Indonesia. The deal added approximately $4.3bn to the Singapore-based bank’s AuM, enabling it to stay ahead of local rival OCBC on our list.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTan Su Shan, group head of consumer banking and wealth management at DBS Bank, says it is not enough to just bring a western platform to Asia and do a “plug and play” – as clients in the region demand specific Asian solutions that may require customisation to local currencies, local assets and liquidity solutions.

She says: “Therefore, it behoves banks here to have a deep understanding of the Asian landscape and add value for clients. The bank’s ability to provide liquidity and credit solutions to these clients, many of whom run family businesses which may have liquidity or structuring needs, is also important.”

In Asia, where the wealth-management process is intrinsically tied to the wealth-creation process, banks that can play a role in the business banking side of these clients and combine this with a highly relevant wealth-structuring and wealth-management solution should stand to win long-term market share.

According to Tan, there remains more scope and opportunities for dominant local or regional players to gain market share as clients look for customised solutions with well-known names that remain committed to the region and the business. She says Singapore stands out as a jurisdiction of choice where safety, stability and the independence of the nation are key advantages and attractions for investors, both within the region and beyond.

“Rules surrounding tax reporting and anti-money laundering have been tightened significantly and this may cause some short-term pain for the industry in terms of increased costs of compliance and surveillance, but it is better for all industry players in the long term as standards are lifted across the board,” she adds.

The acquisition trend of last year is likely to be at least partly replicated in 2017, when the completion of LGT’s acquisition of ABN AMRO’s private banking business in Asia should push the private banking business of the Princely Family of Liechtenstein closer to Standard Chartered Bank and Deutsche Asset & Wealth Management in PBI rankings.

Dr Henri Leimer, LGT’s private banking Asia CEO, says with the region continuing to enjoy solid economic growth, the bank saw the acquisition as an opportunity to consistently implement its international growth strategy in 2016 by expanding and strengthening its private banking platform in Asia. Leimer says:

“With the low-interest-rate environment and market volatility, investors were looking for managers that placed investment management at the core of their operations and were focused on long-term, underlying economic fundamentals to deliver stable returns.”

Increased compliance

According to Leimer, regulatory compliance requirements have increased the complexity of management and fixed costs, as well as being a catalyst for structural change among private banking market players.

However, he remains confident that institutions with simple ownership arrangements, clear and efficient organisational structures and a core focus on private banking services will continue to deliver strong returns for clients and maintain profitability within this more regulated environment.

Leimer says: “We are confident that our stronger presence in key wealth management markets will result in further profitable growth in 2017.” He adds: “The first half of the year saw LGT continuing on its profitable growth path, once again attracting significant net asset inflows and successfully integrating ABN Amro’s private banking business in Asia and the Middle East into our existing structures. An important cornerstone remains the strong focus on investment management as a core competency.”

One of the big winners in 2016 was Goldman Sachs, which increased its regional AuM from $52bn in 2015 to $70bn in 2016. The bank’s discretionary portfolio management strategy in Asia has been a significant contributory factor to this growth, optimising overall portfolios by rebalancing the assets booked with the bank.

Elsewhere, UOB recorded an impressive year-on-year 25% increase in AuM in 2016 to $25bn, more than doubling the number of relationship managers since 2014. This success is in part due to its ability to leverage its relationships with ultra-wealthy individuals in the region, who tend to be slightly older than their global peers, have a higher level of wealth and are often at the wealth-creation rather than the wealth-preservation stage.

According to Ong Yeng Fang, head at private bank at UOB, one of the most noticeable characteristics of the private banking industry in Asia is the limited availability of talent. However, she says regional private banks have increased their profile among clients, which has helped them to become more attractive to potential recruits over the last few years – particularly younger people who have the potential to develop in the role.

She comments: “Discretionary product management has not been a popular strategy in Asia, so we have been surprised by the level of interest from clients who have realised that they don’t have the time to manage their wealth personally.”

As mentioned above, there are new faces in the top 20 this year, with UBP filling 19th place with $11.8bn and Bank of China (Hong Kong) coming onto the list in 20th with $10bn.

Challenging year

Despite a challenging year, Sudhir Nemali, chief operating officer Asia-Pacific at Deutsche Bank Wealth Management, says the bank is committed to investing €65m ($76.4m) between now and 2019 to improve client-focused digital technology and boost client-related systems and processes.

In the first half of this year the bank launched Deutsche Wealth Online, an app to connect clients to their portfolios seamlessly and securely anytime, anywhere in Hong Kong and Singapore.

“There will be more initiatives to put advanced digital wealth management products into the hands of our clients, enabling them to interact with us how they wish and enabling our people to focus on adding personal value,” says Nemali.

