An increasing number of financial services companies are developing solutions utilising generative AI (gen AI). However, growing adoption underscores the need for policymakers to establish regulatory standards around its safe usage and deployment.

Gen AI has become a hot topic in the financial services industry. In 2023, banks including OCBC and Morgan Stanley launched gen AI-driven internal chatbots to support their staff and financial advisers. Meanwhile, the likes of Goldman Sachs and JPMorgan Chase are working on gen AI projects that could be launched in 2024. This trend will only accelerate going forward.

At present, use cases for gen AI mostly focus around utilising the technology to analyse vast amounts of data, with the results generated helping expedite decision-making.

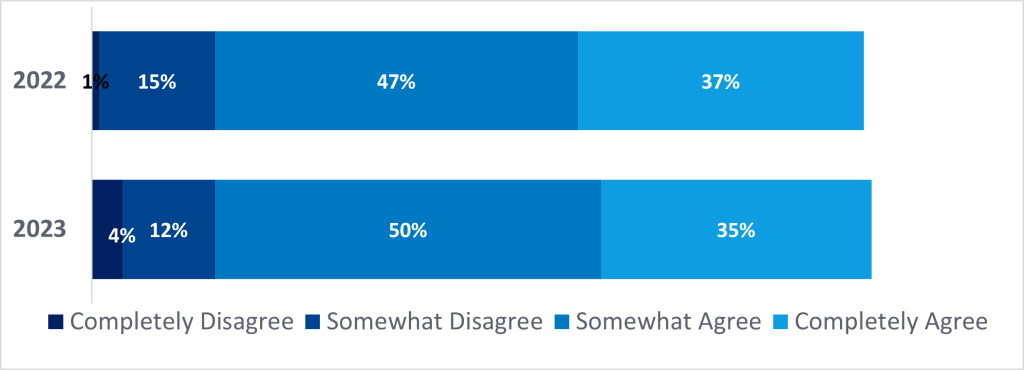

In turn, this can boost wealth manager productivity, freeing up time to focus on client interactions and other high-value tasks. But as the technology develops, providers will hope to find more overtly client-facing use cases. As per GlobalData’s Wealth Management Industry Conditions Analytics 2023, 85% of wealth managers agree that emerging technologies could offer hyper-customised/personalised services and products. We expect to see more gen AI initiatives in this area as the technology becomes increasingly established within the wealth space.

Level of agreement that emerging technologies will enable wealth managers to offer hyper-customised/personalised services (2022–23)

Yet as wealth management firms rush to adopt gen AI, it cannot be ignored that there are no formal guidelines governing usage of the technology. For example, using ChatGPT to manage sensitive financial data can expose firms to legal, reputational, and financial risks due to the risk of data leaks. Meanwhile, The New York Times initiated legal action against ChatGPT developers OpenAI and Microsoft in December 2023, alleging copyright infringement. More lawsuits of this nature seem likely in the future.

Such issues will not deter wealth management companies from adopting gen AI. However, they do highlight the need for regulators to develop a set of standards that will help ensure safe and secure gen AI usage. Crucially, regulation would help safeguard providers against any potential missteps that could cause financial or reputational damage.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData

Related Company Profiles

Morgan Stanley

The Goldman Sachs Group Inc

JPMorgan Chase & Co

Microsoft Corp