Wealth management remains one of the most vulnerable sectors due to COVID-19 as it is closely linked to capital market performance.

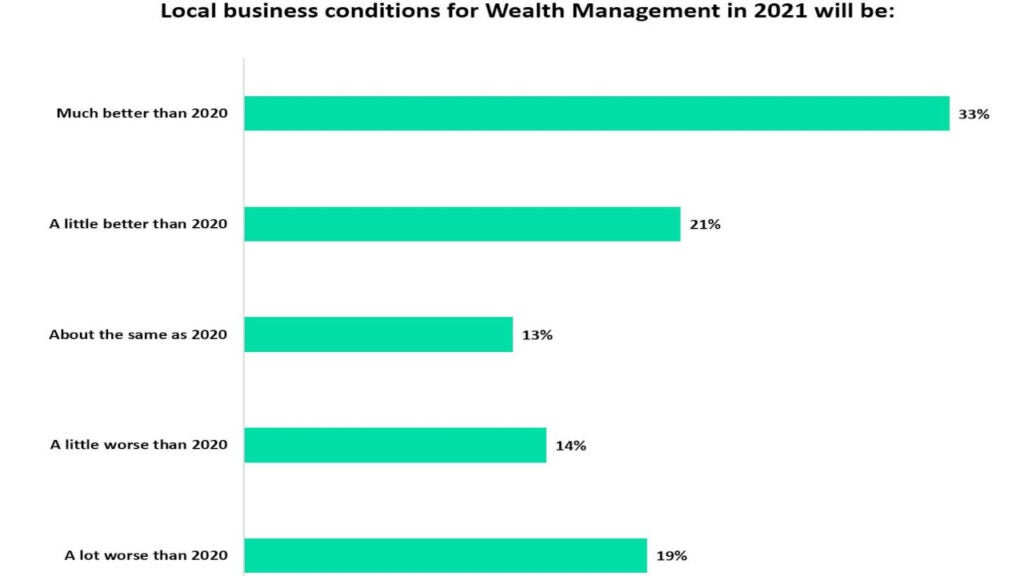

Verdict has conducted a poll to assess the local business conditions for wealth management in 2021 amid COVID-19. Analysis of the poll results shows that a majority 54% of the respondents expect better local business conditions compared to 2020. While 33% of the respondents expect a high improvement, 21% expect slight improvement.

Conversely, 33% of the respondents expect the local conditions to worsen in 2021, including 19% who predict the conditions to be a lot worse than 2020 and 14% who expect the conditions to be slightly worse.

The remaining 13% of the respondents expect no change in the local business conditions for the wealth management industry in 2021.

The analysis is based on 63 responses received from the readers of Private Banker International, a Verdict network site, between 22 January and 02 June 2021.

The analysis is based on 63 responses received from the readers of Private Banker International, a Verdict network site, between 22 January and 02 June 2021.

Growth of the wealth management industry in 2021

The wealth management industry witnessed record levels of growth in 2019 before the COVID-19 pandemic dramatically altered the industry’s outlook. Oliver Wyman estimates global high net worth (HNW) wealth to have declined by 4% in 2020 due to COVID-19 but is expected to rebound in 2021. OliverWyman is a management consulting firm based in the US and owned by professional services provider Marsh McLennan.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe immediate impact of the pandemic was on continuity of operations as wealth managers struggled to perform critical tasks such as client onboarding checks, account setup and trading amid lockdown restrictions.

Despite a strong rebound in capital markets in North America in 2020, the local wealth management firms delivered lower returns to shareholders over the first three quarters of the year. Although the assets under management (AUM) reached record high, the revenue yields and industry profit pools and pre-tax margins declined, according to McKinsey. The industry outlook in 2021 remains uncertain, although the business conditions are improving.

The European wealth management industry witnessed similar trends, with an increase in AUM and a slight dip in cost margins, but flat overall profit margins. The current year will, however, be better with a high potential for incremental profits, says McKinsey.

The pandemic nevertheless highlighted the need to redefine operational framework, which was already undergoing a shift towards next-generation technologies. It has accelerated the adoption of technology and personalisation, which have become an integral part of the industry and will continue to be so.