A high reliance on deposit products limits wealth growth among the UK’s less affluent individuals. With risk aversion being the number one investment deterrent, education will be key to drive uptake of investment products in a sustainable and responsible manner.

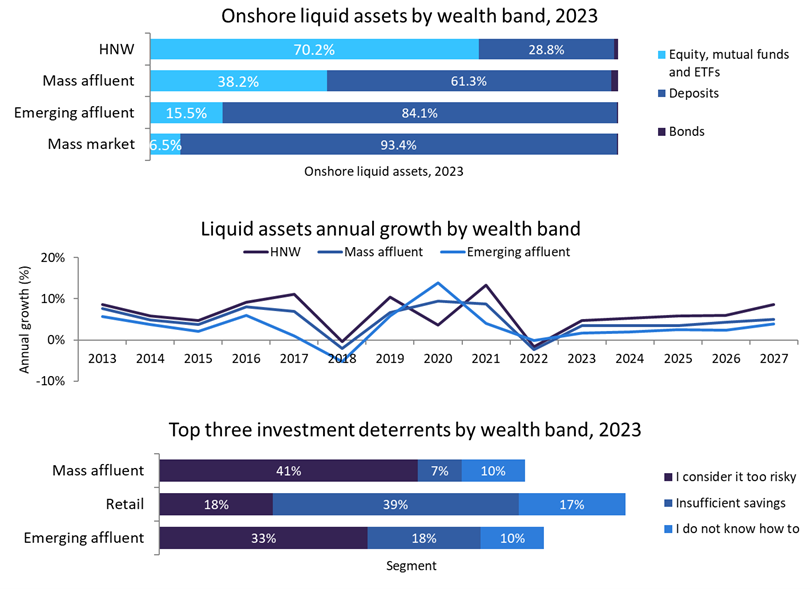

GlobalData’s Investor Demographics Analytics shows that investment product holdings drop significantly in lower wealth tiers. UK HNW investors allocate an average of 70.2% of liquid onshore wealth to equities, mutual funds, and exchange-traded funds (ETFs). This proportion drops to 38.2% among the mass affluent and a mere 15.5% among the emerging affluent.

This data is in line with findings from the Financial Conduct Authority. The regulator’s Financial Lives 2022 survey found that 79% of adults with investable assets of between GBP10,000 ($12,710.72) and GBP20,000 ($25,421.45) hold all or most of these assets in cash. This, in conjunction with lower uptake of advice and lower levels of diversification, drastically limits wealth generation among this segment.

Indeed, there is clear evidence that greater exposure to investment products, if well diversified, is linked to higher overall wealth growth. According to MSCI data, the annualized return of cash over the past 20 years was 1.42%. This compares to 4.48% diversified portfolio growth. Large cap growth was more impressive with 11.29% annual growth, but also significantly more volatile. Long-term findings from GlobalData’s Wealth Markets Analytics provide further evidence. Between the beginning of 2013 and the end of 2023, wealth held by UK HNW investors, among which investment product penetration is universal, recorded a compound annual growth rate (CAGR) of 6.2%, compared to 4.9% for mass affluents and 3.4% for emerging affluents.

This is a crucial point when addressing risk aversion, which is the number one investment deterrent among those with sufficient investable assets, quoted by 41% of the UK’s mass affluent and 33% of emerging affluent non-investors.

GlobalData findings further show that investors in lower wealth tiers tend to be less diversified. Thus being more exposed to market shocks, they are more likely to retreat to cash and near-cash products should markets turn sour. As per Investor Demographics Analytics, HNW investors allocate 85% of their liquid risk assets to fund products, which offer greater levels of diversification. Mass affluent and emerging affluent investors, on the other hand, are more likely to opt for direct holdings (45% and 55% of risk products, respectively).

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataHowever, despite these trends there is also an opportunity for UK wealth managers. The challenge lies in reaching reluctant investors and addressing portfolio shortcomings. Explaining the importance of a long-term investment approach and a well-diversified portfolio spread across different asset classes, sectors, and regions will be key to unlocking the substantial amount locked up in deposit products. Potential interest rate cuts, which will limit the allure of deposits and are likely as early as this summer, will also play in wealth managers’ favor, and should form part of any narrative when promoting investment products.