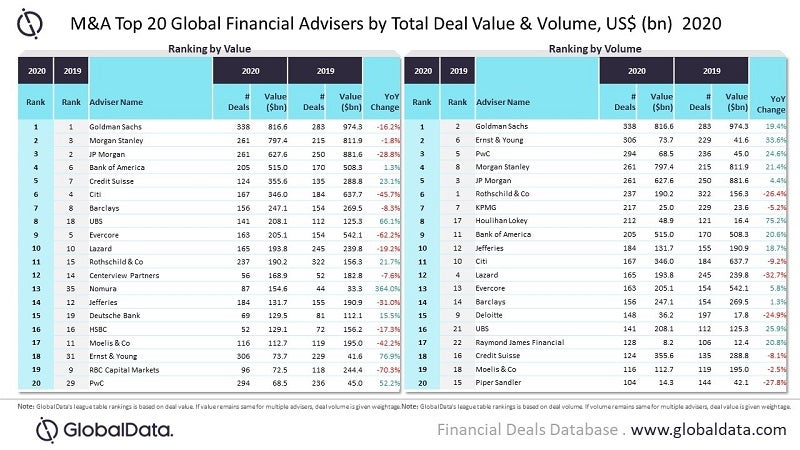

GlobalData, a leading data and analytics company, has revealed its global league tables for financial advisers by value and volume for 2020.

Goldman Sachs tops by both value and volume

Goldman Sachs was the top financial adviser for mergers and acquisitions (M&A) deals by both deal value and volume for 2020. The American investment bank advised on 338 deals worth $816.6bn.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData has published top 20 league table of financial advisers ranked according to the value of announced M&A deals globally.

GlobalData lead analyst Aurojyoti Bose said: “Goldman Sach’s diversified and global scale helped the firm top the ranking, while its involvement in big-ticket deals was also pivotal. The firm advised on 16 megadeals worth greater than or equal to $10bn.

“Goldman Sachs was the only adviser that managed to surpass the $800bn mark, whereas deal value for several of the top 20 advisers failed to cross $200bn during the Covid-19-hit 2020. Moreover, Goldman Sachs was among the only two firms (the other firm being Ernst & Young) that managed to advise on more than 300 deals.”

Morgan Stanley took the second position by value with 261 deals worth $797.4bn, followed by JP Morgan with 261 deals worth $627.6bn and Bank of America with 205 deals worth $515bn.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataIn terms of volume, Ernst & Young occupied the second position with 306 deals worth $73.7bn, followed by PwC with 294 deals worth $68.5bn

To ensure further robustness to the data, the company also seeks submissions from leading advisers, through adviser submission forms on GlobalData’s website