How does a bank choose his canal of communication while most people are used to mobile phone apps such as WhatsApp or Facebook messenger?

How to prevent frauds?

In private banking trust between relationship managers and their clients play a primary role, it’s the essence of private banking existence.

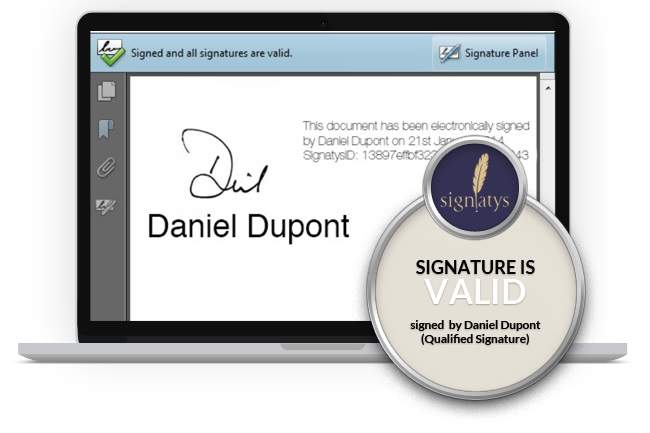

At Signatys, we are building the unique digital standard of trust for data and documents exchanges. We make exchanges and approvals/signatures as secure as making payments. Our company provides solutions to secure communication and get trusted critical decisions via digital signature and strong authentication. Thanks to our diversified team composed of experts in digital signature and mobile security, we have built SignMit, a secured application dedicated to private banks. It allows banks to provide to their customer a secure channel to exchange information and get strong and compliant approvals.

The load of administrative work don’t cease to increase these past years due to more and more transparency in the banking field. New regulations such as MiFID II force banks to innovate and find a new communication canal that is easy to use, efficient but secured. The technologies such as digital signature, biometry and blockchain allow providing trust through smart and secured digital solution.

For instance, the evidence captured by a digital signature, with the addition of some form of identity verification and appropriate cybersecurity, gives sufficient evidence and trust. Banks can have the proof that the signature is genuine and intentionally applied to a particular document in order to be compliant in case dispute.

Last January 3rd, the MiFID II regulation came into effect. This regulation upset the banking world and these many investors. Despite the announcement of this new directive some time ago, a majority of banks still have not put in place an effective and stable solution to address the various issues raised by MiFID II.

This regulation is particularly complex and raises several issues on different axes. One focus aspect of this regulation is related to reporting and suitability; regulatories ask banks to be able to prove that clients have been well advised and received the correct information. The bank must be irreproachable and be able for instance to prove that such client has accepted such suitable investment. In other words, the client was fully aware of the risk taken at the price that was indicated on a specific date.

The reporting will become more and more expensive, that all banks won’t be able to assume if they do not make the good choices by putting in place the right solutions. In order to get ahead of the competition and being able to provide a high-level service, private banks would need to provide to their customers with new ways to communicate and get critical decisions.

Many private banks intend to tackle this issue using either post mail or recorded phone conversations. Exactly the same tedious way used for years to confirm a payment order for example; It’s commonly called the callback procedure and it should prevent from any frauds but this process is absolutely not automated and has shown several times its limits as various banks have been victims of money disappearance due to a fraud.

Despite the frauds, the waste of time, the possibility of human errors, this procedure is rooted among banks. SignMit has been build to provide a simple, fast and secure solution to private banks. Thanks to our technology we can automate these processes in a much safer way than phone calls or email. In addition to being secure, it saves considerable time and reduces operational costs significantly.

Banks can put in place simple digital solution for a complex regulation. Our goal is to go far beyond digital signature and offer banks a unique experience more secure by providing an audit trail tracking carefully all the events and decisions. The audit trail gives the benefit not only to protect banks as they have access to a body of evidence to be compliant but also allow them to collect statistics about their customer’s preferences. Private banks can then propose adequate investment to their clients and receive a higher acceptance rate for their investment proposals.

Our SignMit product can help your business, the same way it already helps several private banks in Switzerland and abroad. Do not hesitate to contact us if you wish to improve the experience of your customers by providing them digital services of new generations.