Citi has topped the latest M&A league table of the top 20 financial advisers globally for Q3 2018, compiled by leading data analytics company GlobalData.

The American bank advised on 68 deals worth $175.4bn, including the quarter’s biggest deal recorded globally – Energy Transfer Equity’s $60.4bn stake acquisition in Energy Transfer Partners.

With a mix of some big-ticket and several small-ticket deals, the bank climbed up four positions from Q2 2018 to the top rank in Q3 2018.

When compared to the third quarter of 2017, Citi experienced a 47.46% jump in deal value and a 25.93% surge.

According to GlobalData, which uses its tracking of all merger and acquisition, private equity/venture capital and asset transaction activity around the world to compile the league table, Barclays finished second with a deal value of $159.9bn, closely followed by Goldman Sachs with $159.3bn in Q3 2018.

The two players saw a jump of 74.3% and 24.9% respectively over Q32017.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAmong the top 20 legal advisers during the quarter, the 19th-ranked TD Securities saw 1819% growth in value by jumping from $1.2bn in Q32017 to $22.2bn in Q32018.

US banks dominate the top five financial advisers

With 65 deals worth $153.3bn, and 79 deals valued at $152.9bn, Morgan Stanley and JP Morgan secured fourth and fifth positions, respectively.

Interestingly, both the banks saw a drop in value and volume this quarter over the same quarter previous year.

In terms of volume, Rothschild & Co bagged the most number of deals in this quarter – 86, though it recorded a drop in value and volume of 14.41% and 14%, respectively from the same quarter previous year. Goldman Sachs stood second in the volume chart at 82, followed by JP Morgan at 79.

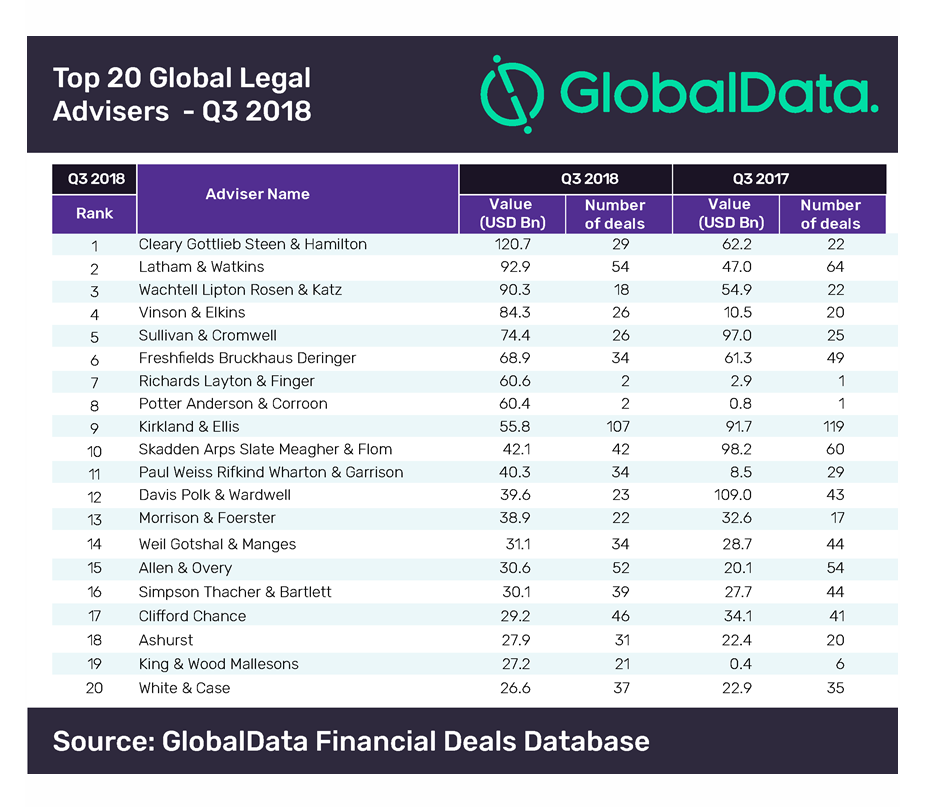

Legal advisers – Cleary Gottlieb Steen & Hamilton tops the list

From its fifth position in Q2 2018, the American law firm climbed up to the top rank in Q3 2018, driven by 29 deals worth $120.7bn, including the biggest transaction of the quarter – Energy Transfer Equity’s $60.4bn stake acquisition in Energy Transfer Partners.

With its involvement in a mix of several big-ticket and small-ticket deals, Cleary experienced a 94% surge in value during Q3 2018 and an almost 32% jump in volume when compared to the same quarter previous year.

Second ranked, Latham & Watkins registered a 97.6% jump in the value of the deals it worked on during Q32018 when compared to Q32017, its volumes dropped by 15.6%.

The Energy Transfer deal had seen the participation of five legal firms – Cleary Gottlieb Steen & Hamilton, Latham & Watkins, Vinson & Elkins, Potter Anderson & Corroon, and Richards Layton & Finger.

Interestingly, Richards Layton & Finger, and Potter Anderson & Corroon made it to the top 20 list with just two deals each, primarily on the back of The Energy Transfer transaction. However, Kirkland & Ellis that topped the table in volume terms with a massive 107 deals to its credit, stood behind them at ninth position.

With 18 transactions worth $90.3bn, Wachtell Lipton Rosen & Katz finished third in the list, while Vinson & Elkins with 26 deals valued at $84.3bn and Sullivan & Cromwell with 26 deals worth $74.4bn held fourth and fifth positions, respectively.