Digital private markets platform Moonfare has launched operations in the US. This now gives it presence and operations across Europe, Asia, and the US.

The move follows a $125m Series C funding round led by Insight Partners. A Singapore launch is set for the coming weeks as well.

“We are thrilled to expand our global footprint and proud to be amongst the few European fintechs expanding into the US,” says Moonfare founder Steffen Pauls.

“Entering the U.S. market provides a tremendous opportunity, allowing us to use our proprietary technology platform to create a unique experience for like-minded investors who are bullish on pursuing investments into private markets unavailable to them in the past. As customer behaviour continues to transform towards direct digital solutions we see a lot of growth potential for the platform with it’s easy and direct access to private markets.”

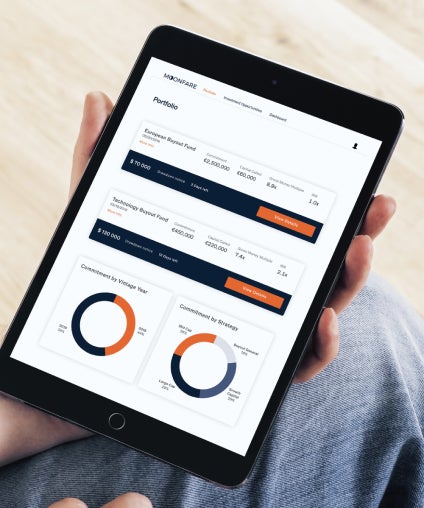

Moonfare enables its members to invest directly in a selection of curated, top-tier funds with low-entry minimums of $125,000. As part of its US roadmap, the firm will be based in New York City.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataUnder the partnership, which commenced in April 2021, Fidelity’s customers will gain access to Moonfare’s leading digital investment platform for high quality private market funds.

The announcement follows Fidelity’s recent transition into private credit, advancing its alternative asset offering. As the first institutional investor to take an equity stake in Moonfare, the partnership represents a pivotal moment for Fidelity.

Moonfare has over 2,500 users currently and over €1.5bn assets under management, according to the firm.