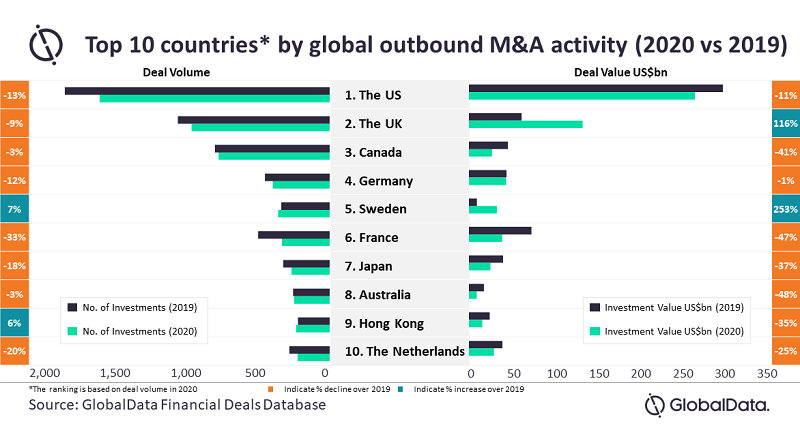

The US took the top spots in terms of outbound and inbound mergers and acquisitions (M&A) deal volume and value in 2020, even though it saw a decline in activity during the Covid-hit 2020.

Meanwhile, China continued to stay attractive to overseas investors and became a notable exception to witness growth in inbound M&A activity, according to GlobalData, a leading data and analytics company.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData lead analyst Aurojyoti Bose said: “Cross-border M&A activity declined significantly during 2020 with growing protectionism, heightened geopolitical tensions and fears of an economic slowdown due to the Covid-19 pandemic. However, the US managed to be in a relatively better position and witnessed a sizeable number of cross-border M&A deals. The strength of its economy appears to have played a crucial role in driving deal activity.”

The US saw 1,631 outbound M&A deals valued at $269.3bn in 2020, which is a drop of 13% and 11% in deal volume and value, respectively, as against 2019. Inspite of the decline, the US continued to lead the outbound M&A activity by having close to 20% and 30% of the outbound M&A deal volume and value in 2020, respectively. In terms of deal volume, top target destinations for US outbound M&A transactions were the UK, Canada, Australia, Germany and France.

The US was followed by the UK, which saw 980 outbound M&A deals valued at $135.4bn in 2020.

Although deal volume reduced by 9% for the UK, it was among the few countries that saw increase in deal value in 2020 as against the prior year. Out of the top ten, Sweden was the only other country that experienced growth in outbound M&A deal value.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSweden also saw growth in outbound M&A deal volume. Hong Kong was the only other country that experienced growth in outbound M&A deal volume.

Although most of the countries witnessed decline in inbound M&A activity, China became a notable exception and saw growth in deal volume as well as value in 2020 compared to 2019.

Bose adds: “Despite China being the country from where the Covid-19 outbreak originated, it remained attractive to foreign investors. The country’s success in curbing the virus remained pivotal. The relaxation on foreign investment regulations by the Chinese Government is also likely to have encouraged foreign companies to invest in the country.”