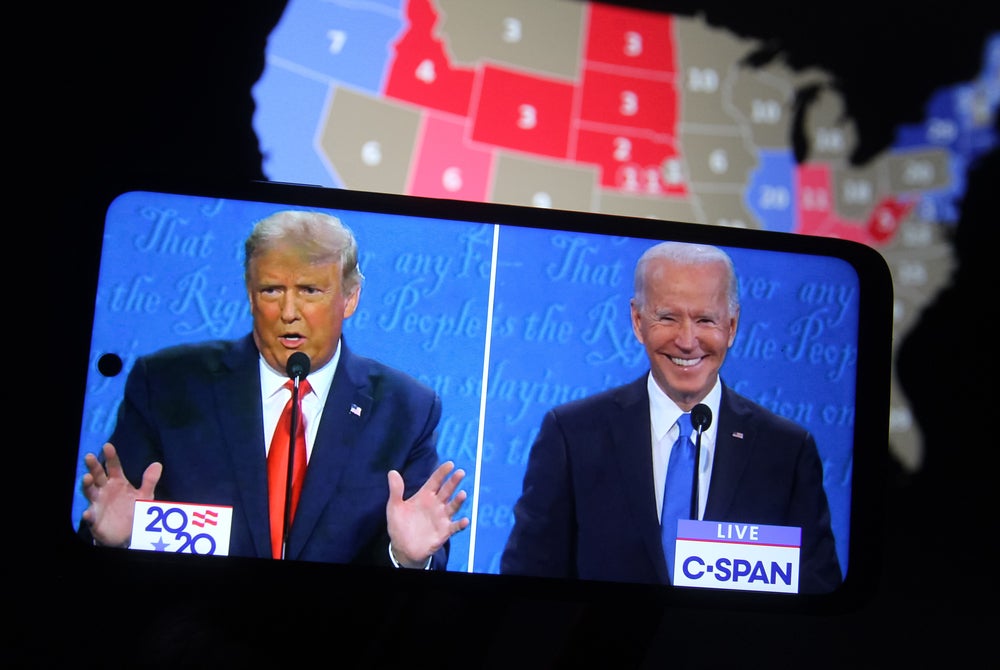

The US election is at its end stage, votes have been cast, ballots are being counted as we speak, and private banking has reacted. Patrick Brusnahan asks some experts for their immediate reaction

In general, it seems that there is a lot for private banking to unpack in the US election.

Adrien Pichoud, chief economist and senior portfolio manager, SYZ Private Banking

This was an unthinkable scenario for many, yet here we are: while the result of the election remains far from certain, the initial results credit Donald Trump with a lead in several key states, providing a margin for the incumbent president to claim victory. The mail-in votes yet to be counted may eventually give Joe Biden the presidency. But, of course, we can expect Trump to challenge postal votes at a state and federal level through the Supreme Court. This could prove pivotal, since Trump has appointed three of the nine justices over the course of his four-year term.

The US is now entering a period of political uncertainty, and possibly social instability that could last weeks or longer. States now have until 8 December to fix any controversies over registered voters or the validity of mail-in ballots, and the electoral college then has to ratify its allocation of seats to each party on 14 December, handing the presidency to Trump or Biden. This majority should then, ordinarily, be rubber-stamped by Congress at its first session on 6 January, ahead of the inauguration on 20 January.

Prepare for market mayhem in private banking after US election

The period of uncertainty ahead of us has the potential to unsettle financial markets, especially as the Covid-19 pandemic is again forcing many countries to resume social distancing and disrupt economies. If Trump were eventually confirmed for another four-year term and re-elected with a split Congress, we may see equity markets resume the positive trend, but we think this is unlikely, as long as uncertainties and the possibility of social unrest remains.

As we have already reduced our market exposure in client portfolios over the past two months, we are not in a rush to cut exposure further. Although the US dollar could strengthen during the period of political uncertainty, we expect to see range-bound long-term dollar interest rates, as the structural trends of slow growth and inflation remain in place, along with very accommodative monetary policy from the Federal Reserve. We have a number of positions in place to contain the impact of any significant short-term equity market volatility, as well as defensive assets, such as high-quality bonds and gold. Volatility will also provide opportunities to add exposure, as this low interest rate environment is here to stay and will ultimately support higher yielding assets.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataDaniele Antonucci, chief economist & macro strategist, Quintet Private Bank

While the vote counting is ongoing, a likely divided Congress points to no meaningful policy change in the US regardless of the presidential outcome. However, markets should now assign a lower probability to corporate tax hikes – a relief for the business sector.

A fiscal package looks likely early next year. But it could fall well short of expectations, depending on the election outcome, and only include virus-related support measures.

We expect US Treasury yields and the dollar to stay range-bound until the policy agenda becomes clearer.

Rupert Thompson, Chief Investment Officer, Kingswood

At the time of writing, the name of the next US President remains quite uncertain although the odds do now seem to favour Trump over Biden. Trump won the key swing state of Florida but the Rust Belt states of Wisconsin, Michigan and Pennsylvania, where the results will only be known over the next couple of days, could yet swing the election Biden’s way.

As for Congress, which is critical in determining how easy it will be for the President to implement his policies, it looks likely to remain divided. The Democrats look set to retain control of the House of Representatives while the Republicans should retain their majority in the Senate.

The worst outcome for the markets had generally been expected to be a close and contested election and this seems to be what we are now headed for. Certainly, if Biden does manage to pull a rabbit out of the hat, Trump will contest the result and we face weeks of uncertainty.

The market reaction, however, so far has been limited. European and UK equities are currently now up a little, as are US futures. There has also been no rush into safe haven assets with gold, the dollar and US Treasury yields volatile but overall little changed from earlier in the week.

So where do we go from here? We have said all along that markets were probably in for a choppy few weeks and this seems more likely than ever. If the election does end up being contested, the risks are clearly to the downside although the relatively calm market reaction as yet suggests any decline may not be that great.

Longer term, the main impact is that there is now no prospect of the big fiscal stimulus which was on the cards if there had been a Democratic clean sweep. Still, with infections climbing quite rapidly in the US and likely to force renewed social distancing measures which will hit the economic recovery, a rather smaller stimulus should eventually be agreed.

All said and done, the events of the last 24 hours do not justify any major change in our longer term views for markets. We continue to believe equities should see further upside next year as the virus is slowly brought under control.

Chris Tinker, Co-founder, Libra Investment Services

As markets digest a dramatic shift in expectations over the US Elections, the idea of a clear victory for Joe Biden that had been implied by the polls has swung round to a far less certain outcome. Having largely failed to price in this as a risk – market price movements only really shifted the SP500 back to a small discount to its discounted future value as we measure it on our valuation model, Apollo – there is a need to quantify the scale of the potential downside that the market might face due to a longer period of uncertainty.

We calculate a measure of the “Margin of Safety” for the S&P500 that provides a guide to this. Using a real options pricing approach, we define this as the price level equivalent at which a call on the future value of the market would effectively be “free”. Currently this would be 2413 on the S&P500 – some 28% below yesterday’s close – but importantly still at a premium to the lows of March 2020. This is not to suggest that such a level will be reached in the coming weeks – far from it – but with a current market value of 3480 on our Apollo system, the current discount to value of just over 3% could widen out appreciably in an otherwise sideways trending market. Although a move to the lower risk boundary of this Margin of Safety is not a central forecast, a repeat of the December 2018 sell off will be the reference point that the market might wish to look at in the near term. This would point to a break of the 2900 level on the S&P500.