Avaloq has launched Engage, a solution that lets wealth managers and advisers communicate with clients through social messaging channels.

The app was developed to help financial institutions capitalise on the growth of conversational banking. It also follows the launch of Avaloq Wealth and forms part of the firm’s new stand-alone, core-agnostic range of digital wealth management platforms.

The Engage app allows relationship managers to service clients through WhatsApp and WeChat in a responsive and timely manner. For clients, it allows them to interact with their relationship manager using their preferred channels.

Furthermore, WhatsApp usage increased by 51% during the COVID-19 lockdown and solutions like this can help with a bank’s availability.

Fabian Grande, Avaloq group product manager, Engage Platform, said: “Avaloq Engage has been launched to allow wealth managers to benefit from socio-behavioural changes as digital channels have become an integral part of the customer journey. Face-to-face advice will remain a central part of wealth advisory but social channels have risen in importance in much the same way as telephone banking did decades ago. Keeping ahead of this fragmented environment, and turning it into a competitive advantage, is at the heart of Avaloq Engage.”

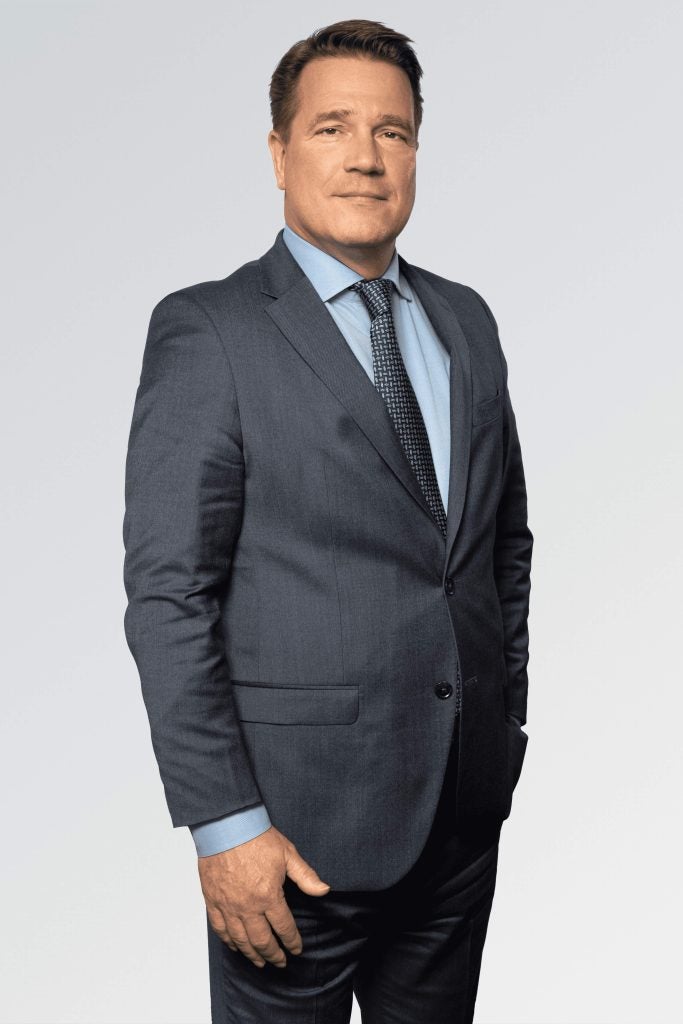

Martin Greweldinger, Avaloq group chief product officer, said: “The wealth management sector is evolving, and it is evolving fast. Aspects of the market will remain the same, such as offering high levels of client service and competitive products. But digitalisation is creating new challenges and opportunities. There are new market entrants, a focus on the new generation of wealth owners, including digital natives, and competition is fierce. Companies need to adapt to remain relevant, outcompete and succeed.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataNEC agreed to acquire 100% of the shares of Swiss fintech firm Avaloq in a deal valued at CHF2.05bn ($2.2bn).

The sellers are Avaloq founder and employees as well as private equity firm Warburg Pincus.

Warburg Pincus holds a 45% stake in Avaloq, while the rest is held by Avaloq founder and chairman Francisco Fernandez and employees.