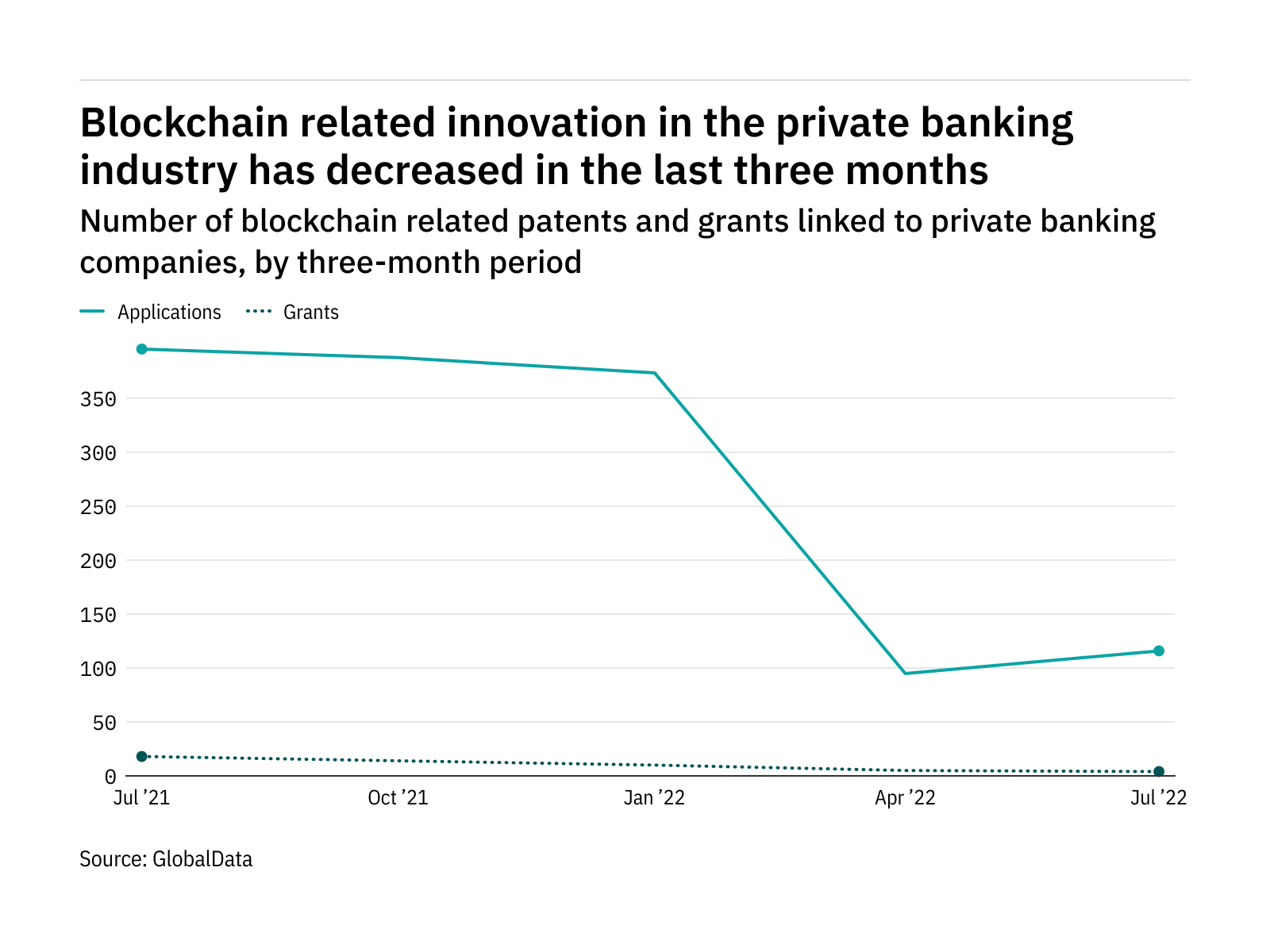

Research and innovation in blockchain in the private banking sector has declined in the last year.

The most recent figures show that the number of blockchain innovation related patent applications in the private banking industry stood at 116 in the three months ending July – down from 396 over the same period in 2021.

Figures for patent grants related to blockchain followed a similar pattern to filings – shrinking from 18 in the three months ending July 2021 to 4 in the same period in 2022.

The figures are compiled by GlobalData, who track patent filings and grants from official offices around the world. Using textual analysis, as well as official patent classifications, these patents are grouped into key thematic areas, and linked to key companies across various industries.

Blockchain is one of the key areas tracked by GlobalData. It has been identified as being a key disruptive force facing companies in the coming years, and is one of the areas that companies investing resources in now are expected to reap rewards from.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe figures also provide an insight into the largest innovators in the sector.

Ping An Insurance (Group) Company of China Ltd was the top blockchain innovator in the private banking sector in the latest quarter. The company, which has its headquarters in China, filed 107 blockchain related patents in the three months ending July. That was down from 279 over the same period in 2021.

It was followed by the United States based JPMorgan Chase & Co with 4 blockchain patent applications, South Korea based BNK Financial Group Inc (2 applications), and Taiwan based Fubon Financial Holding Co Ltd (1 applications).