“The steady rise in global wealth growth came to a sharp halt in 2018”, is the opening line of the BCG Global Wealth Report 2019.

It is the first time in five years that this annual study of the global wealth management industry from Boston Consulting Group (BCG), a management consultancy, has recorded a fall in wealth growth of over five percentage points.

“The big question now, of course, is whether the pullback in wealth growth is a precursor to deeper changes,” ask the report’s authors, Anna Zakrewsky and Tjun Tang, both managing directors of BCG’s Wealth Management division.

BCG Global Wealth Report forecasts

As any wealth manager knows only too well, the fourth quarter of 2018 was to blame for most of the wealth decline over the last 12 months.

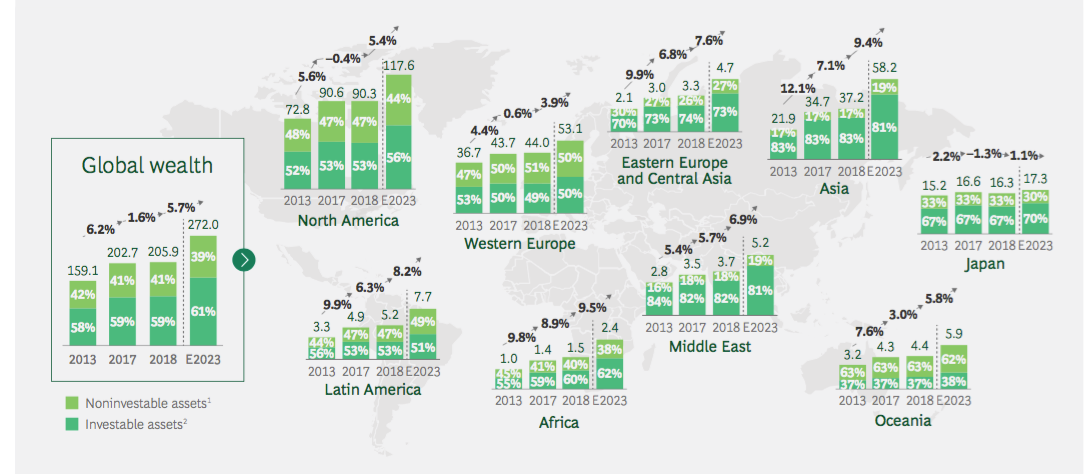

“In 2018, global personal financial wealth grew by just 1.6% to $205.9 trillion in US dollar terms, sharply lower than the 7.5% (to $202.7 trillion) recorded the year before,” says the report, noting that this decline hit wealth managers’ bottom lines.

BCG, however, remains optimistic about the next five years, forecasting a 5.7% increase in global wealth from 2018 to 2023.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“From 2018 to 2023, however, the region likely to experience the fastest millionaire population growth is Asia (excluding Japan) at 10.1%, followed by Africa at 9.8% and Latin America at 9.1%”.

The figures are slightly more optimistic than those from GlobalData (part of the same group as PBI), which forecast a 7% growth in Asia Pacific between 2017 and 2022.

However, both agree that Western Europe will be the slowest growing region in the immediate future. BCG predicts a 3.9% growth, whereas GlobalData forecasts 4.3%.

Affluent market opportunities

BCG’s report suggests the traditional wealth pyramid – with a small number of billionaires at the top and a large number ‘affluent’ at the bottom – might be flattening. “The middle band of affluent households will grow significantly over the next five years,” the report notes.

‘Affluent’ individuals hold between $250,000 and $1m according to BCG’s definition, and collectivity they have $18 trillion in investable assets.

But with their wealth set to by 6.2% over the next five years, these individuals present “a golden opportunity for wealth managers willing to tailor their service and coverage models to clients’ needs,” the report notes.

Wealth managers who currently turn away anybody worth less than $1m should consider the affluent as a form of expansion, suggests BCG.

Currently they are underserved: “Shortcomings include cookie-cutter and overly simplistic offers from retail banks, overpriced services from brand-name firms, and ill-fitting product recommendations from various wealth management providers”.

While the statistics might make business sense, many still argue against banking the mass affluent at a time when many wealth managers are actually increasing their minimum entry requirements.

Gareth Johnson, head of digital channels and investment solutions at Brewin Dolphin, told a PBI conference in London last week that private banks and wealth managers should be wary of the pitfalls in highlighting the mass-affluent client base as an opportunity to onboard more individuals just to supplement decreasing fees.

“Who wants to be a customer of a service where you’re just supplementing someone else’s fees? That doesn’t sound like what I want.”