Private Banker International asks the experts on how the markets are reacting to the Israel conflict with Hamas. As the death toll rises and more nations get involved, the reaction will get larger and investors needs to be aware.

Norman Villamin, group chief strategist, UBP

The Hamas invasion of southern Israel over the weekend is an eruption of an ongoing regional conflict and humanitarian crisis which has the potential to expand into a prolonged conflict that historically has been a headwind for global equity markets.

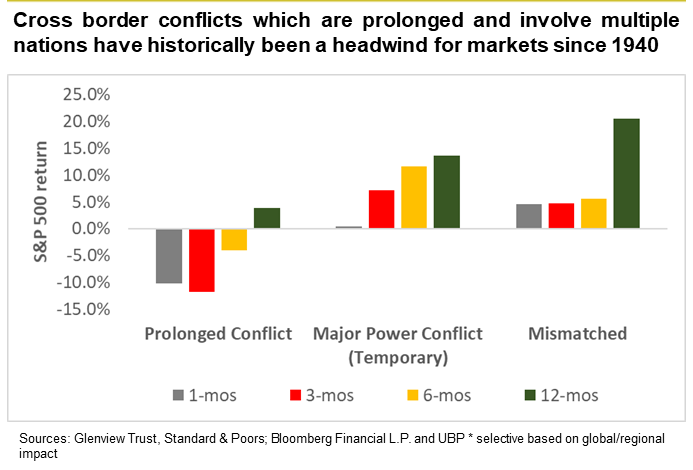

A look back at the impact of such geopolitical conflicts on the S&P 500 going back to 1940 – ranging from coups/assassinations, to terrorist events, and including cross-border wars between nation-states – in aggregate suggests modest upfront impact of such events which dissipate quickly.

However, the type and duration of the event are significant in understanding the potential impact upon markets.

Indeed, domestic terrorist attacks (2004 Madrid, 2005 London, etc.) have historically had only temporary impacts on markets, with the S&P 500 rising, on average 3-12 months afterwards.

Importantly, however, prolonged conflict between or eventually drawing in multiple nations has presented at least a 6-month headwind to US equity returns with the notable exception being the start of hostilities in Korea.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataImplications

Thus, the risk that the largest incursion into Israel since 1973 transforms from a localised event to one that is prolonged and engulfs a wider range of nations should be among the key concerns for investors. Indeed, a prolonged conflict has the potential to draw in Iran and imperil the potential normalisation of Saudi-Israeli ties that are reported to be close to being announced.

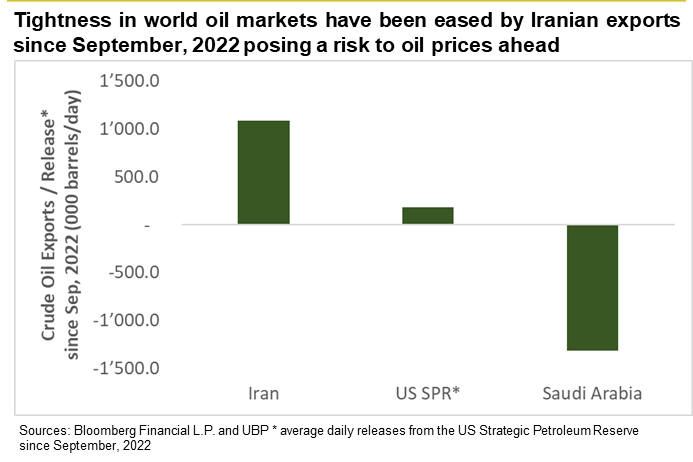

With Iranian exports and US releases from its strategic petroleum reserve having virtually fully offset Saudi supply cuts since September, a global response which reduces Iranian supply where Saudi Arabia does not compensate with increased production would create a renewed supply shock for global energy markets.

