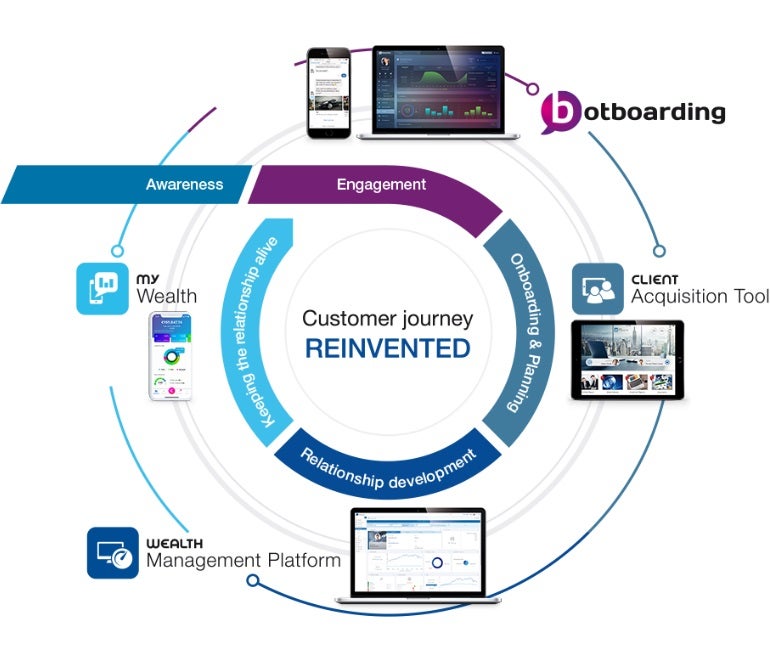

Today, the way a company deals with its customers determines its success and growth more than ever. For financial institutions it is also extremely important to pay attention to their customers’ experience starting with the initial contact, through the engagement process and during the entire long-term relationship. The aim is to constantly provide superb service quality in each stage of the customer journey. Consistency is the key: if the customer is satisfied with onboarding but administration is poor, a drop out can be expected.

The first decisive stage is the client acquisition. People are tired of filling out endless forms especially when applying for banking services thus we believe that a mobile first approach is the key for acquiring potential new clients. Today, there are 2.6 billion smartphone subscriptions globally which number will reach 6.1 billion by 2020 and this also signifies an evolution in customer behavior. In the recent years, people have been increasingly changing the medium through which they connect and communicate moving towards to more text-centric and social messaging platforms. What can prove it better than Facebook Messenger’s 1.2 billion users reached by April 2017? Among the many things we can do with our phones today texting is the most-done activity. Moreover, texting is no longer just a trend of millennials, in 2015, 97% of the US population sent at least one text a day.

Dorsum agrees with the forecasts and accordingly thinks that most probably the future of FinTech lies in mobile technology. This is why we created our chatbot platform, Botboarding. Utilizing chat can help wealth managers to connect easily with a broader customer base, social media alone gives access to more than hundreds of millions of users. The chatbot guides potential clients through the whole acquisition process until they become a new qualified prospect. For financial advisors, chatbots open up new opportunities to differentiate their offerings from competitors. The platform incorporates human-like communication with traditional customer data gathering and user profiling in a fast and easy way. Additionally, a real time analytics can be seen which helps to optimize the bot’s behavior and seamless CRM systems integration.

To adopt to tomorrow customers’ rising expectations, it is indispensable to offer innovative, digital solutions all along the customer journey. On its subsequent stages, customers are in constant contact and dialogue with their advisors and, therefore the hybrid solutions we provide appeal for both digital efficiency and personal touch. As for onboarding, Dorsum’s Client Acquisition Tool helps to maximize the sales and onboarding efficiency with a vivid presentation tool with instant investment recommendations.

Following the customer on their journey, the next step is the relationship development. Our core solution for this stage is the Wealth Management Platform. The solution is a new generation front-to-mid software providing the ability to control, analyse and monitor a large number of accounts and supporting the advisory process with enhanced user experience, from which customer and advisor can both benefit.

Nevertheless, we do not leave the customer behind at the end of the customer journey but we offer them new products and re-purchasing possibilities, restarting the customer journey. My Wealth is a brand new, Wealth Management mobile app which serves the needs of the “new type” of customers. My Wealth is a unique app because it grants a hybrid advisory model and provides the best possible UX to the clients. It has integrated wealth management and trading functions and it has a simple, easy to understand, client-oriented wealth reporting system. Its Easy Invest function brings the complicated world of investments closer to everyone.

We believe that our solution portfolio, provides an answer for all arising challenges of the emerging world and therefore Dorsum offers a 360° software solutions for every need of all the stages of the customer journey.