Equities are still the main asset class in HNW portfolios, and recent stock market performance is helping maintain this trend. But when the bull run inevitably ends which markets will be hit hardest? GlobalData Financial Services explains

Equities have long been favoured by HNW investors for the capital appreciation opportunities they offer, and the current stock market bull run means their appeal endures.

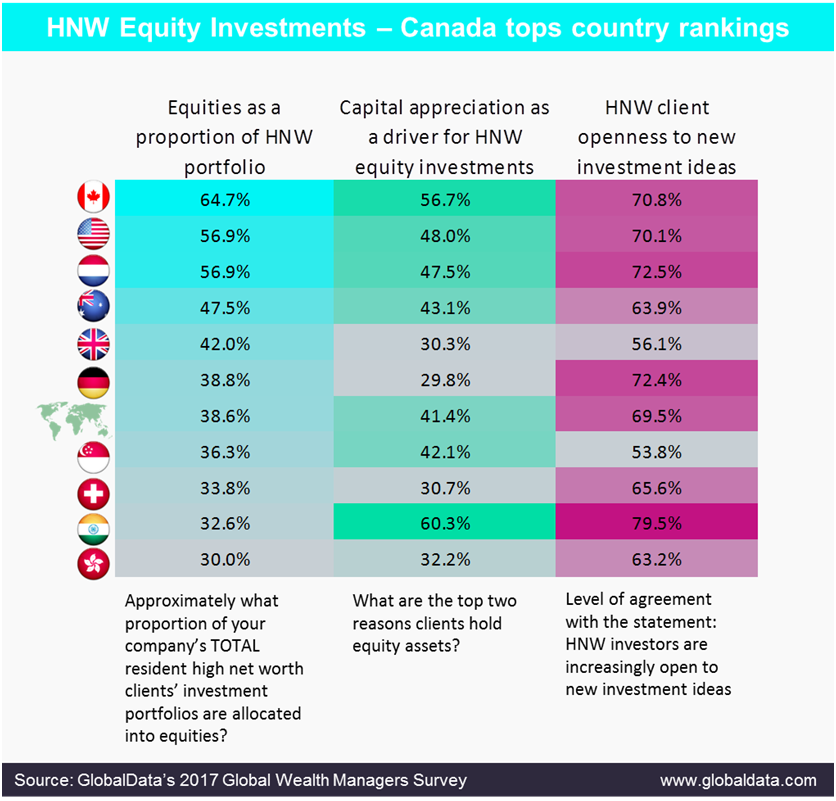

According to GlobalData’s 2017 Global Wealth Managers Survey, 38.6% of the typical HNW investor portfolio is held in equities, followed by fixed income investments at 24.9%.

In fact, the stock market has performed well over the last 12 months across all regions, with MSCI regional markets indices showing a consistent upward trend, with double-digit returns in 2017.

On a country level, the markets where HNW investors have most equity exposure include Canada (64.7%), the US (56.9%), and the Netherlands (56.9%). The prime motivation for equity investments in eight of the top 10 markets is capital appreciation.

The two exceptions are Germany and the UK, where dividend income is more important when investing.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataYet at some point the bull run will end. As such, advisers in the top ten countries invested in equities will need to be primed to discuss strategies to rebalance clients’ portfolios.

The bright spot is that our data also shows that 70.5% of investors globally are open to new investment ideas, with countries such as China and India showing particularly strong openness.

However, agreement levels are also high in developed markets on top of the ranking such as Canada and the US, which means advisors in these countries will have a better chance to diversify their clients’ portfolios.