In the third in our series of articles on wealth management in the Middle East, Criselda Diala-McBride looks at the appeal of Sharia finance among HNWIs in the region and finds parallels with today’s ESG investment wave.

Islamic finance may represent just 1% of the world’s financial assets, but it has steadily become a force to be reckoned with. From managing $200 billion of assets in 2000, it has evolved into a $2.4 trillion industry, returning an average growth rate of between 10% and 12% per year despite challenging market conditions.

Outlook for the sector remains bright with assets projected to expand further to $3.8 trillion by 2023, according to the Islamic Finance Development Report.

Making up the lion’s share of Islamic finance are Islamic banks, which contribute more than 70% or $1.72 trillion of the sector’s assets, ResearchAndMarkets.com has reported.

Meanwhile, Emirates Investment Bank (EIBank), in its GCC Wealth Insight Report 2018, highlighted that more than 70% of HNWIs surveyed said that having access to Islamic investment products is important to them and they would choose a local banking partner that offers these solutions.

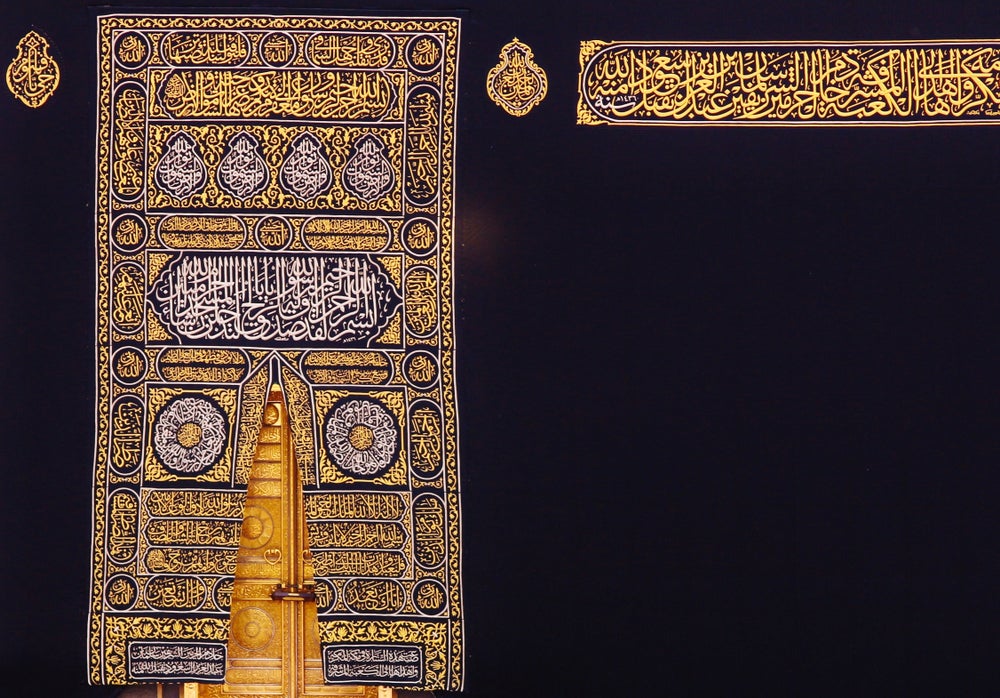

The Ethical Muslim

The Ethical Muslim

The appeal of Islamic finance among HNWIs has coincided with the rise of ESG (Environmental, Social and Governance) investing, where investors divest companies that have poor governance, environmental or ethical stances.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataSharia investments, by nature, cannot make money through interest. They therefore rely on ties to tangible assets, such as real estate and equity and charging ‘rent’ instead of interest. Having earnings from identifiable assets, not opaque combinations of derivatives and securities, fits well with the ‘Governance’ factor of ESG.

The limit on debt ownership also means that a Sharia-compliant equity portfolio may appear higher-quality than more conventional portfolios due to the screening out of highly leveraged companies, and the absence of sectors like alcohol, tobacco, gaming, etc.

The reassurance of investing ethically, as well as the positive returns that Sharia investments can provide, is starting to appeal to a much wider group of investors than just Middle Eastern HNWIs, says Sandeep Singh, senior director and regional head, Central Eastern Europe, Middle and Africa, at Franklin Templeton Investments.

“The principles of Sharia investing mean that these products lend themselves well to diversify any investor’s portfolio, regardless of faith. Not only are the returns attractive relative to traditional fixed income assets, volatility has historically been more subdued – something that could prove important in a rising interest-rate environment,” Singh wrote in the DIFC Wealth and Asset Management Report.

In recent years, investors from non-Muslim countries, such as South Africa, Hong Kong and the United Kingdom have tapped into the Sukuk (Islamic Bond) market, as their countries have used Islamic finance to raise funds from the Middle East: In 2014 the UK government became the first country outside the Islamic world to issue a sovereign Sukuk and it has since been followed by others in Europe and Asia.

As a result, demand for Shariah-compliant investment funds, including Sukuks and Takaful (insurance), has been robust in major markets such as Saudi Arabia, Malaysia, United Arab Emirates, Kuwait, Qatar, Iran, and Turkey.

A force to be reckoned with

But despite the internationalisation of Islamic finance, a report by Reuters recently found that Iran, Malaysia and Saudi Arabia, collectively account for 87% of the $110 billion total Islamic assets under management by wealth managers. These assets were mostly invested in Shariah-compliant equities, mixed assets, bonds, money markets, and real estate.

The lack of diversity is a concern in the industry. Many funds launched in countries like Pakistan and Indonesia, which have strong demographics for Islamic investment, have failed to achieve scale.

The size of the funds is also an issue for the sector: “Globally, 70% of Islamic funds are below $25 million, and many of these are under $1 million,” the Reuters report mentioned.

In its Wealth and Asset Management Report, the Dubai International Financial Centre (DIFC) highlighted the concern that Islamic investments remain under-utilised despite strong demographic demand.

“Scale remains one of the main challenges for the Islamic asset management industry when compared to conventional funds, despite strong demographics for Shariah-compliant investments providing ample opportunities to scale up. Government support can also play an important role in channelling institutional capital into Shariah-compliant and/or SRI (socially responsible investment) funds, but few countries have taken concrete steps to support this growth area,” DIFC said.

In Qatar, Islamic asset managers have to increase activities and the size of their funds to compete with their conventional peers, according to the Qatar Financial Centre (QFC), which added that “globally, the industry is suffering from its small scale, which is a result of poor market strategies in targeting different sectors and regions”.

DIFC also noted that despite developments in Islamic finance and growth in Islamic assets, Islamic wealth management is still considered a niche market, with local services still largely underdeveloped, prompting most Middle East investors to park their money overseas.

“We believe much more needs to be done to grow and deepen the Islamic finance industry, not just by attracting more faith-based investors but also by appealing to and creating awareness among non-faith-based investors,” Singh notes.