The Spanish economy has experienced several years of recession over the past decade, and the country’s tourism and hospitality industries have been the strongest engine for growth in the recovery years. However, since the COVID-19 pandemic reached the country, travel restrictions and shuttered business have severely hurt the economy and will negatively affect retail wealth growth.

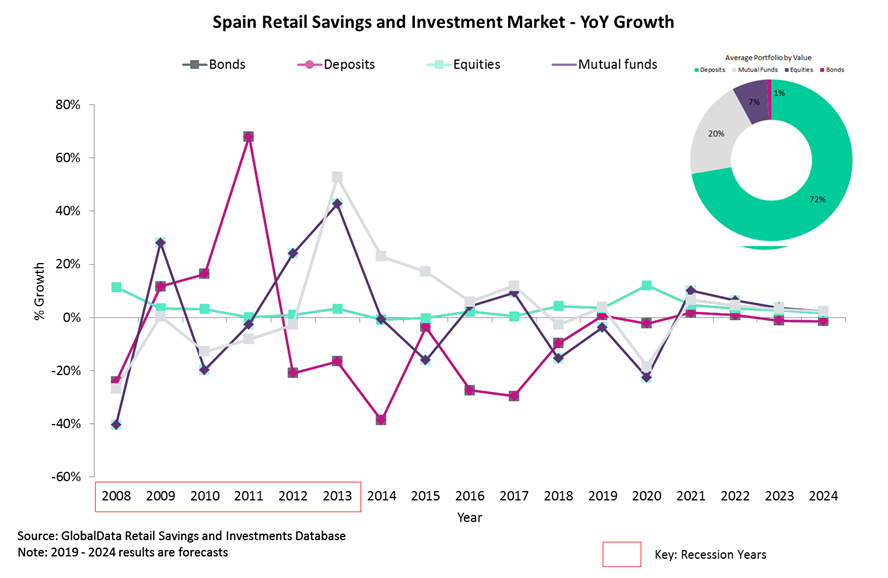

According to our Retail Investments Analytics, we estimate that the Spanish retail savings and investment market will grow by 1% in 2020. Just under 75% of the average investor portfolio is in safe-haven products, mostly deposits, and only 1% in bonds. Deposits will be the only asset class that grows in 2020, with an expected gain of 12%. Despite returns for savers being low, this is still better than holding wealth in riskier asset classes.

Bond balances in Spain have been declining drastically for years as yields have remained low. Although we expect bond balance growth to decline by 2%, it is better than previous years’ declines: a dip of 30% was recorded in 2017, for example. With this epidemic hurting the economy, the European Central Bank’s €750bn ($842bn) emergency quantitative easing program to prop up the economy will see more money than usual flood into bonds, thus suppressing yields.

Like most countries, Spain’s equity and mutual fund holdings will be hurt the most in 2020. We estimate 22% and 14% declines respectively. March 2020 saw the IBEX 35 dip to levels last seen in 2012, when the country entered a double-dip recession. Since then, the Spanish stock market has remained low, volatile, and dependent on news. Although mutual fund holdings have the benefit of being diversified (and we therefore don’t expect balances to be hit as hard as equities), a fifth of the average portfolio is held in mutual funds, meaning that the declines will be more pronounced. However, stock markets are expected to bounce back once the government begins to loosen its measures and the lockdown and travel bans are lifted. With all this expected to happen during the year, we expect both equity and mutual fund balances to increase in 2021 by 15.1% and 11.6% respectively.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataUnfortunately, the first half of the decade will not be the most fruitful for investors and their wealth managers in Spain. Although travel restrictions may be lifted in 2020, it will take a few years for the country to attract as many tourists as it once did due to low consumer confidence in traveling. This also means the hospitality industry will take time to recover too. Therefore, we expect retail wealth growth to be slow but steady in the coming years.