GlobalData, a leading data and analytics company, has revealed its league tables for top ten financial advisers by value and volume in Europe for Q1-Q3 2022.

A total of 8,691 merger and acquisition (M&A) deals worth $511.6bn were announced in the region during the period.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Top advisers by value and volume

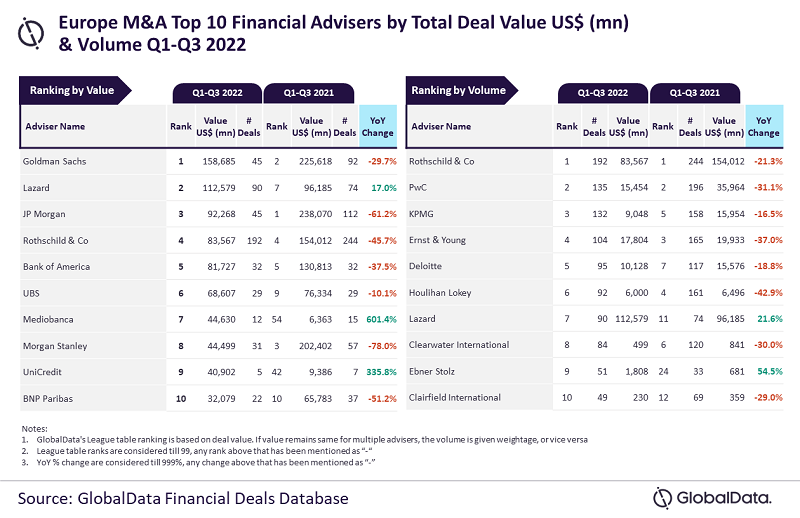

According to GlobalData’s ‘Global and Europe M&A Report Financial Adviser League Tables Q1-Q3 2022’, Goldman Sachs and Rothschild & Co emerged as the top M&A financial advisers in the region during the period by value and volume, respectively.

Goldman Sachs advised on $158.7bn worth of deals, while Rothschild & Co advised on a total of 192 deals.

GlobalData lead analyst Aurojyoti Bose said: “Rothschild & Co, apart from leading by volume, also occupied the fourth position by value as it managed to advise on some big-ticket deals. It advised on 23 billion-dollar deals during Q1–Q3 2022*.

“Meanwhile, Goldman Sachs advised on 20 billion-dollar deals that also included four deals valued more than $10bn. As a result, it was the only adviser to surpass the $150bn mark during Q1–Q3 2022, however, it did not feature among the top 10 by volume.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataAs per GlobalData’s financial deals database, Lazard took the second spot by value, by advising on $112.6bn worth of deals; followed by JP Morgan with $92.3bn; Rothschild & Co with $83.6bn; and Bank of America with $81.7bn.

In terms of volume, PwC got the second place with 135 deals; followed by KPMG with 132 deals; Ernst & Young with 104 deals; and Deloitte with 95 deals.

GlobalData’s league tables are based on the real-time tracking of thousands of company websites, advisory firm websites and other reliable sources available on the secondary domain. A dedicated team of analysts monitors all these sources to gather in-depth details for each deal, including adviser names.

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website.