As the world economy stumbles into recession due to the COVID-19 pandemic, certain parts of the banking world will hold up better than others, including private wealth. Wealth management is likely to fare best out of all banking divisions, even with the selloff in the markets. However, much of the work that went into improving profitability in recent years will be reversed as revenue drops, even as costs continue to grow.

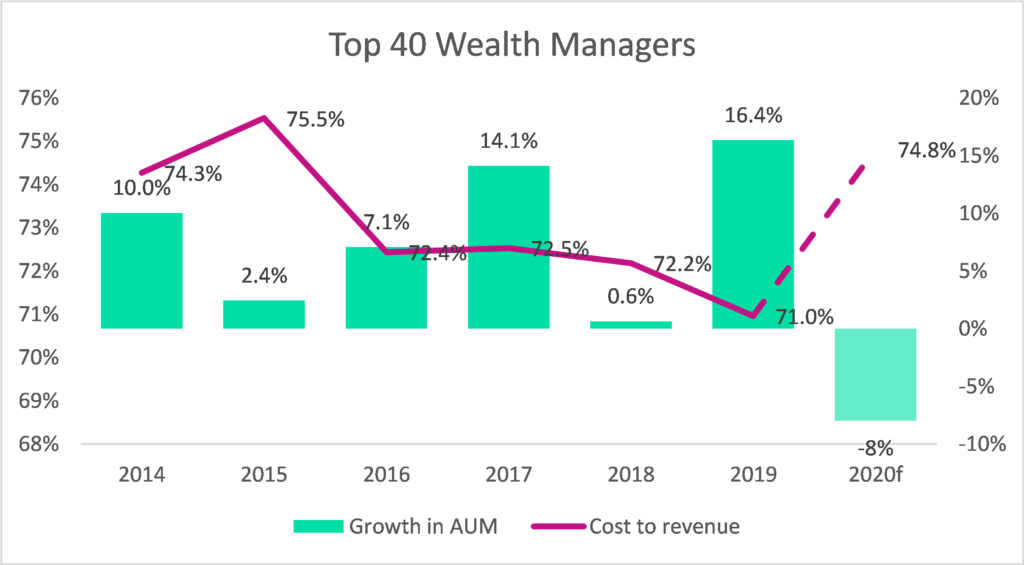

The leading wealth managers around the world entered 2020 in a relatively strong position with a stellar year for client assets, driven both by a buoyant market and positive client inflows. The cost-to-revenue ratio also improved after a couple of stagnant years, driven mostly by higher revenues significantly outpacing growth in costs. However, this will all go into reverse in 2020.

After the initial spike in revenue, driven by clients trading into the downturn, GlobalData expects revenue for the rest of the year to be rather subdued as lower assets under management (AUM) begins to bite, even as wealth managers book sizable increases in costs due to the pandemic disruptions.

Based on the past spike in costs to revenue recorded in the aftermath of the global financial crisis and its attendant recession, we see this all-important ratio returning to levels not seen since 2015. While this means the world’s largest wealth managers and private banks will remain profitable in aggregate, there are a number of lean years ahead for many, particularly smaller players and boutiques that might lack these giants’ economies of scale.

In addition, improvements in the cost-to-revenue ratio are hard won by the wealth management industry, with the global financial crisis causing continued deterioration in profitability years after the recovery was well underway. It was only in 2012 that profitability began to grow again in wealth management and 2014 when ratios got back into shape.

While private wealth management will not see the oceans of red ink that retail and commercial banking will as loans sour in the recession after Covid-19, expectations of profits clearly need to be downsized for some years to come.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataPast trend suggests lower AUM and tighter margins for wealth managers in 2020