Due to the strength of AI, blockchain, and other technologies, the era of hyper-personalisation has come, and it has never been more imminent.

In his opening speech, Cowell remarks that “understanding and engaging in your investment is really useful”.

To strengthen services and solidify client relationships, a rising number of wealth management firms are becoming considerably more personalised.

Hyper-personalisation enables wealth managers to accelerate portfolio management and make portfolios more tailored to the particular needs of the client and this is often utilising technologies such as artificial intelligence, data analytics, and automation.

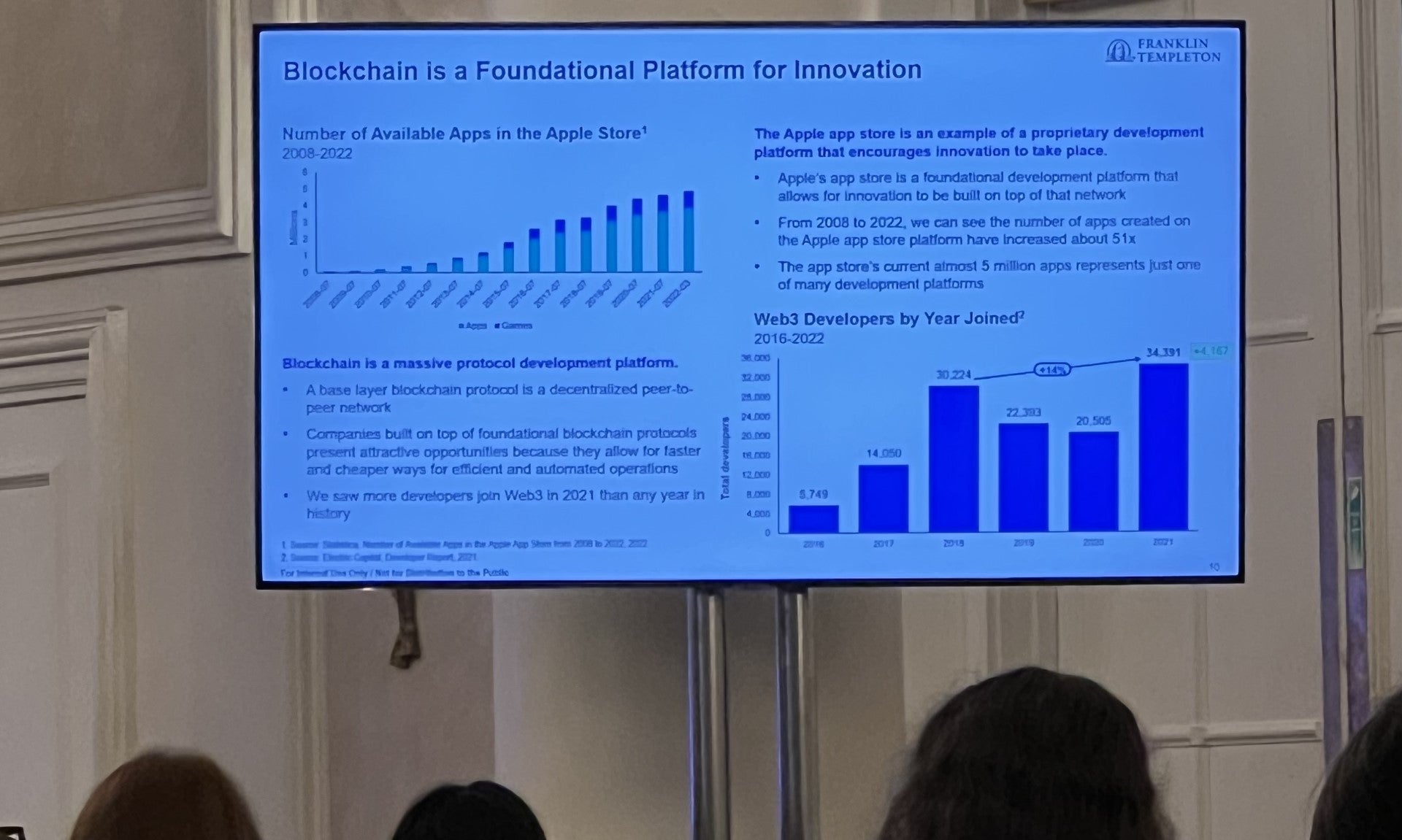

Yet every day, we hear about blockchain and its potential to revolutionise the banking industry.

At the conference, Cowell expressed how blockchain digitisation has become effective to certain audiences and went onto explain how music artist Rihanna’s most famous song sold as NFT royalties ahead of the Super Bowl earlier this year.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData‘’Prior to the Super Bowl, she issued 300 NFT tokens. Reality is 300 of these tokens sold for a sizable amount of money and were bought by her fans. Now, what are these tokens? They give a royalty share of her songs, but it also gives the connection, that they literally have ownership, a component of peace and Rihanna in their life. What we’re seeing is very much the entire idea of investment portfolio of the future,’’ said Cowell.

He added: “It’s important because it’s affected microfinance. And this is where blockchain digitisation comes in, and what it is able to do and effectively creates the liquid market for this investment. The same stuff happens where anything you buy can be a lifetime membership, and you can start to turn that into a tokenisation.”

Blockchain is the underpinning technology that will usher in the future internet: a shift from a web of information sharing to a network of value exchange.

“It becomes a tradable asset. And that’s where a lot of work was invented to come down to is we have to start saving before the stock market, you got to start thinking about the risk profile, unlike anything we wouldn’t have. As an asset manager, if we can start to really understand the model, we’re going to be able to give you the portfolios that you really want to have in your life.”

Through the usage of a blockchain-integrated system, Cowell highlights how Franklin Templeton continues to see operational benefits, such as better security, quicker transaction processing, and lower costs, which are advantageous to the fund’s shareholders.

‘’What we’ve developed, is OnChain money market. These things are money market funds, lots of changes going on very heavily. So, we built this really within a public blockchain, working with Polygon, we are able to demonstrate that by bringing real funds and really show efficiency,’’ said Cowell.

Franklin Templeton introduced its OnChain U.S. Government Money Fund just over a year ago, and as of today, the tokenised fund’s assets under management (AUM) had topped $270m.

It is the first U.S.-registered fund to track transactions and ownership using a public blockchain (Stellar).

So, what does the future innovation look like for Franklin Templeton?

Cowell’s response: “Our innovation is to be more relevant to our clients as much as we can.”

He lastly predicts: “Within two to three years traditional funds. I think HSBC and Northern Trust during that 10 percent all global assets will be on blockchain asset’s structure. And I think it’s, it’s, it’s obviously, on the regulations that come through, I think there’s been a lot of change going on. With our financial services system, we proved that the industry can be a powerful thing, and this can actually be accelerated.”