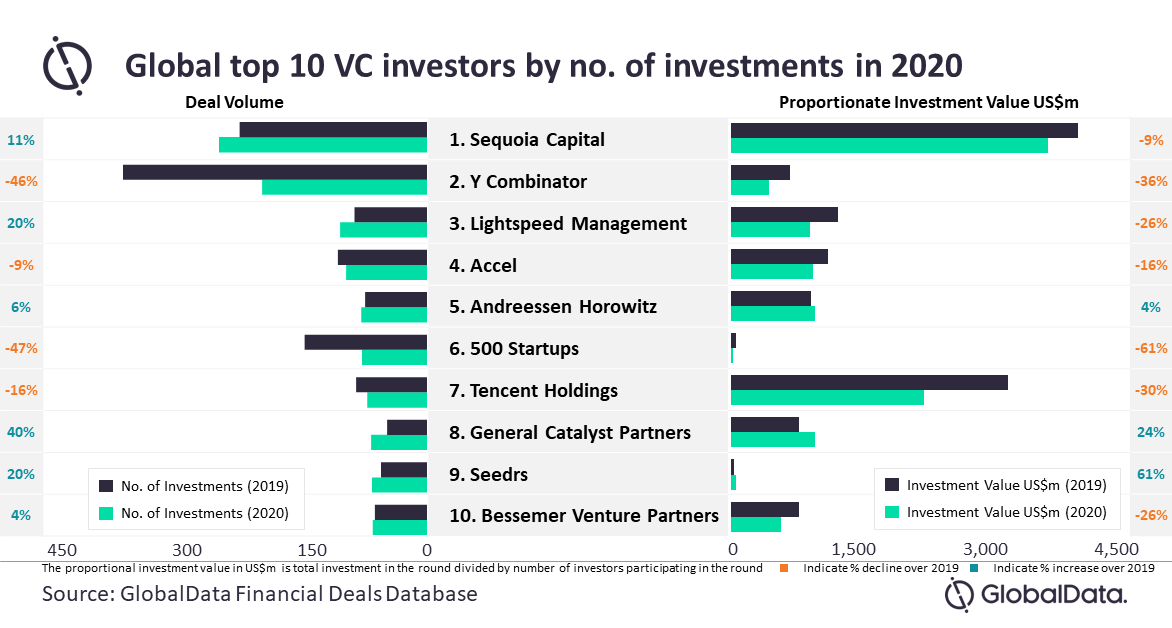

Many US venture capital (VC) investors managed to make sizeable number of investments, even though there were challenges around Covid-19, says GlobalData, a leading data and analytics company.

US-based firms dominated the list of top ten VC investors by count of investments, with eight based in the US, .

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Sequoia Capital took part in 275 VC funding rounds, which is the highest count of investments among all VC firms during 2020.

The only non-US VC firms to make it China-based Tencent Holdings and the UK-based Seedrs.

GlobalData lead analyst said: “Interestingly, Silicon Valley/California was the home to seven of these top investors. This shows that, despite tough market conditions, these firms have continued looking for opportunities in innovative start-ups in the US – albeit cautiously.”

The top ten global VC investors took part in 1,186 funding rounds in 2020, as against 1,385 funding rounds in 2019. Four of the top ten experienced YoY decline in their count of investments, of which three recorded double-digit decline.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe proportionate investment value of these firms fell from $13.3bn in 2019 to $11.2bn in 2020.

The fall could be attributed to the lower proportionate investment value for the majority of these VC investors. Seven of the top ten experienced YoY decline in the proportionate investment value in 2020, of which six recorded posted double-digit decline.

Sequoia Capital, which topped the list, saw decline in its proportionate investment value by 9% as against the earlier year.