Activity in venture capital (VC) funding and mergers and acquisitions (M&A) in the artificial intelligence (AI) sphere indicated a fluctuating trend during 2016-2020, according to GlobalData, a leading and data analytics company.

Despite the fluctuation in deal activity, however, there had been a significant growth in 2020’s deal volume and value as against 2016.

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

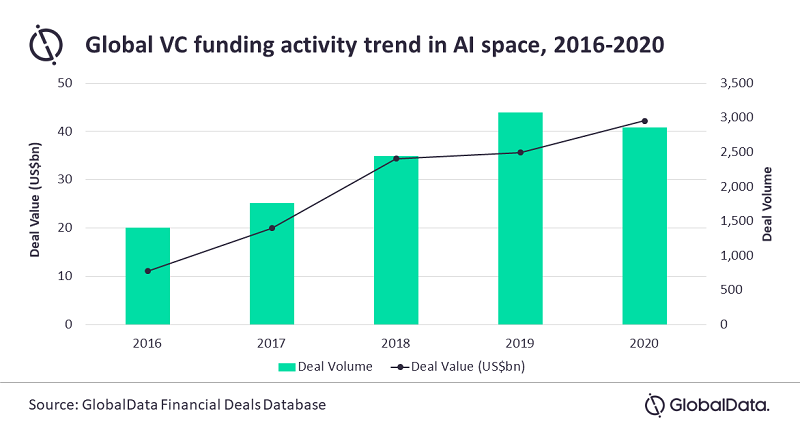

VC funding deal volume in the AI space indicated steady growth from 2016-2019 until 2020 when the Covid-19 pandemic reversed the trend and deal volume reduced by 7.1%. Funding value, however, managed to retain the growth trajectory.

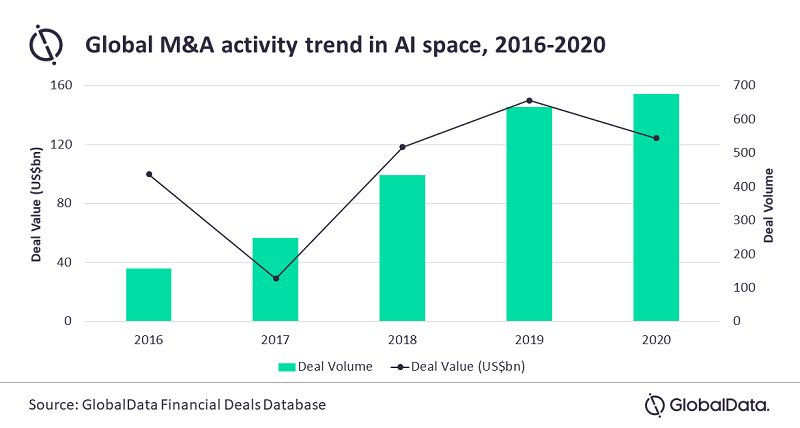

M&A deal volume recorded steady growth during 2016-2020, while M&A deal value continued to fluctuate.

Following recovery from the decline in 2017, M&A deal value saw growth in 2018 and 2019 before dropping again in 2020.

Even though there was fluctuation in deal activity, there has been a notable growth when comparing 2020 numbers with 2016. VC deal volume and value grew at a compound annual growth rate (CAGR) of 19.4% and 39.9%, respectively, during 2016-2020. M&A deal volume and value grew at a CAGR of 44% and 5.6%, respectively, during the past five years.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataGlobalData lead analyst Aurojyoti Bose said: “Despite the fluctuating trend, investors’ interest and deal-making sentiments for AI grew significantly in the past few years. With global organisations replacing their conventional operations with disruptive technologies such as AI, the space managed to gain a significant investment boost.”

VC deal volume in the AI space reduced by 7.1% from 3,075 in 2019 to 2,856 deals in 2020. Inspite of the fall in volume, the Covid-hit 2020 witnessed the announcement of some big-ticket VC deals as a result of which deal value grew by 18.7% as against 2019.

Among some of the notable VC deals announced during 2020 include $1.9bn secured by SpaceX and $1.7bn secured by Manbang Group.

Bose added: “Though COVID-19 did not deter M&A activity in the AI space from taking place and deal volume increased in 2020 compared to 2019, distressed valuation of assets appears to have lowered the deal value.”

The count of M&A deals in the AI space increased by 6% in 2020 as against 2019. However, the corresponding value reduced by 17.3%. While 2019 witnessed the announcement of around 60 $100m+ deals, 2020 saw around 50 US$100m+ deals.