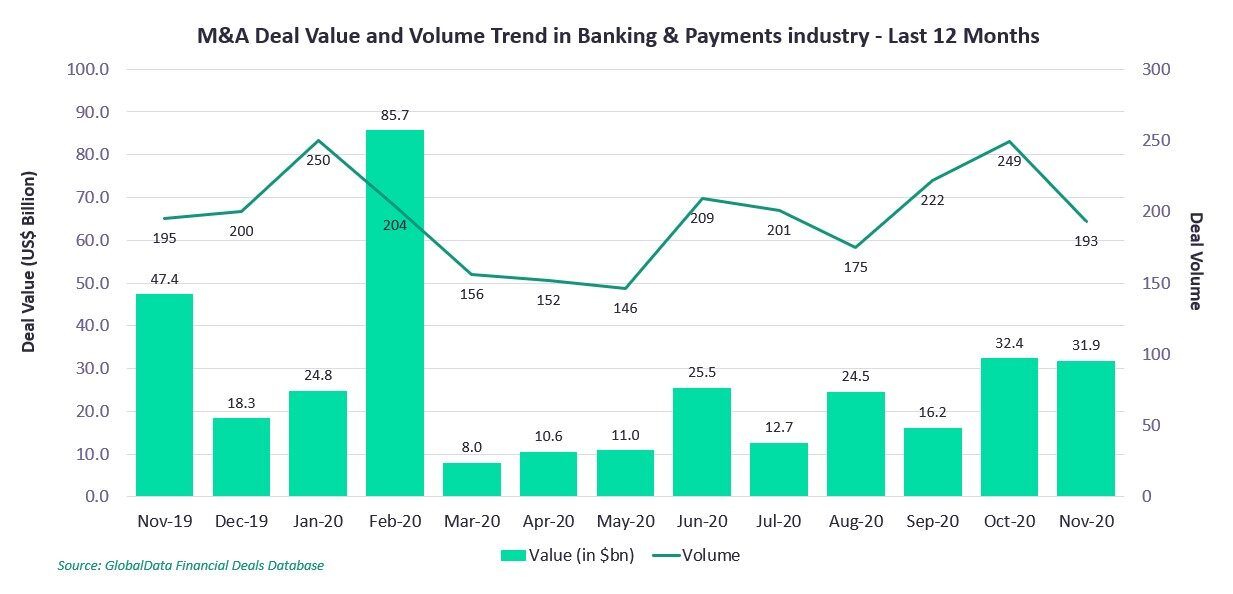

The value of the ten biggest banking and payments deals neared $30 billion in November, with regional US bank PNC’s mid-November bid for the US subsidiary of Spain’s BBVA bank for $11.6 billion in cash dominating merger and acquisitions for the month.

Pennsylvania-based PNC is largely a regional bank and the deal would give it a presence across the US, especially across Texas and southern states.

Pennsylvania-based PNC is largely a regional bank and the deal would give it a presence across the US, especially across Texas and southern states.

While mergers and acquisitions of big banks have almost disappeared since the 2008 financial crisis, regional banks are facing stiff competition now from the popular banking apps developed by national banks and have been hurt more than larger banks by low-interest rates.

Meanwhile, Italy’s Nexi struck its second tie-up in six weeks, agreeing a $9.2 billion merger with Nordic rival Nets to create Europe’s largest payments group as consolidation continues to sweep the fast-growing payments industry.

Just days earlier Nexi revealed its plan to buy domestic rival SIA for $5.6 billion in shares.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData