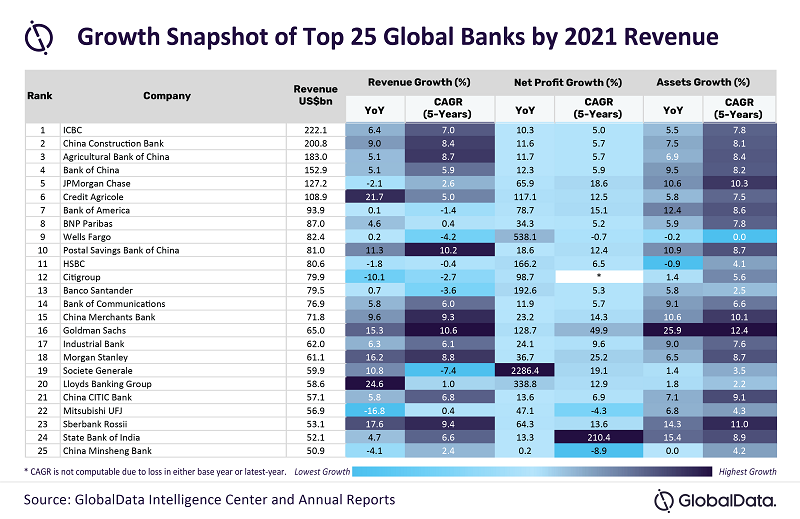

The year-on-year (y-o-y) average growth rate of total assets of the top 25 global banks stood at 7.5% last year, finds GlobalData, a leading data and analytics company.

Most of the top banks bounced back from the impacts of Covid-19 in terms of revenue and profit growth.

Twenty banks posted y-o-y growth in their revenues, and among the most prominent entities were Lloyds Banking Group and Credit Agricole. These two banks witnessed an annual growth of over 20%.

GlobalData company profiles analyst Parth Vala said: “Although there was a 7.3% decline in Lloyds Banking Group’s interest income, a 47.5% growth in non-interest income, owing mainly to a 138.2% growth in net trading income, enabled the bank to post an impressive revenue growth of 24.6%.”

Credit Agricole saw muted growth of 1.1% in its interest income. However, it posted a 31% growth in its non-interest income, driven by a huge rise in net gains on other financial assets at fair value through profit. This pushed the revenue of the French entity by 21.7%.

Mitsubishi UFJ witnessed a huge decline in interest income last year, due to lower average interest rates on interest-earning assets. This led to a drop of 16.8% in revenue.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGoldman Sachs and Postal Savings Bank of China were the only two entities that saw a compound annual growth rate (CAGR) of more than 10% in their revenue between 2017 and 2021.

Societe Generale had seen the most notable drop at a 7.4% CAGR.

All 25 banks bounced back to growth with regard to profitability, with 11 players witnessing an exceptional growth rate of more than 50%.

Vala comments: “Most of these exceptional performers benefitted from a substantial decline in loan loss provisions that were made to mitigate the effects of COVID-19. As the economic activities gradually returned to normality in 2021, the banks reduced the amount that was set aside for mitigating potential unforeseen losses.”

In the last five years, State Bank of India and Goldman Sachs posted a CAGR of 210.4% and 49.9%, respectively, in terms of profitability. China Minsheng Bank and Mitsubishi UFJ, however, posted a negative CAGR of 8.9% and 4.3%, respectively.

Goldman Sachs witnessed y-o-y growth of 26% in its total assets, driven by an increase in cash and equivalents, collateralized agreements, net loans and customer and other receivables. HSBC’s total assets, however, shrunk 1% annually because of lower derivative assets and a fall in financial investments.

Vala adds: “The banks that reported a CAGR of over 10% in total assets over the past five years were JPMorgan Chase, China Merchants Bank, Goldman Sachs and Sberbank Rossii.”