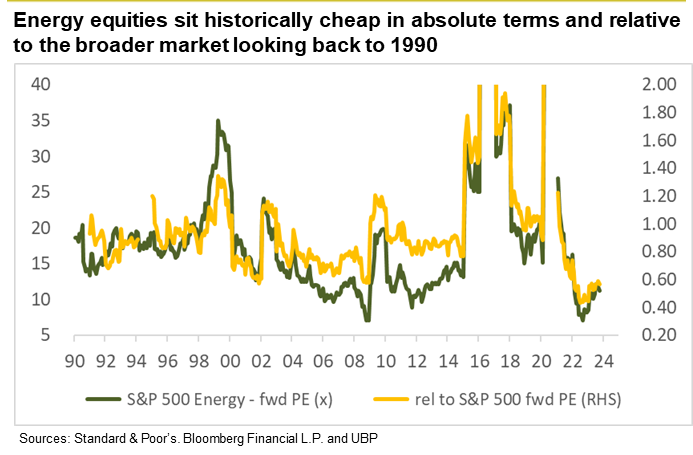

With energy equities historically cheap on an absolute basis and relative to the broader market, the sector may offer a safe haven amidst the geopolitical uncertainty introduced over the weekend.

Nigel Green, CEO, deVere Group

The events in this region are now directly impacting financial markets worldwide, which, as ever in times of increased volatility, is immediately prompting some investors into selling off riskier parts of their portfolios, such as stocks and some currencies.

Oil has a disproportionate impact on global financial markets due to its pivotal role in the world economy, its interconnectedness with various sectors, and its potential to influence broader economic conditions and investor sentiment.

I would urge investors to avoid knee-jerk reactions to the oil price surge and geopolitical tensions that are creating the market turbulence.

Investors are likely to profit by sitting still and not selling and then having to buy back at higher prices.

Indeed, savvy investors, including the likes of Warren Buffett, will likely use the volatility and lower entry points to top-up their portfolios for the long-term with high quality stocks that have robust fundamentals.

Diversification is your best weapon to mitigate the risks associated with geopolitical events.

While short-term market fluctuations can be unsettling, it’s essential to maintain a long-term perspective when making investment decisions. Historically, markets have rebounded from geopolitical crises, and a well-constructed portfolio can weather such storms.

Susannah Streeter, head of money and markets, Hargreaves Lansdown:

‘The shocking attacks in Israel have sent the price of oil soaring, as investors assess the potential for the conflict to disrupt supply in the Middle East, if other countries are drawn in. With the Israeli government warning of a long and difficult war, there are concerns that deep and incessant retaliative strikes on Gaza could potentially bring Iran into the conflict and have an impact on the flow of energy in the region. The strikes and incursions by Hamas have sent the price of a barrel of the benchmark Brent crude, up by more than 3%, to trade above $87 a barrel. It’s the latest surprise twist in the path of oil prices, with the commodity pushed upwards partly due to supply cuts by Saudi Arabia and Russia, then buffeted down by concerns about a weakening global growth outlook. This latest jump will fuel inflationary worries, at a time when investors are already jittery about the interest rates potentially staying higher for longer.

Nerves are showing signs of being frayed again just as investors had started to breathe a sigh of relief that the US might be heading for a softer landing, despite the high level of interest rates. Investors had cheered Friday’s jobs data given that it showed continued strength of the US economy, with a bumper payroll number, but also indicated that wage growth was moderating. With geo-political risk sharply in focus we’ve seen investors retreat into safe haven assets, with the dollar and the yen edging up, while gold has jumped 1%. The ultra-cautious mood is set to keep a lid on gains for the FTSE 100. While the higher oil price is set to support energy stocks, nervousness about a conflict escalating in the US is set to keep the index trading pretty flat in early trade.

The S&P 500 is expected to start the week in a downbeat mood, given the shocking eruption of conflict in Israel. The latest inflation snapshot, due out this week, is set to keep investors on edge. Although price rises are expected to have slowed again in September, any hint of stubbornness creeping back into the picture could lead to another bout of selling. Bond markets are closed for Columbus Day, so it’s unclear yet what impact events in Israel will have on Treasury yields, although concerns about fresh inflationary pressures from higher oil prices, may limit a move lower despite a search for safety by other investors.