A considerable proportion of high-net-worth individuals in the United Kingdom feel that their banks undervalue and provide inadequate help according to a recent financial wellbeing study by Arbuthnot Latham.

In an effort to close the disparity between the wealthiest people in the UK and their financial providers, Arbuthnot Latham has investigated the areas in which it believes the greatest gaps exist, as well as strategies for resolving the top issues.

Between 30 November 2023, and 5 December 2023, Arbuthnot Latham and Atomik Research, an independent market research firm, conducted a poll of over 500 UK citizens who had a net worth of at least £100,000 ($126,342) per person.

Results

40% of respondents had a net worth of at least £500,000, and 60% have a net worth (excluding property assets) of between £100,000 and £499,000.

Based on Arbuthnot Latham’s research, the capacity to discuss finances during big life occurrences such as marriage, losing a loved one, or having children is the main factor why many of the UK’s wealthy individuals feel disregarded by their financial institutions.

Reactions to the existing banking service:

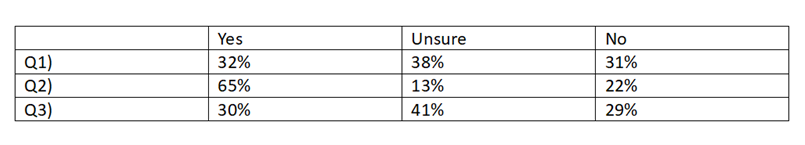

Q1) Do you feel valued by your bank?

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataQ2) Do you feel you can have a conversation with your financial provider about your financial wellbeing?

Q3) Would you feel comfortable talking to your bank about how they can support your financial wellbeing during significant life events?

The absence of expert advice and guidance at these critical periods is most certainly a significant factor behind the UK’s 70% surge in demand for Current Account switching services.

Kevin Barrett, managing director, private and commercial banking, said: “Ensuring our clients have a platform to openly discuss and seek support for their financial wellbeing during significant life events is paramount to us at Arbuthnot. We understand that life’s transitions can bring about financial complexities and emotional challenges.

“By fostering a space where individuals feel empowered to share their concerns and aspirations, we not only enhance their financial knowledge, but this also cultivates trust and long-term relationships. Our experts at Arbuthnot believe that enabling these conversations is not just a service, but a commitment to our clients’ overall financial wellbeing.”

Cracking the code of wealth worries

It’s critical that banks react swiftly to the main stressors faced by the wealthiest citizens in the UK, as one in three of them feel their provider undervalues them, and a significant percentage of them are interested in switching.

Moreover, the following options are recommended by the Arbuthnot Latham team of financial professionals to allay the client’s worries and guarantee their financial security:

The Arbuthnot experts stated: “Start planning for retirement early – Begin saving and investing for retirement as soon as possible to build a sufficient nest egg. We would recommend creating a comprehensive retirement plan. This includes assessing your current financial situation, estimate future expenses, and develop a strategy to ensure your desired lifestyle during retirement.

“Those particularly worried their future finances, perhaps those in jobs where income is not a steady or guaranteed stream, should consider diversifying income sources: Explore options such as pensions, retirement accounts, investments, and annuities to create a steady stream of income in retirement.”

Arbuthnot Latham’s experts also share that 40% of survey respondents worry about investing, suggesting diversification across asset classes and regular updates to reduce risk and enhance returns.

As well as consulting a financial adviser to assess risk tolerance, investment objectives, and creating a personalised plan to ease concerns about managing wealth.

“Create a will, establish trusts, and designate beneficiaries to ensure your assets are distributed according to your wishes and minimise taxes.

“Education is also key here. We would recommend teaching beneficiaries about financial responsibility, money management, and the importance of long-term planning before the time comes for your wealth to be passed on. This way, you have given them the knowledge needed. Gifting is also a popular option for those concerned about passing on their inheritance.

“Speaking to a financial adviser will help inform you of the best ways you can utilise tax-efficient investment strategies. Consider the tax consequences of investment decisions, estate planning strategies, and major financial transactions to optimise your tax situation.

“Practice caution and scepticism – Be wary of unsolicited offers, requests for personal information, and high-pressure sales tactics, and verify the legitimacy of any financial opportunity or investment.”