Avaloq has launched an ESG investment solution for banks and wealth managers that allows them to build personalised portfolios for clients.

The solution is aimed at helping firms capitalise on the market shift towards ESG investing. In addition, it ensures compliance with MiFID II for companies in the EU.

Avaloq’s ESG investment solution uses a range of adaptable, third-party feeds and intuitive functionality to allow wealth managers and front-office staff to build appropriate portfolios.

Furthermore, advisers can match client needs through a range of filters and tools, such as scorecards, “green” benchmarks, exclusions, and norms-based screening.

MiFID II has an amendment, expected to come into force in Q4 2021, that means banks and wealth managers will have to take into account a client’s ESG preferences when deciding suitable investments.

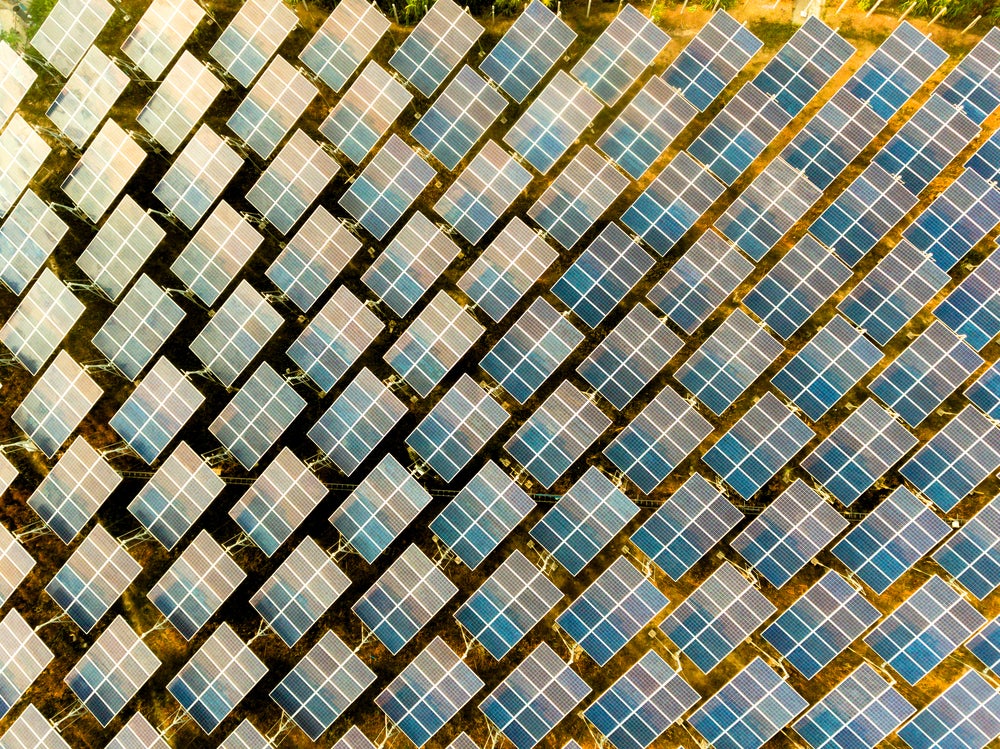

Martin Greweldinger, Avaloq group chief product officer, said: “For many people, ESG has become the most significant trend in business and in investing – one that, given the fundamental and serious nature of the issues being tackled such as climate change, will likely define the future of the asset and wealth management sectors. While the ESG market has grown rapidly, it is very likely to accelerate much further as investors, particularly younger market segments, continue to reallocate assets with specific ESG criteria and goals in mind.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData“One challenge for providers is that there are no rules defined by regulators or standard setters for how the ESG preferences should be collected – it is considered an area of competition between investment companies. As such, we believe that banks and wealth managers that can offer the most comprehensive ESG service will be the ones that see stronger market growth. This is why Avaloq’s ESG investment solution will be available in the new Avaloq Wealth platform starting next year and will ensure comprehensive features along the investment process like ESG profiling, ESG construction and ESG analytics.”

44% of expert investors have stated that sustainable investments lead to higher returns, according to new research.

Investors in America and Asia are especially looking at sustainable investments, while Germany and Europe slightly lag behind.