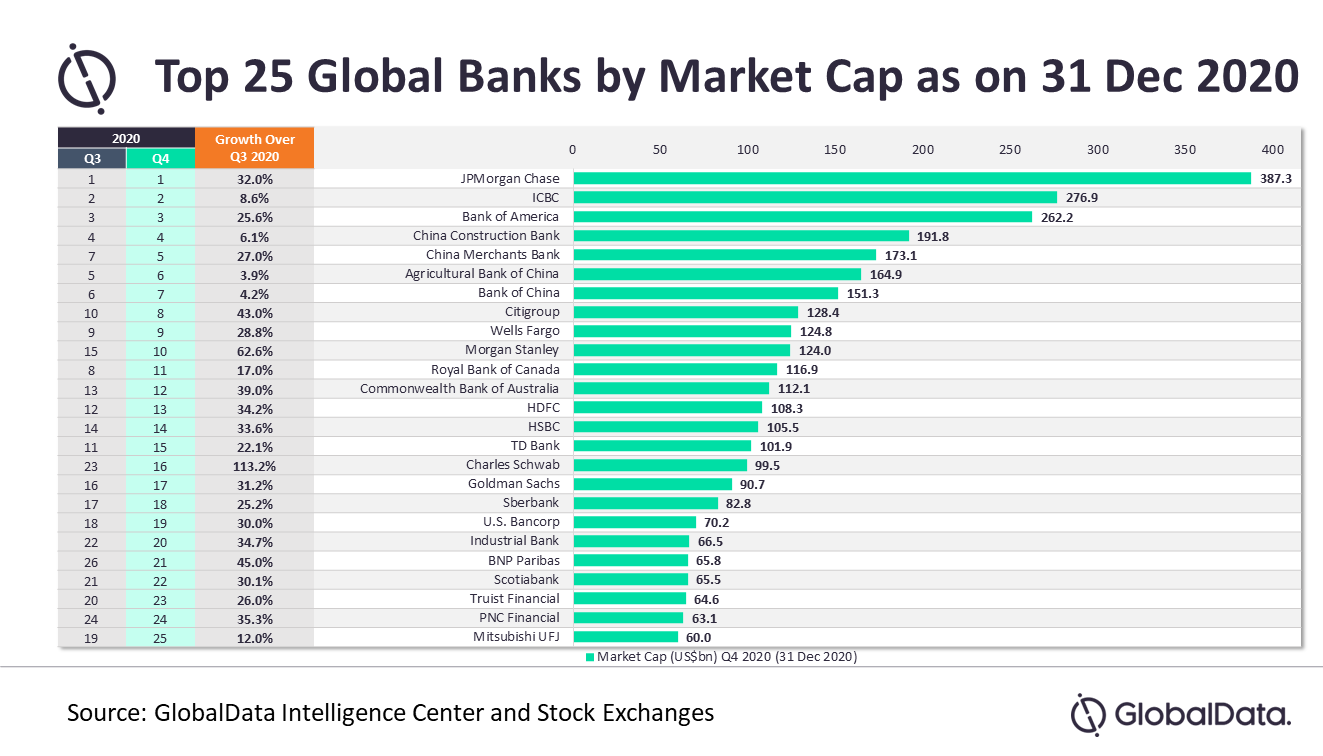

Top global banks ended the year 2020 on a high, with total market cap increasing by 25.4% from $2,597.1bn, as of 30 September 2020 (Q3 2020), to $3,258bn, as of 31 December 2020 (Q4 2020), says GlobalData, a data analytics and research company.

Other than the top four Chinese banks, which saw single-digit growth, all other global banks increased substantially in double digits, with the most noteworthy being Charles Schwab, Morgan Stanley, BNP Paribas and Citigroup, whose market cap increased by more than 40% q-o-q, respectively.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

GlobalData company profiles analyst Parth Vala said: “One of the prominent reasons for buoyant investor sentiment in the US banking sector was that the Federal Reserve allowed large banks for dividend payments and limited share buy backs in Q1 2021. This was granted for the first time since the Covid-19 downturn and post positive second stress test results.”

Share price of Charles Schwab surged 113.2% q-o-q. The increase in the company’s stock price since Q3 2020 can be attributed to better-than-estimated Q3 2020 results; the acquisition and integration of TD Ameritrade, which allowed it to widen its client assets portfolio over $6 trillion; and rise in its asset management business.

Morgan Stanley’s shares increased 62.6% as it recorded impressive results in Q3 2020, with institutional securities, wealth management and investment management reporting better revenues than Q3 2019. The purchase of E*TRADE Financial and signing of definitive agreement to buy Eaton Vance also created positive sentiments among its investors. Furthermore, after receiving a green light from the Fed, the company announced its plans to commence $10bn share repurchase programme that also got validation from investors.

BNP Paribas was back in the top 25 with market cap gain of 45% over the previous quarter. The significant rise in currency and commodity trading volumes and lower-than-expected loan loss provisions aided the bank beat Q3 2020 estimates. Revenue of its corporate and investment banking division increased 16.4% for the nine months ending 30 September 2020, led by 25.8% rise in global markets, 11.1% increase in corporate banking and 5.6% growth in securities services businesses.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataCitigroup’s market cap increased by 43% q-o-q. It also beat its Q3 earnings estimates with net income of $3.2bn, which was due to strong performance in Institutional Clients Group segment – particularly in investment banking, markets and private banking activities.

As against other global banks, the top four Chinese banks posted a rather tapered growth in their market cap in Q4 2020.

Vala said: “Financial regulators in China have asked banks to lower their profits and facilitate cheap lending to struggling businesses and deferring loan repayments, which seemed to have affected the stock momentum of larger banks”. As a result, commercial banks in China have reported a net profit of CNY1.5 trillion as of 30 September 2020, reflecting a decline of 8.3% y-o-y.

“Despite mass vaccination on the horizon, 2021 still poses a great uncertainty to the global banking sector amid precariousness of virus trajectory, along with the low-interest-rate environment continuing to put pressure on margins, and potential increase in credit costs in light of gradual decrease in government support measures”.