Demand for investor visas and residency-by-investment programs is growing rapidly among Indian HNW investors – a trend wealth managers should capitalize on. Supporting investors before and during the application process provides wealth managers with a straightforward avenue to assets under management (AUM) growth.

Demand for investor visas is on the rise across the globe, with reasons including tax efficiencies, quality of life, or merely prestige. Multiple citizenships are also effectively an insurance policy should an individual’s country of origin become unstable – be it politically or economically.

However, demand is particularly pronounced in India. The Passport Index ranks the Indian passport in place 69 (out of 94 ranks), just before Sierra Leone and Rwanda. It provides visa-free access to a mere 25 jurisdictions. In comparison, a Portuguese passport allows holders to travel to 124 countries without the need for a visa. For internationally-active Indian HNW investors and entrepreneurs this presents a strong incentive to hold multiple residencies.

While the Indian government does not allow dual citizenship, a residency visa in any European country would provide the holder with access to the entire Schengen visa zone. For example, residency in Portugal is available for a minimum investment of €350,000 ($400,000).

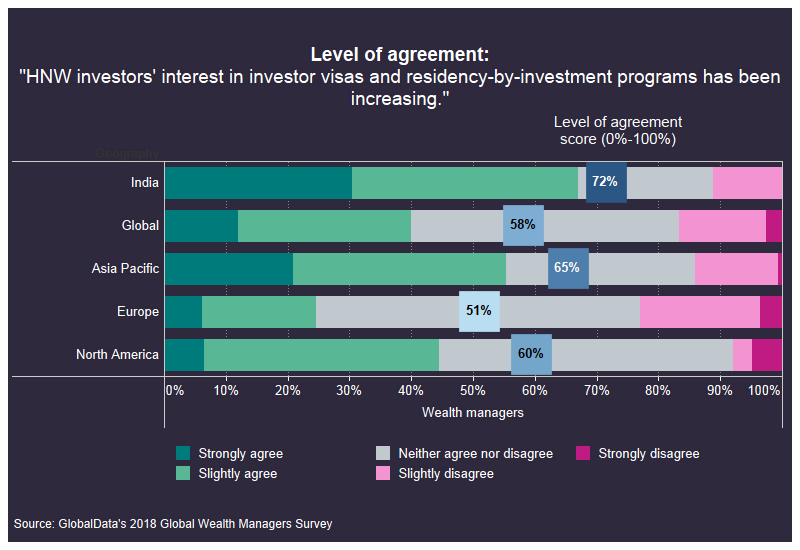

According to our Wealth Management Industry Conditions Analytics, 66.5% of industry participants “strongly” or “slightly” agree that demand for investor visas and residency-by-investment programs is on the rise among Indian HNW investors. Globally, this proportion drops to 40.0%.

According to our Wealth Management Industry Conditions Analytics, 66.5% of industry participants “strongly” or “slightly” agree that demand for investor visas and residency-by-investment programs is on the rise among Indian HNW investors. Globally, this proportion drops to 40.0%.

Targeting potential investor visa applicants will allow wealth managers to get their hands on a good chunk of clients’ AUM, given that visa requirements tend to stipulate that applicants are required to make certain minimum investments for a fixed period of time. Providing investment accounts that comply with a country’s investor visa requirements has the potential to attract a significant share of a client’s wealth. Clearly, there is a business case to be made for addressing rising demand.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData