A new report by GlobalData wealth management shows Chinese HNWIs are investing more of their assets offshore. Could this be driven by global trade tensions or a slowing national economy, asks Mishelle Thurai?

Chinese entrepreneurs have expanded their wealth at double the global pace in the past year according to a new report by UBS and PwC.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataTheir collective wealth grew by 39% to $1.12trn, meanwhile the number of Chinese billionaires increased to 373 in 2017 from 318 in 2016. Every week, China produced two new billionaires whereas Asia minted more than three per week.

This rapid growth could be countered by rising trade tensions, however. PBI looks at the recent research to see how China’s wealthy are securing their wealth.

The offshore opportunity

According to GlobalData’s Wealth in China: HNW Investors 2018, HNWIs invest 34% of their total liquid assets offshore. This figure is significantly above the regional average of 25% and global average of 14%.

China is leading the region when it comes to offshore holdings and subsequently Chinese private banks are internationalising their operations.

Bank of China Private Banking has built a network outside China to meet client demand. It was the first such bank to launch services in London in November 2017, an expansion driven by the growing number of wealthy Chinese studying, buying property and investing in the UK.

Offshoring Chinese wealth also benefits private banks serving Mainland China from booking centres Singapore and Hong Kong. The GlobalData report says competition will only intensify in these markets.

By taking their wealth abroad, Chinese investors are looking to access a better range of investment products and diversify away from the local economy, which is showing signs of slowing, says GlobalData.

However, since the report was published in June, concerns have grown on the tightening controls on outbound investments.

A private banker from UBS’s Singapore office was asked to meet with authorities in Beijing last month while being denied exit from the country. Though no reason for the detention, many speculated that it was due to wealth being transferred outside the county. The event alarmed other private banks in the region BNP Paribas and JP Morgan among those asking their staff not to travel to Mainland China.

One wealth manager told Reuters, the news agency: “The immediate impact will be that everyone will be on pause for some time and try to figure out what this all means for Chinese offshore wealth management business.”

Property is popular

When allocating their investments, GlobalData found that property is the preferred asset class among HNWIs when investing offshore.

Research by Juwai.com, a property website, found that over three-quarters of Chinese travellers would consider an overseas property purchase in 2018.

Research firm Hurun Report found that the number of Chinese HNWIs buying overseas holiday homes has increased by 25% over the past year. A further 41% of HNWI would like to relocate their local holiday home overseas.

GlobalData’s survey of Chinese wealth managers showed that just five countries account for over 90% of HNWI offshore investments, with the US alone representing 52%. The biggest markets for Chinese buyers in the US include California, Texas, Florida and Illinois. Buyers typically purchase residential properties.

Female wealth is underserved

Approximately 89% of wealthy Chinese investors are male according to GlobalData, but the next five years will see an increase in female HNWIs.

Investor profiling has revealed female HNWIs are typically younger than their male counterparts. Roughly 42% are aged under 50, compared to 30% of males. Female Chinese HNWIs are also more likely to have inherited their wealth with 12% versus less than 5% of males.

Despite these expectations there few wealth propositions aimed at wealthy women in China. GlobalData suggests that providers need to look at international peer offerings to develop their female propositions. The report cites Miss Kaya, a robo advisory platform which specifically targets Asian women.

Another solution would be to hire more female private bankers. UBS has made it a priority to help women investors in Asia with the creation of UBS Unique, which provides advice to female HNWIs.

Online is king in China

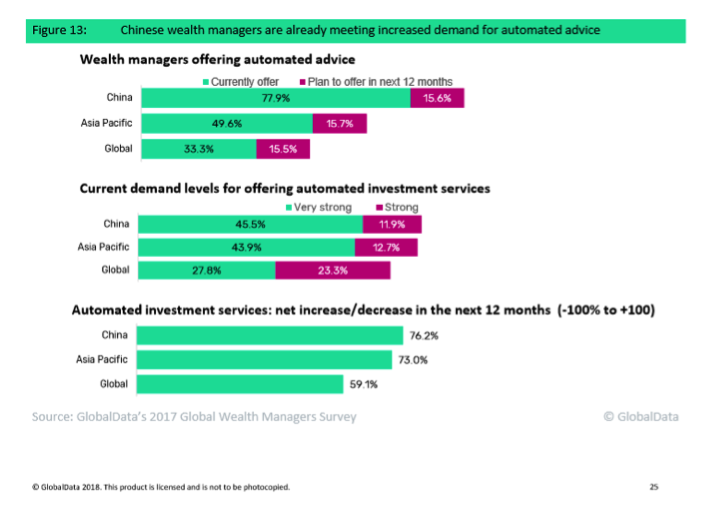

GlobalData’s research of wealth managers has shown that local investor demand for automated investment advice has increased substantially.

Currently 78% of Chinese wealth managers claim to provide automated investment services to HNWIs, way higher than the global average of 33%.

GlobalData suggests this is due to economic factors. The country’s broader economic slowdown, a weakening currency, volatile stock markets and a cooling real estate market have bolstered demand for online robo-advice.

The momentum prompted ICBC to become the first of China’s big-four lenders to launch an online wealth management platform just over a year ago.

As well as using online tools to attract younger HNWIs, wealth managers should also look at promoting automated services among older demographics says GlobalData. Robo-tools developed specifically for younger clients elsewhere have often found their biggest uptake among retirees who have more time to tweak investments.

The future of China’s wealth market

According to GlobalData the Chinese wealth market is set to see significant growth over the next few years. It is forecasting that between 2017 and 2021 another 609,000 individuals will qualify as HNWIs, supporting the overall market growth.

However, with Chinese HNWIs using on average three different wealth managers, there is clearly some dissatisfaction with the current offering. Rising female wealth and online activity are going to put pressure on private banks and wealth managers. Meanwhile, a slowing economy and the effects of trade tariffs are going to make making money even more difficult for wealthy Chinese.