UK retail investors suffered in 2018, as major asset classes either fell in value or saw minimal gains. Political uncertainties ranging from Brexit to the US-China trade war took their toll and negatively affected investment returns.

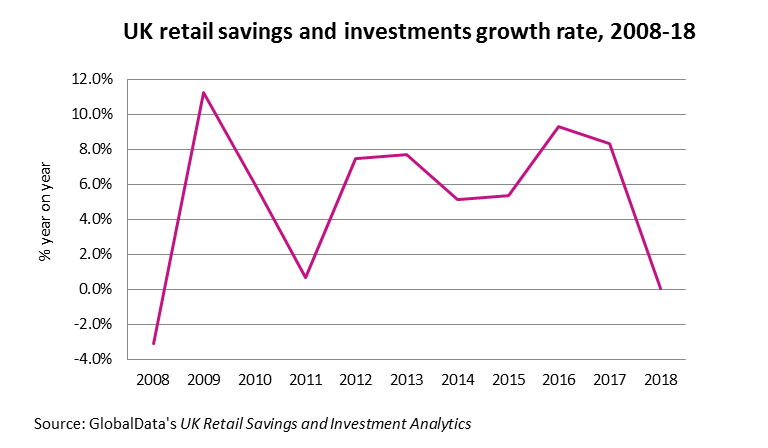

For the UK savings and investment market, 2018 was the worst year since the 2008 financial crash. The only year close was 2011, when the UK just escaped a double-dip recession. GlobalData’s UK Retail Savings and Investment Analytics estimates that the growth of retail assets was flat in 2018 compared to 2017 at exactly 0.02%. Although deposit balances were up 3%, this did not offset stock market losses. Stock markets globally closed 2018 on a bad note, and the UK was part of this crowd. As a result, UK retail direct equity and unit trust holdings decreased by -7% and -4% respectively.

Brexit uncertainty

Brexit uncertainty

The ongoing uncertainty around Brexit spooked investors in 2018, but this was not the only political issue to play a part in causing the FTSE 100 to suffer its worst year since the financial crash. Shortly after the Brexit referendum, the weakening pound played in favour of the exporters that constitute a large share of FTSE 100 companies. But this effect weakened throughout 2018, and anxieties around the continuing US-China trade war and overall global sentiment contributed to the UK stock market’s decade low.

This has hit UK retail investors who were holding their assets either directly on the stock market or in equity funds in hope of good returns. Bank deposits (including cash ISAs) still make up almost half of retail investors’ portfolios in the UK, although our data suggests the returns they offer are not considered attractive. Net inflows into retail deposits in 2018 were the lowest since 2011. August 2018 saw the Bank of England raise the base rate from 0.5% to 0.75%, but rates offered by banks to consumers remained largely unchanged.

Since 2018 ended, not much has changed regarding political uncertainty. The UK is set to leave the EU on March 29, 2019 – but whether it is with or without an agreement remains to be seen. In addition, US President Donald Trump’s trade war continues to intensify. Upset about recent stock market performance, in the current climate investors might be willing to shift their assets to safer products. The onus is on advisers and wealth managers to stay acute to any political and economic change in order to adjust client portfolios and yield the desired returns.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Brexit uncertainty

Brexit uncertainty