Average portfolio asset allocation towards impact investing is set to almost double, from 20% in 2019 to 35% in 2025.

Furthermore, 27% of all investors expect to move to move than 50% invested for impact within five years.

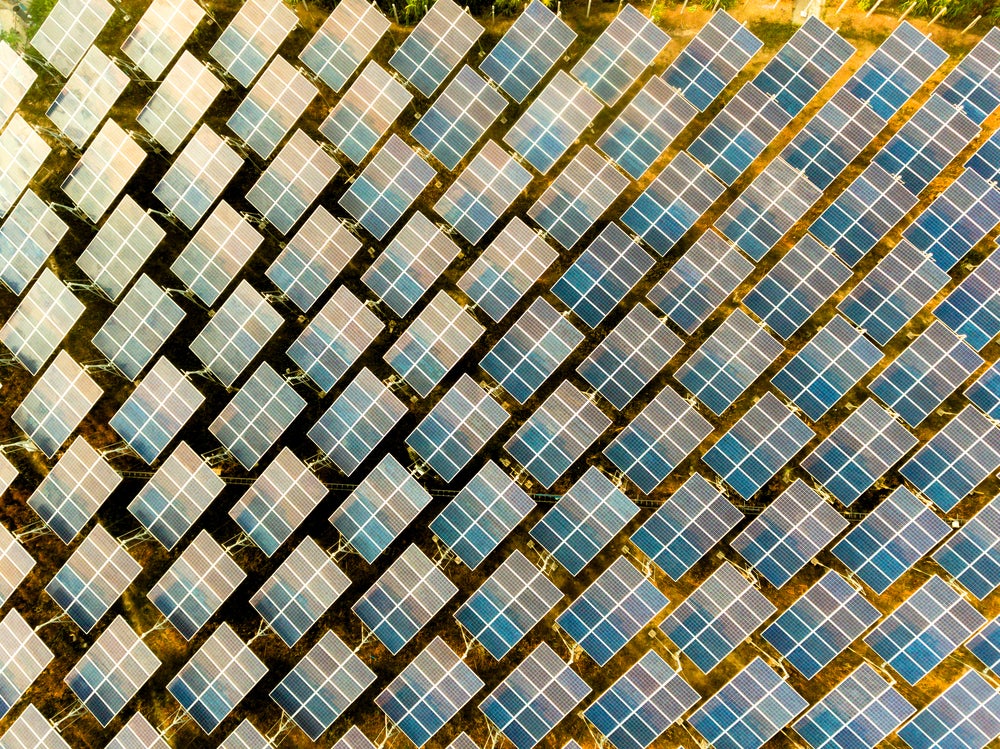

Also, according to research launched by Barclays Private Bank, 87% of investors say climate change influences their investment choices. Over half (52%) viewed climate change as the greatest threat to the world.

Seven-in-ten (69%) say COVID-19 has affected their outlook on investing and the economy. And 66% said they were likely to broaden their risk assessment to add more ESG factors.

Impact investing allocation

According to the research, the proportion of wealth investors allocating more than 20% of their portfolios to impact investing is expected to increase from 27% to 39% as soon as 2021. 27% are predicted to allocate more than 50% within five years as well.

Why are investors changing tact? 38% believed they have a responsibility to make the world a better place. In addition, 24% reported that this approach will lead to better returns and risk profiles. 26% wanted to show that family wealth can create positive outcomes across the globe.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataFurthermore, 82% felt a “responsibility” to support global social and environment initiatives. Already, 83% of investors were concerned with climate change and 87% stated it plays a part in their investment choices.

As a result, 39% want to know the carbon footprint of their portfolios to inform their investing and 19% already have access to this information.

Damian Payiatakis, head of sustainable and impact investing, Barclays Private Bank: “Investors are being challenged to safely pilot their family’s lives and their portfolios through the disruptions of 2020, and it means they are having more discussions about the future – how their family’s wealth can reflect more of their values and the role they want to play in society.

“Families are considering the impact of their capital and then increasingly taking action, by allocating more towards solving our urgent global societal and environmental issues. We see that investors wanting to make this shift are looking for guidance to navigate the rapidly evolving field and to access high-quality opportunities that can deliver financially and with positive outcomes.”