In retrospect, it was only a matter of time before Viktor Fischer would have to weigh in on Russia’s war in Ukraine. After all, his venture capital firm Rockaway Blockchain Fund counts several cryptocurrency exchanges amongst its portfolio companies. Regulators around the world have warned that cryptocurrency exchanges could be used by Russian oligarchs to skirt the unprecedented sanctions imposed in retaliation of Vladimir Putin’s war. However, Fischer thinks this fear is unfounded.

“It’s very difficult to evade sanctions via bitcoin or blockchain because everything is traceable,” the Rockaway Blockchain Fund managing partner tells Verdict. “You can actually trace the transactions all the way back to when the person entered or exited the blockchain through KYC [or] AML. So we actually know which transactions are illicit.”

KYC and AML stands for “know-your-customer” and “anti-money laundering,” respectively. The terms describe the processes financial services firms like banks, credit card companies and cryptocurrency exchanges must take in order to prevent their services being used by criminals.

Cryptocurrency exchanges have vocally touted their KYC and AML chops for years. However, a report from the British National Bureau of Economic Research has warned that even if individual exchanges have strong processes in place, nothing prevents users from transferring cryptocurrencies from a high-KYC exchange to an exchange with low-KYC where the money-trail can be more challenging to trace.

Fischer is not concerned, quoting a Chainalysis report suggesting that only 0.15% of all cryptocurrency transactions made in 2021 were illicit. “So I don’t really see how this technology could be used to evade sanctions,” he says.

The same report noted that while the overall share of illicit cryptocurrency transactions have plunged in the last two years, the total value hit an all-time high in 2021, with illicit addresses receiving $14bn over the course of the year, up from $7.8bn in 2020. Numbers like those do little to dissuade politicians and regulators who have already decided that digital money is only used by cybercriminals and, possibly, Russian oligarchs.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe cryptocurrency exchanges in the Rockaway portfolio have pledged to ban Russians sanctioned by the US and its allies after the war in Ukraine. This means they cannot use the exchanges to get money out of Russia. The exchanges in the portfolio include 1inch.Exchange, Vega and Sushiswap.

Other cryptocurrency exchanges like Binance, Coinbase, Kraken and Bitstamp have issued statements saying that they will follow the law to the letter. Most of them, however, haven’t extended that ban to ordinary Russians. Rockaway’s exchanges haven’t done that either.

“I don’t think it would be fair,” Fischer says, arguing that regular Russians, even ones openly opposing Putin’s war, could be hurt by wide sweeping bans.

Given that the ruble plunged to record lows of 154 rubles per dollar by March 7, the Rockaway boss believes it would be unfair if Russians that haven’t been part in the Ukraine war machine to not “have an option to store the value of the money they had because they might not be involved in the conflict. They might be against it. And personally, I don’t think that just by someone’s nationality, we should basically throw them out.”

The same line has basically been touted by other cryptocurrency exchanges. They’ve even made the argument despite big payment providers like Visa and Mastercard having pulled out of Russia. Their Russian businesses only represented 4% of their total net revenue, whereas Russians held over $200bn in cryptocurrencies, representing about 12% of the world’s total holdings. Russia is, in other words, a massive cryptocurrency market.

It should also be mentioned that despite Visa and Mastercard dominating the market in Russia, their share of the payment sector has declined due to rising adoption of the central bank’s own Mir programme, as pointed out by GlobalData’s research.

Ukraine and cryptocurrencies

Cryptocurrencies have become even more controversial after Russia invaded Ukraine, and that says a lot. The technology dreamed up by the mysterious bitcoin founder Satoshi Nakamoto in 2007 has grabbed headlines for the better part of the past two decades. During the pandemic, soaring valuations even emboldened some blockchain evangelists to suggest that digital dosh was on par with other safe haven assets like gold, which some people invest in during times of crisis.

