The European Central Bank (ECB) wage tracker suggested negotiated pay will again be up around 4.5% in 2024. With inflation rapidly declining, this means real wages are growing. Frédérique Carrier writes on how the 2024 UK Budget will reflect these changes.

Stronger real wages and a tight labour market should support consumption which, in turn, would be the main factor to underpin a modest economic recovery in the second half of the year. We expect economic growth, currently flat, to inch up 0.1% q/q each quarter, to reach growth of 0.3% by Q4. It is subdued growth, but growth, nevertheless.

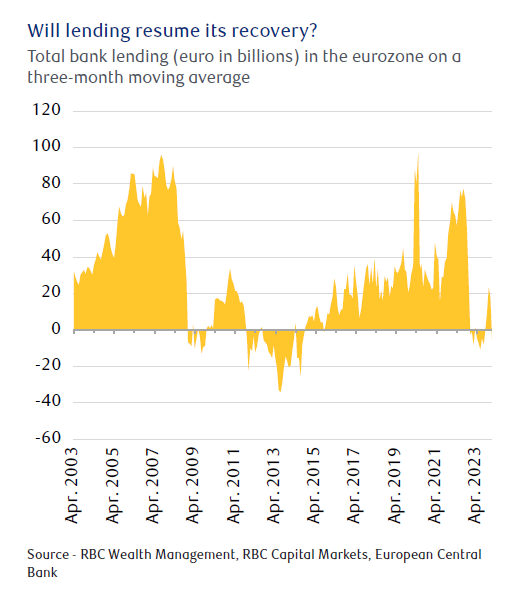

Should bank lending recover, these estimates could prove too conservative. Bank lending made a tentative recovery late last year, but fell back in January, perhaps as a one-off. Still, it seems 2023’s very severe contraction as a result of the aggressive interest tightening cycle has passed, particularly in the context of a looser monetary policy in H2 2024. There is expectation that the ECB to embark on its rate-cutting cycle in June.

What is set to appear in the 2024 UK Budget?

In the UK, the Chancellor of the Exchequer Jeremy Hunt is scheduled to present the 2024 UK Budget to the House of Commons on March 6. With the ruling Conservative party facing a 20 percentage point gap to the opposition Labour Party according to recent polls, this is one of the last opportunities the government may have to shore up its popularity ahead of upcoming general elections.

We estimate that a fiscal giveaway, possibly in the form of personal tax cuts and as large as £20 billion, is likely. But this fiscal largesse, combined with wage settlements still above 5%, and above-inflation price increases in a wide array of services ranging from broadband to insurance, mean core services inflation could remain suborn.

Still, with the energy price cap primed to fall by 12% in April, headline inflation could decline to below 2% by midyear, in our view. Even if services inflation and wage settlements remain buoyant, such an improvement in the inflation figure would likely put pressure on the Bank of England to embark on its rate-cutting cycle in this coming summer.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Frédérique Carrier is the head of investment strategy for RBC Wealth Management in the British Isles and Asia

Related Company Profiles

RBC Wealth Management