As the wealthiest generation to date continues to age, a large inter-generational wealth transfer is on the horizon. Consequently, there will be a change with regards to what the next generation of young millionaires deem most important to manage their wealth effectively.

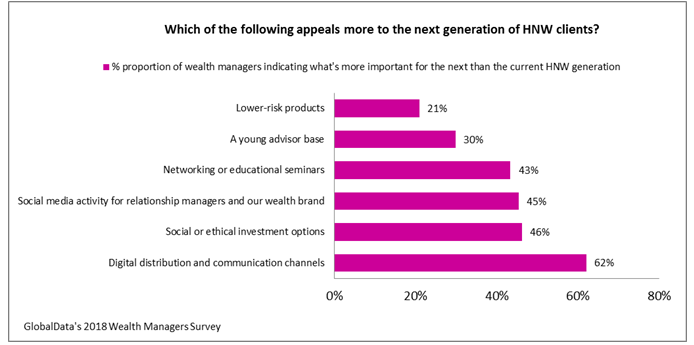

Data from the GlobalData 2018 survey of wealth managers explored what will be more important for the next generation of HNW individuals, relative to current clients.

It is no surprise that digital distribution and communication channels were cited as being of much greater significance, with 62% of wealth managers globally considering this to be more important for the future generation than the current one.

The vast majority of future millionaires are digital natives and will expect a more digitally inclusive society across all aspects of their lives.

Risk taking generation

This cohort is also no strangers to risk. Only a handful of providers expect low-risk investments to matter to the next generation of clients more than to their parents.

This appetite for risk has already started to materialise, as for instance millennials are one of the largest groups of crypto investors, a very volatile market to invest in.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

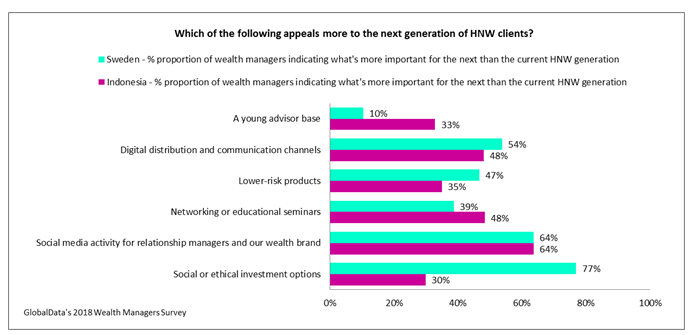

While in the majority of markets surveyed by GlobalData the dominance of digital channels over other features is clear, there are exceptions suggesting that wealth managers’ focus should be wider.

Giving back is important

As discussed in a previous comment “Millennials vs retirees – HNW Philanthropy,” the movement towards investing back into society is being spearheaded by the young and wealthy.

One market that has a long tradition of taking social responsibility very seriously is Sweden.

After all, the first ethics-based mutual fund available to retail investors in Europe was introduced by the Swedes as early as the 1960s. GlobalData survey results reinforce an even stronger appetite for social and ethical investment options among the next generation of HNW individuals in Sweden.

Social media impact

Another interesting example is Indonesia, which has seen a recent boom in social media. In fact, Facebook reported that its growth was driven by Indonesian consumers in 2018. And the wealth managers we spoke to believe social media will be more important for the next generation than to their forerunners.

Indonesia’s younger, next generation, will continue to drive this growth and will require their financial advisers to be active on social media in years to come.

There is consensus that in order to appeal to the next generation of HNW clients, wealth managers need to beef up their client-facing digital capabilities.

However, the “next gen” will require much beyond digitization. Indonesia’s social media boom and the Swedish values of giving back are examples of what providers should not ignore.

Those wealth managers that pay attention to societal changes and customs will remain ahead of the curve regarding the next generation’s wants and needs.