To successfully engage with the future generation of HNW individuals, it is not enough for wealth managers to simply understand their needs. To avoid assets outflow they must build bonds with the next-gen long before any wealth transfer takes place.

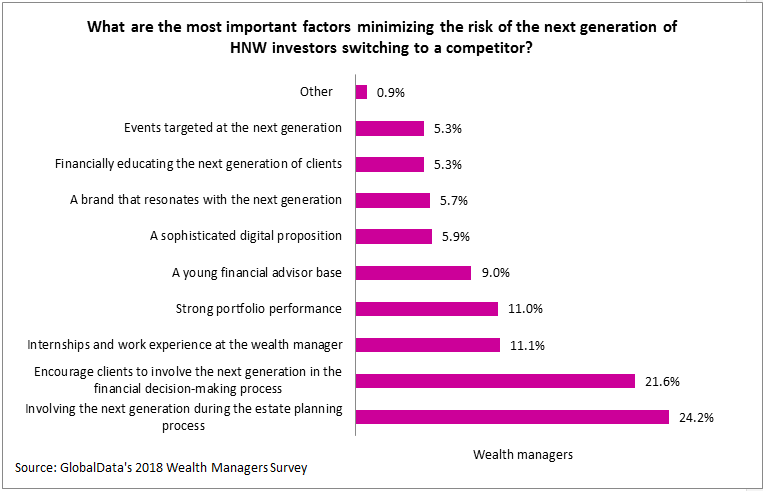

GlobalData’s 2018 Wealth Managers Survey found that catching the next-gen early on tegiving them first-hand experience in managing the family wealth will be most effective to retain assets after they are passed on.

Almost one in four, 24.2%, of wealth managers believe involving heirs during the estate planning process is the most influential way to retain them. This is closely followed by involving clients’ children in the financial decision-making in general.

Simply opening a youth account in an heir’s childhood will not be enough.

GlobalData survey shows that less than half of such accounts transform into a proper relationship with the bank in the successor’s adulthood.

Wealth transfer – the next-gen tends to change adviser too

The next-gen build their own relationships with advisers and tend to bank with different providers than those used by their parents.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataConsequently, preserving family assets after inheritance will be a tough nut to crack for wealth managers.

This is also an important issue for HNW testators who want to ensure the family wealth remains in the hands of a trusted adviser.

Hence giving the next generation responsibility in the management of family wealth early on will be beneficial, as much to wealth managers as to their HNW clients.

Relationships take time to build, and the earlier advisers start, the more time they will have to gain a good position to showcase why they are better than the competition.

Those wealth managers that understand this will win out as one of the largest intergenerational wealth transfers to date unfolds. The alternative is watching how inherited assets flow to the competition.