New Zealand millennials are a promiscuous bunch, relying on an increasingly large number of different types of providers for their investment needs. Creating loyalty among this segment is critical as competition for share of wallet is on the rise.

GlobalData’s 2022 Financial Services Consumer Survey found that baby boomers make use of an average of 1.4 types of providers. Among the millennial segment this proportion jumps to 2.1. This poses a critical challenge for traditional investment providers. The same survey also shows that only 25% of millennials would prefer to invest via their bank (be it through an advisor or a platform), compared 36% of baby boomers.

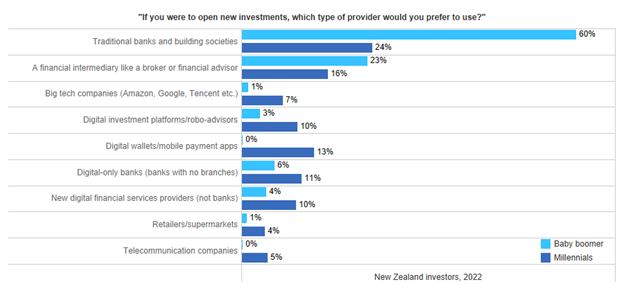

Indeed, only 17% of baby boomers would look beyond traditional banks and building societies or financial intermediaries when opening new investments. In stark contrast, 60% of millennials would favour non-traditional players. This increasingly matters as the rate of investing among New Zealand millennials rose from 35% in 2018 to 46% in 2022. This age cohort is increasingly coming to dominate the investment market.

To avoid losing younger investors to new entrants, New Zealand’s incumbents will have to work on their brand image and offerings in order to create loyalty. The single most important attribute millennials look for in a financial services provider is an easy-to-use digital banking platform. 43% of New Zealand millennials value this, according to GlobalData’s 2022 Financial Services Consumer Survey, meaning it is the single most important change providers can make. No matter how good your product range, wealth managers need to be taking into account how easy it is for their DIY or digital clients to invest with them. Increasingly large sums of assets under management are at stake, and investments in technology are critical to remain relevant.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData