Brexit uncertainty has continued into 2019. With decision day approaching fast, if no deal is the outcome then UK investors are likely to suffer, believes GlobalData.

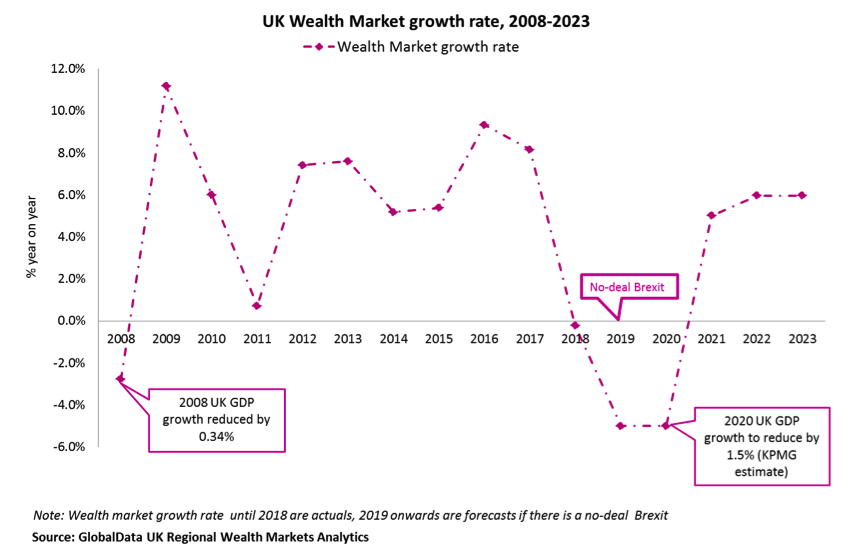

In September 2019, global professional services company KPMG predicted that a no-deal Brexit will result in a 1.5% GDP decline in 2020. Bear in mind that UK GDP only fell by 0.34% in 2008 when the world went into recession, which contributed to the 3% decline in the UK wealth market that year. Considering both GlobalData’s UK Regional Wealth Markets Analytics and KPMG’s estimate, UK wealth market growth is likely to decline by 5% in 2019 and 2020 in the case of a no-deal Brexit.

This noteworthy decline will largely be felt in the fund and equity markets. In fact, as of mid-September 2019, the FTSE 100 is back in the same position as September 2018, and a no-deal Brexit is likely to push the stock market over the edge. In addition, the fund market holds a larger proportion of the overall wealth mix and so will be a big driver of the declines.

In the UK, interest rates have remained low for over a decade, reducing deposits’ role in the nation’s investment portfolio. As per GlobalData, deposits in the UK held 64% of the average UK portfolio in 2008. However, this figure had fallen to 58% as of 2018. With deposits’ ability to act as a shock absorber reduced, the average portfolio is more prone to larger swings in times of market upturn and downturn. And the appetite for bonds has also declined as a result of low interest rates. This loss of enthusiasm for bond investments is mirrored in many countries across the world.

2019 has been another year of Brexit uncertainty so far, with the original March 2019 deadline pushed back to October 2019. A change of prime minister has prompted further complications, with Parliament attempting to block a no-deal Brexit. Although 2021 onwards look promising, wealth managers must be well prepared to reduce the extent of investment distress for their clients in the next few years. Taking a page from the strategies that worked during the global financial crisis may be a savvy approach.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData