Ortec Finance was established in Rotterdam in 1981 and now has a team with 250 experts in Rotterdam, Amsterdam, Hong Kong, the United Kingdom, Canada, and Switzerland.

Our mission is to improve investor’s decision making and monitoring of risk and return in the institutional and private markets.

For financial services providers, we design, build and implement solutions for Goal-based Wealth Planning and Goal-based Financial Planning.

Client-centric advice with goal-based planning

Why do clients invest? Does their income meet their expenditure, now and after retirement? Is the advised investment portfolio in line with the objectives and means? And how do you monitor a client’s goals and risk?

Questions like these get to the very heart of goal-based financial planning: how to make ambitions concrete, translate them into an optimal investment portfolio, and monitor whether clients stay on track to reach their financial goals.

Goal-based financial planning focuses on the objectives of consumers, resulting in client-centred advice where product and client profiles are fully aligned.

Goal-based planning with OPAL Platform

With the OPAL platform, Ortec Finance offers a goal-based planning and investment decision support tool that meets the needs of different business models, as well as a wide range of online advice propositions.

From a client intake module and risk-profiling tool to (online) client reporting and proactive monitoring, the platform facilitates all stages in a goal-based advisory process.

Our solutions use ‘what-if’ analyses that help clients and advisors better understand their options. Clear visual aids show the current situation and effects of investment decisions, changes in a client’s financial situation and market developments, on the probability of reaching financial goals.

OPAL solutions range from sophisticated wealth planning to holistic financial planning. Both modules enable financial institutions to translate personal goals of clients into an optimal financial plan and monitor these goals over time. In Wealth planning, the focus lies on defining the optimal investment portfolio.

The OPAL Financial planning module additionally offers a cash flow planning module that offers a holistic view of the client situation and addresses both income and investment risk. OPAL Wealth planning and OPAL Financial planning can function as separate modules or as a fully integrated solution.

With OPAL Platform, clients and advisers can consistently capture, measure and communicate risk and return, as well as comply with the latest regulatory frameworks. The client-centric approach furthermore increases the likelihood of meeting your client’s expectations and has a proven positive effect on business retention.

Industry-leading solution for goal-based wealth and financial planning

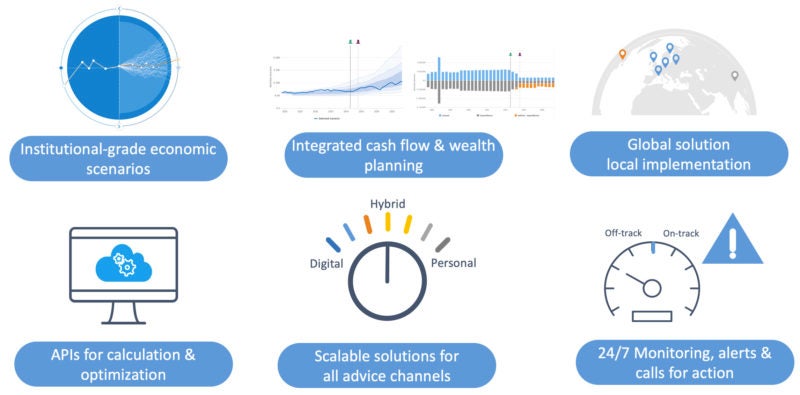

Global solution with local implementation

The OPAL platform is implemented in different countries. Our tooling offers multiple language packages and currencies, in addition to country-specific products.

Scalable solutions for all advice channels

A scalable solution for all advice channels, OPAL goal-based planning offers functionality for different business models, as well as a wide range of online advice propositions. The platform supports financial advice through a modern graphical user interface and advanced application programming interfaces (API).

Advanced APIs for calculation, optimization and integration

The OPAL platform supports this trend by offering a calculation engine via three API modules hosted in a private Cloud (software-as-a-service) or on-premise. These modules – wealth planning, financial planning, and optimiser and automated advice – are designed for calculation, optimisation and integration.

Institutional-grade economic scenarios

The OPAL engine gives access to Ortec Finance’s Dynamic Scenario Generator. This state-of-the-art stochastic projection engine generates real-world, institutional-grade economic scenarios that reflect possible future developments and are built on refined analysis of historical behaviour.

Integrated cash flow & wealth planning

OPAL not only provides information on current and future cash flow position. The platform differentiates itself from all other financial planning tools by integrating the effect of investment risks on the realisation of financial income goals.

24/7 Monitoring, alerts & calls for action

The OPAL platform automatically manages and monitor the client’s financial situation and goals. It provides 24/7 continuous monitoring of the risk, returns and financial goals for optimal client management.

Customer testimonials

Insinger Gilissen said: “We appreciate that Ortec Finance positions itself as an independent party that also dares to pose critical questions about our governance, investment policy, and how we guarantee good risk management.”

Munnypot COO Frankie Mendoza said: “Ortec Finance offers a dynamic forecasting solution backed up by quality and professional personnel.”

VisualVest co-founder and CEO Olaf Zeitnitz said: “From the beginning, Ortec Finance has offered a client-oriented approach not only during phases of product implementation but also with expertise in scenario analysis and client targeting in wealth and financial planning.”

PGGM said: “Ortec Finance provides the calculation engine OPAL that brings together all pension entitlements (state pension, 2nd and 3rd pillar), salaries and property (house, savings and investments), and which provides insight into the net disposable income of the participant or the household.”

Triodos Bank private banking director Albert van Zadelhoff said: “With the OPAL-platform, we offer a framework for the client-central advisory process. This framework provides a consistent investment experience, which meets the latest regulations and leads to satisfied clients.”

About Ortec Finance

Ortec Finance is the leading provider of technology and solutions for risk and return management. It is our purpose to enable people to manage the complexity of investment decisions. We do this through delivering leading technologies and solutions for investment decision-making to financial institutions around the world. Our strength lies in an effective combination of advanced models, innovative technology and in-depth market knowledge. This combination of skills and expertise supports investment professionals in achieving a better risk-return ratio and thus better results.

Headquartered in Rotterdam, Ortec Finance has offices in Amsterdam, London, Toronto, Hong Kong and Zurich.

- 20+ countries represented

- 500+ customers

- 96% retention rate

- €3 trillion total assets managed by our clients