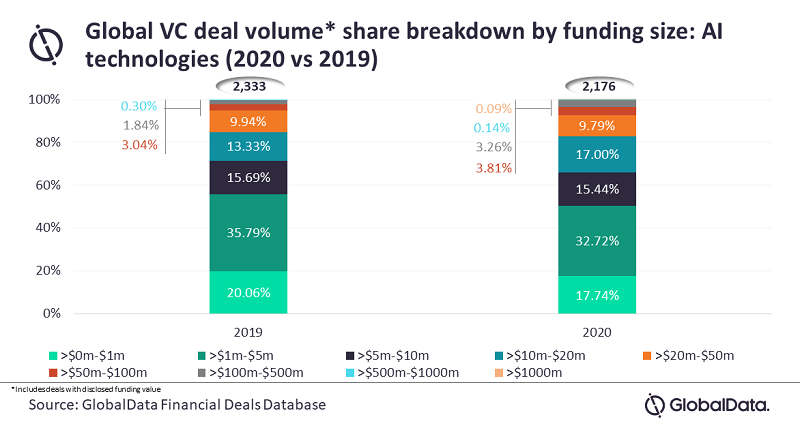

Volume of low-value venture capital (VC) funding deals (investments less than or equal to $10m) reduced as overall VC funding activity in the artificial intelligence (AI) space fell during the Covid-19 2020, according to GlobalData, a leading data and analytics company.

There was a decline in share of low-value deals as a proportion of total deal volume; however, it still continued to have a dominant share.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

Meanwhile, high-value deals (investments worth greater than or equal to $100m) saw growth in volume and share.

In the AI tech space, a total of 2,176 VC funding deals (with disclosed funding value) were announced during 2020. This was a drop from 2,333 VC funding deals (with disclosed funding value) in 2019.

The count of low-value deals also fell from 1,669 in 2019 to 1,434 in 2020. Low-value deals continued to dominate the VC funding landscape in the AI space although its share of total deal volume fell from 71.54% in 2019 to 65.9% in 2020.

Meanwhile, the count of deals valued over $10m grew from 664 in 2019 to 742 in 2020, and the corresponding share as a proportion of the total deal volume also grew from 28.46% in 2019 to 34.1% in 2020.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe count of high-value deals also grew from 50 in 2019 to 76 in 2020 and the corresponding share as a proportion of the total deal volume grew from 2.14% in 2019 to 3.49% in 2020.

GlobalData lead analyst Aurojyoti Bose said: “VC investors are more cautious now due to volatile market conditions amid the Covid-19 pandemic, yet they continue to show interest in companies working in the AI space. VC investors are not shying away from committing to big-ticket financing deals in companies at the scaling stage.”

Interestingly, 2019 did not witness any billion-dollar deals, while 2020 managed to see two billion-dollar deals even in the wake of Covid-19 outbreak. These deals included $1.9bn secured by the US-based SpaceX and $1.7bn raised by China-based Manbang Group.