Shares, the social trading app, has secured $40m in a Series A funding round, confirming our scoop from February. The round brings the total venture capital injected into the fintech startup to $50m. The company stayed mum about what the cash injection means for its valuation, but sources with intimate understanding of the deal that spoke to Verdict put it somewhere around €180m ($200m) ahead of the announcement.

Valar Ventures led the round. The venture capital firm is run by PayPal co-founder Peter Thiel who recently announced that he’s leaving Meta’s board. He was an early investor in Facebook, but has since become a controversial figure following his support of ousted US president Donald Trump. Other investors backing Shares’ Series A round included Singular, Global Founders Capital and Red Sea Ventures.

The Series A round will enable Shares to expand its app from the UK, where it has only been accessible the 60,000 people on its waitlist, to Europe. The startup has offices in London, Paris and Krakow.

Social trading: How the Series A will enable Shares to “democratise” trading

Shares is not alone in launching a trading app in Europe. Rival platforms include UK challenger stockbroker Freetrade, which raised a $69m Series B round in March 2021 and German Trade Republic. Trade Republic rolled out its services in France a year ago. America’s Robinhood had planned to jump across the pond but postponed its UK rollout in the summer of 2020.

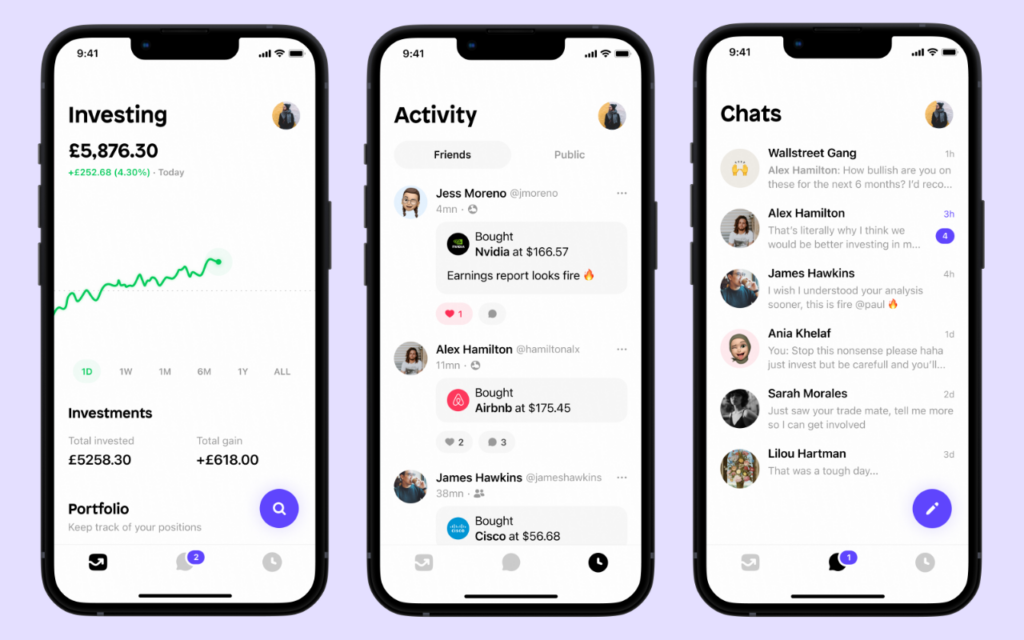

Like its rivals, Shares promises to “democratise” trading by offering users access to a no-minimum and no fee solution enabling to trade hundreds of stocks from just £1. The difference between the new venture and its competitors is that Shares aims to combine the trading aspect of the likes of Robinhood with the social aspect of platforms like Facebook or Reddit.

“The use of social networks has fundamentally changed how we interact with friends and family, what we talk about and how we make decisions,” says Harjas Singh, CPO and co-founder of Shares.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“With being more connected than ever, why shouldn’t it improve the way we think about investments too? People are already using solutions like Whatsapp, Telegram and joining communities to talk about trading. We’ve realised there is a need for an investment product that allows groups of friends to invest, discuss and share their investment journey. At Shares, we decided to bring it all together.”

Combining stock trading with social media may give some readers cause for pause, especially those remembering how a rogue subreddit, r/WallStreetBets, created the meme stock trading frenzy at the start of 2021. However, Shares it is confident in its ability to prevent a similar situation.

For starters, Singh says the company has built “an investing product with an incredible back-office capability with sophisticated [anti-money laundering and financial crime] detection systems.”

It has also limited the number of people each user can influence directly and interact with, arguably reducing the risk of one mega-influencer convincing people to make a raw deal. Users can reach more people, but only by making a trade and then explaining why it has done it, essentially making them put their money where their mouth is.

“I am very proud of the team we’ve built in just a few months, 130 talents coming from the best tech companies across Europe in order to launch Shares, a whole new category of investing product,” says Benjamin Chemla, CEO and co-founder of Shares.

“The app is inspired by our own experiences as retail investors and we wanted to improve people’s journey by combining trading with a community element that would radically transform the way people approach finance.

“We’re on a mission to help people connect, share experiences and invest in long-term financial wellness and a better future for themselves, together. From the UK, to Europe and beyond, launching today is the first giant leap toward giving everyone what’s missing in the experience of investing today.”