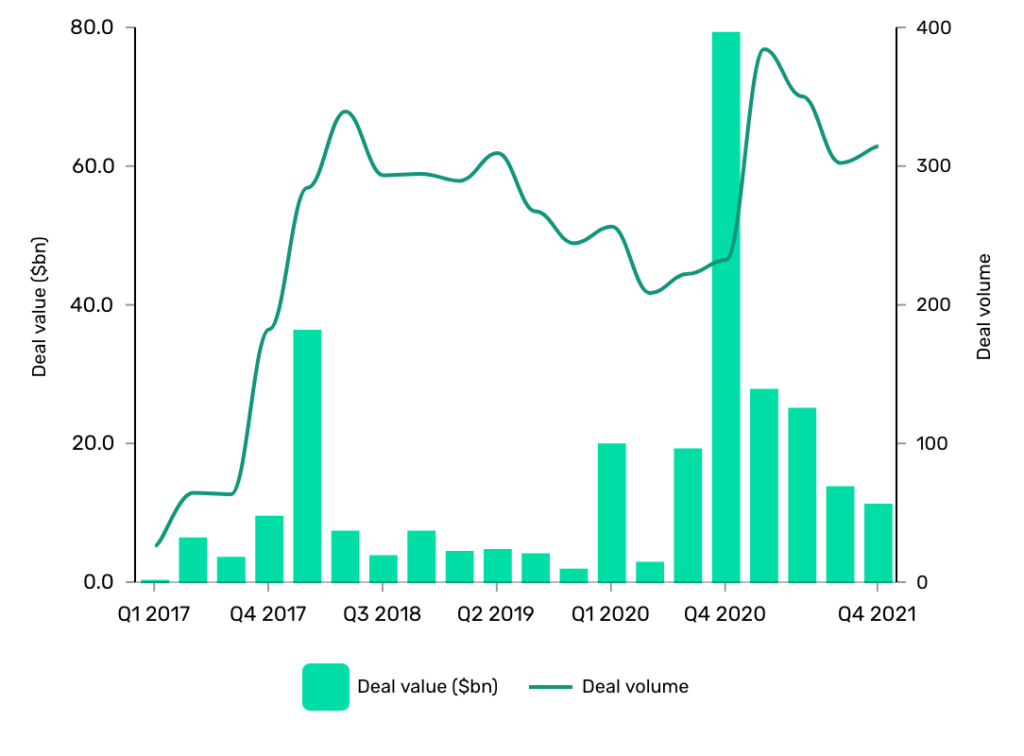

In 2020 the blockchain sector raised $121.02bn across 922 deals, according to GlobalData’s data. In 2021, the $81.652bn raised 1,354 deals.

However, when Russian tanks rolled into Ukraine in the early hours of 24 February, it was only a matter of time before distributed ledger monies would creep into the discussions again. Apart from the potential of oligarchs using the technology to skirt sanctions, the debate has also been about whether bitcoin can still be seen as a safe haven asset. The consensus seems to be that it can’t, given that it has yet to recover from its massive slump from the beginning of the year. As a consequence, some analysts have warned that a cryptocurrency winter may be on the cards.

The Rockaway boss still believes cryptocurrencies can have a part to play in the conflict in Ukraine. He points to the millions of dollars in cryptocurrencies that have been donated to help Ukraine and refugees as an example.

“The bottom line for us is that cryptocurrencies currently are helping more Ukraine than [they help sanctioned people in] Russia to evade sanctions,” Fischer says.

Rockaway helps refugees fleeing Ukraine

Russia’s war on Ukraine isn’t isolated to one nation. Ever since Putin’s army attacked the neighbouring nation one month ago, people around the world have been forced to pick a side. The result has been a global outpouring of support for president Volodymyr Zelenskyy and his compatriots.

Tech companies have shown their support by providing access to internet with low-orbit satellites, raised money with NFTs, helped Ukraine fight back against cyberattacks and have pulled their services from Russia, cutting off the Kremlin regime from the global economy. Fischer has noticed this support first hand.

“We are pretty much part of it on a daily basis in the Czech Republic because there many Ukrainians here,” he says.

Ukrainians comprise the Czech Republic’s biggest foreign community. By the end of 2021, there were almost 197,000 Ukrainians residing legally in the country, according to the Interior Ministry.

“It all ramped up after the 1990s when communism fell,” Fischer says. “They are often employees in the tech industry or logical centres.”

Since the war broke out, over 100,000 refugees have fled across the border to the Czech Republic, with more people making the journey every day.

“Most of those come through Slovakia and are going to Prague because they have their families here,” Fischer says.

At the moment, none of Rockaway Blockchain Fund’s employees are from the Ukraine, but the community around the VC firm has aided refugees coming into the Czech Republic.

“What we do have [is] a WhatsApp group with [almost] all the tech guys, [such as] investors here in Prague, and it’s called TechFugees,” Fischer says. “And whenever there is a family [of for example] a local person who works here and [then] they search for an apartment. Whoever has a free apartment very quickly replies. If [no one has one] then we will look [to find] a hotel room for them. But it’s on top of everyone’s mind currently, unfortunately.”

“We nearly died”

Today, Rockaway Blockchain Fund is debating the ins and outs of supporting Ukraine whilst keeping Kremlin gremlins from dodging sanctions. However, two years ago Fischer and his team doubted that the investment firm would ever get into a position like this. “We nearly died,” Fischer says.

The people behind Rockaway Blockchain Fund have been investing their own money into blockchain projects since 2018. They were some of the early investors in the Solana blockchain platform. In 2019, they decided to create an official fund and raise $40m. “In February 2020, we sent a request to our investors,” Fischer remembers.

Unfortunately for the team, the Covid-19 crisis was just around the corner, causing a lot of market uncertainty. Investors, consequently, grew hesitant to investing in anything. When the fund made its first close in June 2020, it had only raised $6.5m.

“We charge a 2% management fee. So 2% of $6.5 million dollars. That’s less than $200,000. We would not be able to pay the six person team with that,” Fischer says.

Despite the discouraging results, the team kept raising funding. “Everything changed for us in March 2021 when bitcoin hit $65,000 and then basically our phones just kept ringing,” he says.

Rockaway Blockchain Fund had raised $123m in total by June 2021. Today it has 20 funds in its portfolio and has made 30 direct investments.

If you and your business want to help the people of Ukraine during these terrible times, you can find information on how to do so here.

GlobalData is the parent company of Verdict and its sister publications.