Common standards and regulations should be used when it comes to wealth management products sold by non-banking institutions, said a senior banking regulator. He forewarned that failing to do so will generate risks and cause a shock this year.

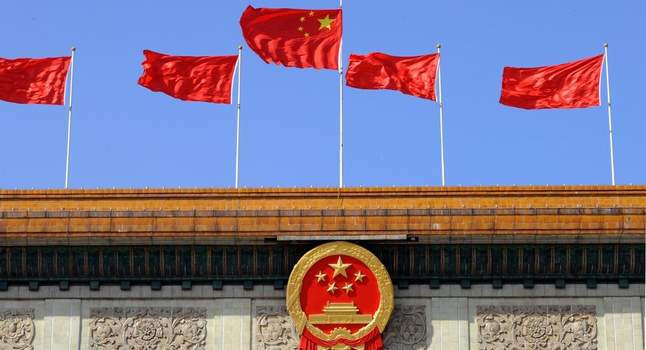

"Not only banks, but insurance and securities companies are also able to sell wealth management products, which raises great challenges for financial regulation," said Yan Qingmin, assistant chairman of the China Banking Regulatory Commission.

Concerns were sparked over wealth management products as financial institutions have the autonomy to set interest rates. Furthermore, many of the assets and liabilities stay off the balance sheets, and this poses risks to the banking sector, according to Fitch Ratings.

Fitch also noted that non-state banks have been the main driving force behind recent issuance, a deviation from the past, and turnover is high with about three-quarters of products maturing within six months. This heightens raises concerns about the bank’s liquidity.

Other articles:

China’s regulator stifles sales of third-party investment products

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData