Francis Menassa, CEO and founder of JAR Capital, says the recent inversion of the yield curve might be telling us something important about future growth and the prospect for equity markets.

Bond markets have been rioting and many are interpreting the extreme low levels of yield as heralding recession in the US. With unemployment at near record lows and rates of economic growth that can only be described as robust, that view may seem a little extreme. Many economic statistics are backward looking, however, while financial markets price on forward looking assumptions. The recent inversion of the yield curve is likely telling us something important about future growth and the prospect for equity markets.

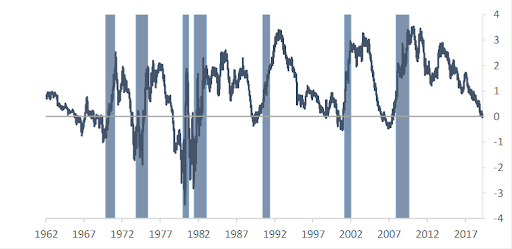

The chart shows that a recession has closely followed yield curve inversion since the 1960’s. Banks typically borrow short-term money to lend out to clients over the longer term. They will reduce their lending activity as it becomes less profitable, likely lending less from here, making it harder for the economy to grow.

Interest rates are so low now (just above 2%) that it will be difficult for policymakers to arrest any economic decline into a recession. That is because the average cut in interest rates as a policy response to recession has been 5%, but assuming zero is the lowest the Fed is willing to go, there is just 40% of the policy setting firepower available to combat recession.

One new form of policy thinking is Modern Monetary Theory (MMT). The basic idea being that the limitation of monetary policy (rates are already low) is a facet of MMT and governments should borrow more money to spend their way out of recession. So long as interest rates stay low, the cost of financing that spending is also low. No one knows how sustainable that model could be, presenting a significant challenge to orthodox policy thinking and an added level of risk to financial markets.

Not only have bonds historically provided useful information about the direction of the economy they have also provided excellent diversification opportunities in balanced portfolios. Typically, in periods of recession equity prices fall and bond prices rise, but returns to both are usually positive in more normal markets. Interest rates (bond yields) are so low, however, that they are unlikely to provide the diversification they once did. If investors can no longer count on bonds for protection against losses in the equity part of their portfolios, then they need to prepare for higher risk or lower returns.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThat might sound extreme, but for those investors that do not want to be exposed to the uncertainty that a looming recession brings, cash type investments offer a good place to hide.

Alternatively, for those that want continued exposure to equity returns, some degree of structured return protection could be a good solution while rates are low. The economic outlook might not be as dire as the Tom Petty reference suggests, but it accurately describes the path of bond yields over the past year or so.

It feels as though markets are getting ready to switch into a new regime, and for investors, doing nothing really should not be an option.