- More than half (57%) of the 677 European-based wealth professionals respondents stated that Unit-Linked life insurance solutions are a good option and that they will always (or whenever possible) recommend them to their clients

- Succession planning is the key driver for these wealth professionals to consider the use of Unit-Linked life insurance

- 54% of these European-based wealth professionals predict growth of the Unit-Linked life insurance market over the next five years

More than half of European-based wealth professionals (54%) predict growth of the Unit-Linked life insurance market over the next five years, with one in five (21%) saying that its growth is likely to be substantial according to the 2020 Wealth Assurance Report from Lombard International Group, a market-leading provider of insurance-based wealth, estate and succession planning solutions for high net worth individuals, families and institutions. Insurance Brokers are the most optimistic group of wealth professionals with more than two thirds (70%) predicting an increase in the use of Unit-Linked life insurance policies over the next five years.

Carried out in association with Accenture Luxembourg, this first of its kind report offers in-depth pan-European analysis of Unit-Linked life insurance, also known as Wealth Assurance. The findings, summarized in 5 parts, paint a truly valuable picture of the motivations, challenges, and most importantly, the opportunities for the Wealth Assurance industry as it looks to adapt and evolve to the changing demographics, economic environment and to the ever more sophisticated wealth and succession planning needs of high net worth individuals (HNWIs) and their families.

Click here to learn more and explore The European Wealth Assurance Report.

In an unpredictable global economy, increasingly mobile HNWIs require wealth and investment solutions that are comprehensive, yet simple to implement, that are compliant and proven, but also, highly flexible, portable and adaptable to their evolving lifestyles. At the same time, they need to safeguard their interests against both the certain and the unknown. This translates into a multitude of challenges and opportunities for the Unit-Linked life insurance industry.

This anticipated growth is building on strong foundations. Around 30% of respondents are found to have over 50% of clients who either currently have or previously had a Unit-Linked life insurance policy; a figure which rises to 70% of respondents based in France and 60% of respondents based in Portugal. Furthermore, more than half (57%) of wealth professionals stated that Unit-Linked life insurance solutions are a good option and that they will always (or whenever possible) recommend them to their clients. Importantly, these findings are similar across all wealth professionals and geographies.

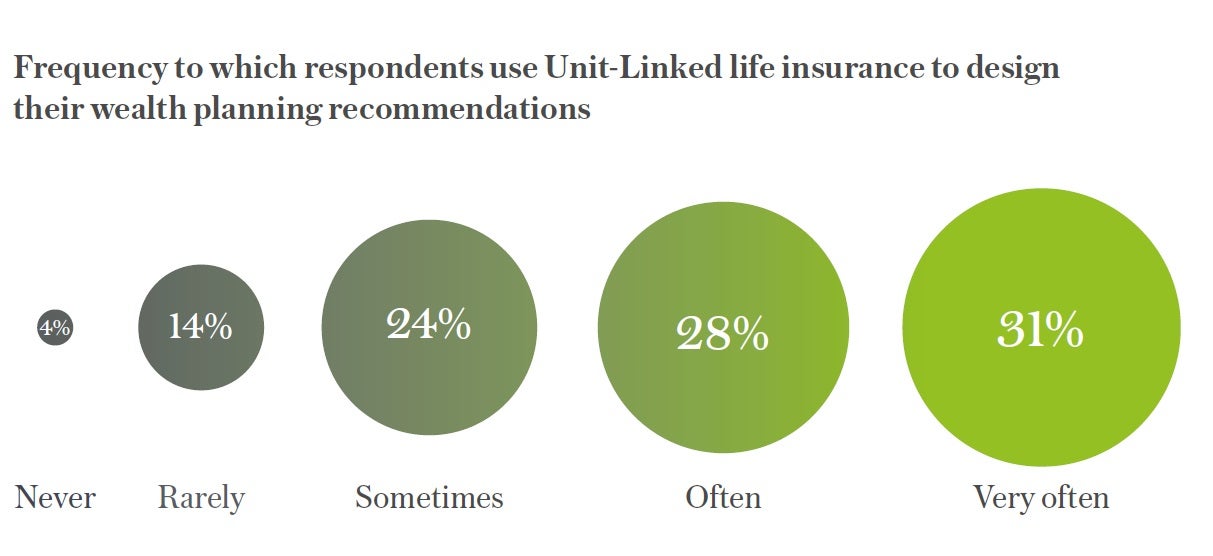

Nearly a quarter (24%) of UK based respondents use Unit-Linked Life insurance either often or very often. A further 47% do so sometimes. Among those that don’t use Unit-Linked life insurance policy as a wealth planning tool, the three most popular alternatives are revealed to be discretionary managed investment accounts (26%), investment accounts managed in ‘execution only’ or advisory (18%), and fixed-interest products or guaranteed products (15%). UK based professionals place ‘a Trust’ as a second preferred alternative (although a Trust can be combined with Wealth Assurance solutions), third for Swiss-based professionals and fourth for those based in Italy.

For wealth professionals that use Unit-Linked life insurance, its effectiveness to support succession planning is the key driver. This is closely followed by elements of the solution that enable a more efficient management of their clients’ investments over the long term. Third is the ‘bespoke’ aspect of life assurance as a structuring tool. More than half of respondents (53%) also comment that Unit-Linked life insurance has a higher, or considerably higher asset stickiness effect than its alternatives.

Click here to learn more and explore The European Wealth Assurance Report.

Methodology

The survey was translated and distributed in seven different languages and sent to active wealth professionals across Europe. Composed of 24 questions and divided into 3 sections, the survey aimed to anonymously collect, analyse, and detail views and opinions to provide an overview of how insurance-based wealth planning solutions are perceived, used and considered across Europe, now and in the future.

The survey, carried out in partnership with Accenture Luxembourg, was in the field between 15 September 2020 and 31 October 2020, generating a sample size of 677 across 12 jurisdictions. As respondents were given the opportunity to skip some questions, the number of answers vary across the survey.

The top five geographical locations were Luxembourg (21%), Switzerland (15.3%), France (14.2%), Italy (13.8%) and Germany (9.4%). This resulting footprint is consistent with Lombard International Group footprint and network of trusted partners in Europe, which includes private bankers, independent wealth and financial advisers, insurance brokers, family officers, independent asset managers, and tax lawyers serving the needs of high net worth clients and families.

N.B. In those questions where respondents were asked to rank choices, a scale was offered, with 1 being the most important and 10 being the least important.