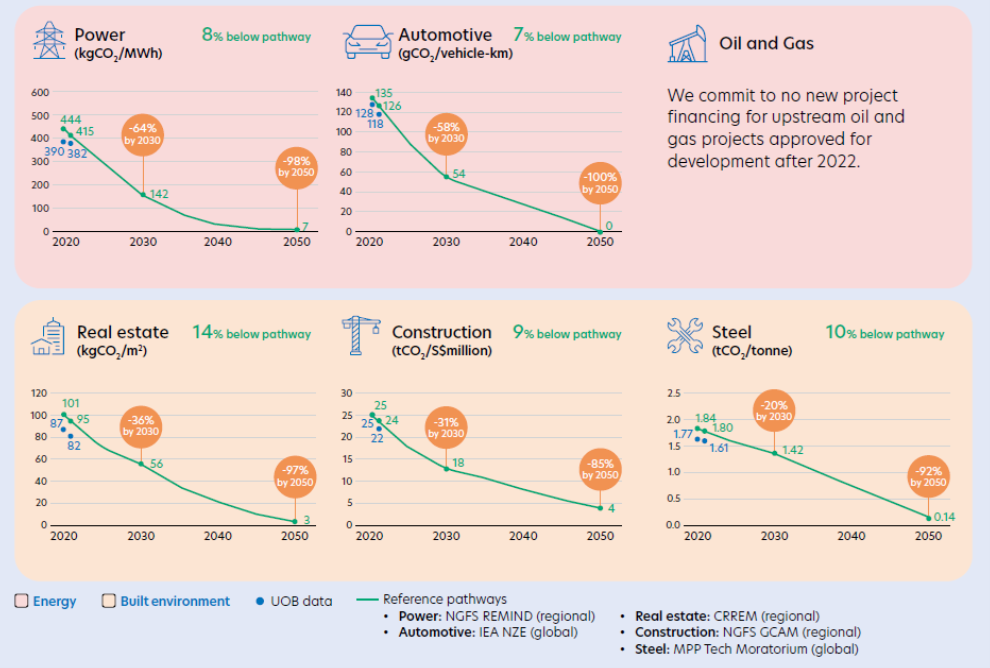

Particular reduction goals for five industries are part of the UOB net zero commitment. The industries are: steel, real estate, power, automotive, and construction.

The bank reduced the emissions intensities in each of the five sectors based on its data for 2022, with the different measures falling between seven and fourteen percent short of the corresponding net zero goal reference paths.

In line with its previous year’s commitment, the bank will not provide fresh funding for upstream oil and gas projects that are authorised for development beyond 2022.

About 60% of its portfolio of corporate loans is comprised of these six industries combined.

UOB built its industry aims on regional routes that are in line with global net zero goals, using widely accepted climate science models.

In order to foster socioeconomic development and enhance energy access throughout the region’s different economies, UOB maintains that fair change is necessary in Southeast Asia, and its strategy represents that perspective.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFurthermore, the bank is scaling up initiatives to reach customers and increase collaboration with global and regional partners on decarbonisation, as well as the opportunities and challenges faced in attaining the net zero targets across sectors.

Wee Ee Cheong, deputy chairman and chief executive officer, UOB, said: “At UOB, we support an orderly and just transition to net zero so that economies continue to grow and people’s access to energy continues to improve. We are here to catalyse funding and support our customers on their transition journey. We have also taken steps to transform our operating processes and to deepen our collaboration with the larger ecosystem of stakeholders, including across all levels of government, economy, and society to effect transformative changes.”

UOB has created a comprehensive framework to put its commitment to net zero into practise.

Four primary objectives of the UOB net zero programme

- Developing sectoral plans: which involves setting goals, tracking progress, and seizing opportunities across industries

- Supporting customers: in their decarbonisation path by offering financial and advice options

- Embedding net zero in the Bank’s operating model: notably capabilities, governance, policies, and procedures

- Driving effective stakeholder engagement: cooperating to promote unity with a wider ecosystem of peers, industry and trade associations, governments, and regulators

As of 30 September 2023, UOB had extended S$38bn (USD$27bn) in sustainable financing.

In addition to searching for ways to partner with clients to assist their decarbonisation initiatives, United Overseas Bank will keep refining and growing its range of sustainable financing frameworks and solutions.