Nemali adds: “We are decisively addressing areas where we need to improve our clients’ experience and remove obstacles to our people having more fulfilling interactions with them.”

Alan Luk, head of private banking and trust services at Hang Seng Bank, observes that clients are more actively leveraging various financing options – such as bonds and insurance policies financing – to instil liquidity into their portfolios and magnify yields. He also warns of the importance of scaling up for private banks in the region.

In 2016, HSBC revamped its discretionary offering and launched a range of in-house and third-party-managed, institutional-style multi-asset discretionary solutions.

Siew Meng Tan, regional head of HSBC Private Banking Asia-Pacific, says closer collaboration with the bank’s global asset management and alternatives investment group has given its clients access to a deeper range of expertise and an institutional approach to products and investment solutions.

“In addition, to simplify our onboarding process for new clients, we adopted an onboarding platform to help relationship managers shorten the client onboarding time and improve their experience,” she says.

The platform streamlines client due diligence and Know Your Customer (KYC) requirements, reducing paperwork and simplifying the process. “We also expanded our footprint in the region by opening an office in Australia in November 2016 to offer resident clients a comprehensive range of private banking services,” Siew Meng Tan continues.

“We work with some of Australia’s largest corporates and we are now able to offer the owners and principals of these businesses services to meet their private wealth needs.”

Tan observes that the region’s growth and development continues to give rise to wealth creation across many countries in Asia-Pacific. Within HSBC Private Banking, Hong Kong contributed over 80% of Asia-Pacific’s pre-tax profits in 2016.

“Part of HSBC Private Banking’s significant growth is down to our close collaboration with colleagues in commercial banking, investment banking and retail banking to ensure clients benefit from our universal banking model,” she says.

“Greater China remained an engine of growth and we are well positioned to capture opportunities from the thriving Pearl River Delta region and from China’s Belt and Road initiative. South East Asia’s move towards closer economic cooperation will add an extra boost to opportunities in the coming years”

Didier von Daeniken, global head, private banking and wealth management at Standard Chartered Bank, describes 2016 as a transformative year for the private bank. “We have significantly enhanced our banker population through training and development and increasing our senior banker population,” he explains.

“Talent and expertise are critical elements to the success of our business – our recent client survey highlighted that our clients value the connection with their relationship manager and this is a key reason why they bank with us.”

With a hiring approach that is focused on senior bankers who can identify and support the diverse needs of its clients through the economic market cycles, Von Daeniken says the bank has continued to increase the overall strength of its frontline teams. “Around 70% of our new hires from the middle of 2016 to date are at executive director or managing director level,” he notes.

“Running a well-controlled private bank is critical to achieving sustainable scale. We launched an internal programme for the business to maintain a strong control environment, through which we have significantly de-risked the business.”

When asked to characterise the private banking market in Asia-Pacific in 2016 in terms of key trends and challenges, Von Daeniken states that in an age of information overload, clients are increasingly looking for high-quality insights that will help them make investment decisions that meet their wealth goals.

“Many of these time-strapped entrepreneurs value the support of trusted advisers who are able to help them navigate and take advantage of the financial market volatility by providing holistic and bias free market advice and convictions,” he continues. “One of our priorities for the private bank in 2016 was to deliver on our conduct and financial crime risk programmes and invest in enhancing our control environment,” he concludes.

PBI Asia-Pacific Top 20 AuM Benchmark 2017 – Key takeaways

The PBI Asia-Pacific Top 20 report – which ranks the top private banks in the region by assets under management (AuM) for high net worth (HNW) clients – has become a trusted source of information for the private banking industry.

Information for the report is drawn from many sources, including publicly available investor information in the first instance, but also articles and interviews from Private Banker International and other reputable media sources.

Our preference is for banks to provide verifiable details of their assets under management. If this information is not forthcoming, a ranking has been based on an estimated figure calculated from the above sources.

Please note that estimates may be conservative and that we accept no responsibility for underestimates that occur as a result of a bank failing to respond to requests for information. Our definition of a ‘high net worth individual’ is anyone with investable assets in excess of $1m, in line with current industry standards.

The figures for this year’s PBI Top 20 Asia-Pacific AuM Rankings were based on figures from the fourth quarter of 2016 where publicly available, and from internal sources.

Where a range of AuM is used, PBI has taken the lower figure in calculating the total AuM.

Exchange rates have been applied for the PBI 2017 Top 20 Asia-Pacific AuM Rankings as at 31 December 2016.

This year’s PBI Top 20 Asia-Pacific Assets AuM Rankings include private banks active in Singapore and Hong Kong booking centres.