WealthTech, personal finance and financial planning have become the most mentioned trends among the top 10 wealth influencer discussions on Twitter during Q3 2020, according to GlobalData, a leading data and analytics company.

The discussions on WealthTech indicated the expansion of digitalisation in wealth management industry, and this was mostly accelerated by the Covid-19 pandemic.

GlobalData influencer expert Smitarani Tripathy said: “WealthTech-based management firms have embraced digital technologies to address the underlying gaps in financial advice and customer satisfaction.”

Among the other two mentioned trends were ‘personal finance’ and ‘financial, led by increase in discussions on how the Covid-19 impacted the outlook for personal finance and new guidelines on financial planning during the ongoing pandemic.

Wealthfront, a California-based automated investment service firm, was the most mentioned company, followed by The Goldman Sachs Group and Bank of America.

Tripathy added: “The discussions related to Wealthfront, one of the leading robo-advisors, revealed about the launch of new service ‘Autopilot’ in September 2020, which automates clients’ savings and investment strategy. This service is a competitive service with digital banking.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

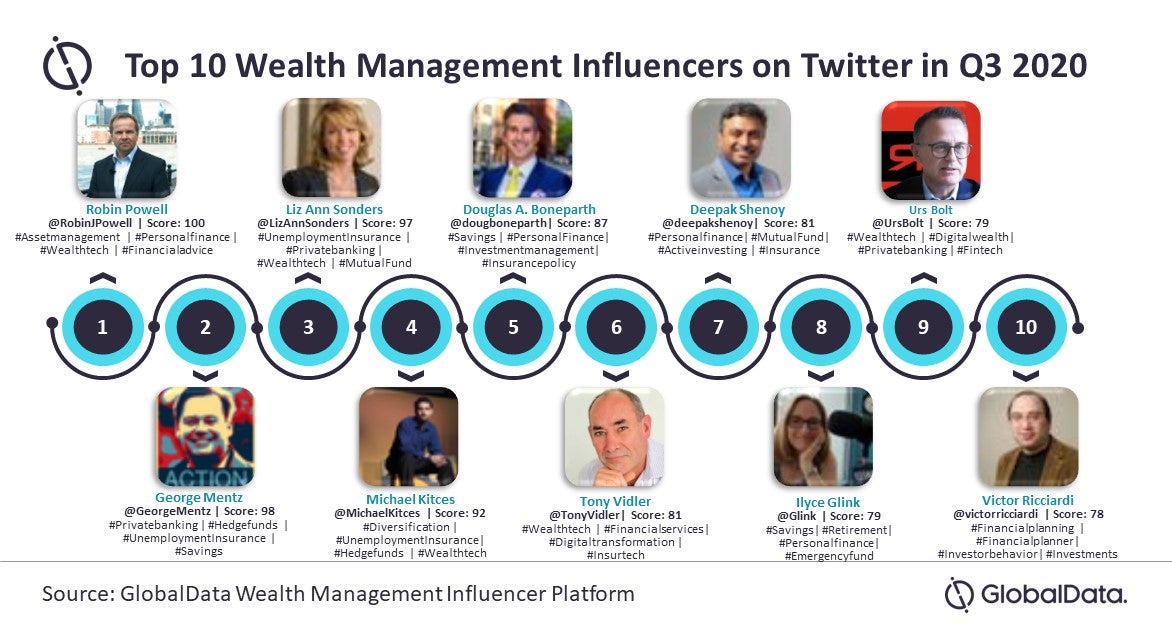

By GlobalDataAn analysis of Wealth Management Influencer Platform of GlobalData, ranked Robin Powell, editor at The Evidence-Based Investor, as the top influencer during Q3 2020, who largely shared financial advice for investment industry on Twitter.

The Wealth Management Influencer Platform tracks over 200 leading industry experts and their discussions on the emerging trends, pain areas, new fields of innovation and other popular areas on Twitter.